Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

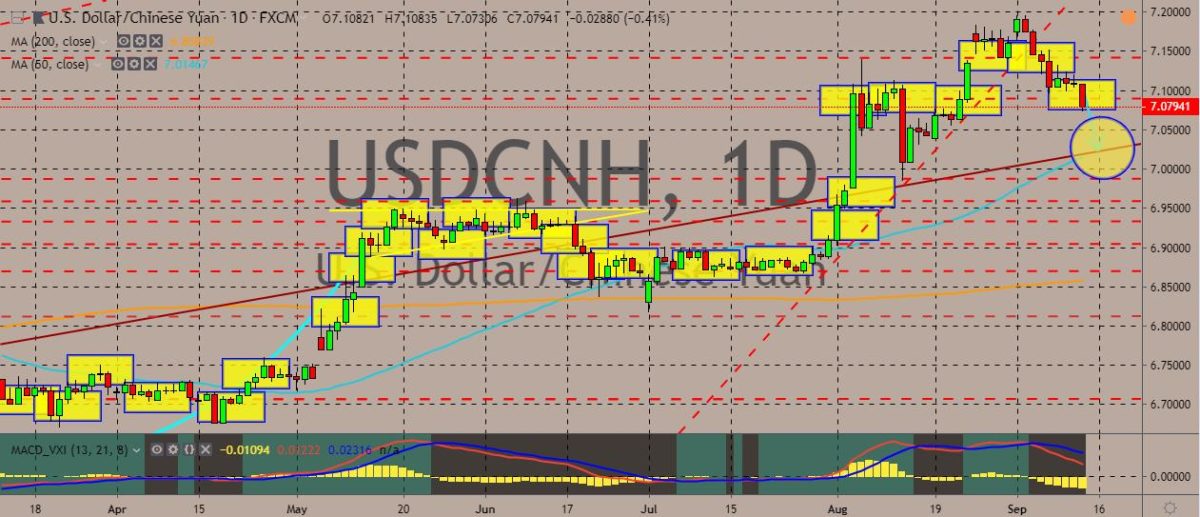

USDCNH

The pair is still traversing the bullish territory above the both the 50-day and 20-day moving averages, although the price has already started a possible retracement of its value after the dollar recently pummeled the Chinese yuan to multi-month lows. In terms of the trade war, the bid force for the Chinese yuan gained traction after US President Donald Trump delayed the move to increase tariffs on $250 billion worth of Chinese goods from 25% to 30%. The tariffs will now take effect on October 15 instead of October 1. The postponement of the tariffs came after China decided earlier to waive import tariffs on 16 types of US products, which include anti-cancer products and lubricants. Chinese and US trade deputies are scheduled to meet in Washington in mid-September before the ministers meet in early October. Overall, markets can view the recent moves as indications that the two sides are more willing to negotiate.

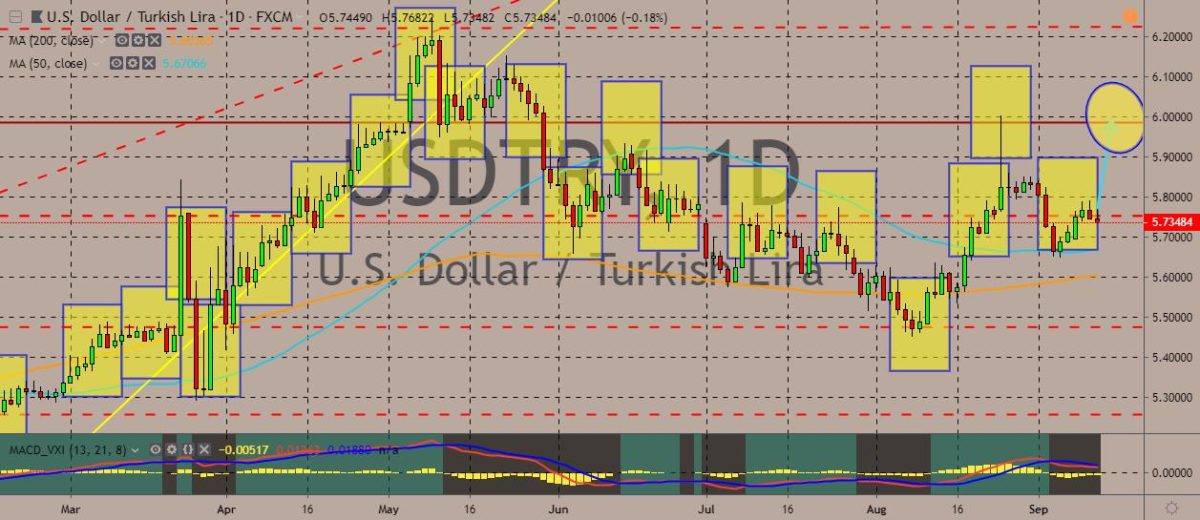

USDTRY

The pair is trading in the red in the recent sessions, although the Turkish lira is still on the defensive amid a growing anticipation of central bank interest rate cut during its policy-setting meeting that could exceed the market’s expected 250 basis points. There are also concerns over the possible reignition of the US-Turkey tensions, as US Treasury Secretary Steven Mnuchin says that the US is considering slapping sanctions over Turkey’s purchase of Russian missile systems. As for Turkey’s economy, data showed that it contracted 1.5% on a year-on-year basis during the second quarter, and that was less than a poll estimate of 2.0% contraction. Last July, the Turkish central bank cut the key rate to 19.75% from 24%, marking its first policy change since September 2018. The currency crisis last year slashed 30% from the value of the lira and catapulted the inflation to a 15-year high above 25%.

EURNZD

The pair is still trading on the bullish side of the trade, hovering above a solid support level near the 50-day moving average. The euro is trading cautiously as traders brace themselves for the European Central Bank to unveil an expected stimulus package. Markets are expecting a rate cut at the meeting this Thursday as the ECB tries to prop up the region’s ailing economy. More importantly, there exist an uncertainty over whether the policymakers will restart a quantitative easing (QE) program after some ECB members became divisive, with some expressing doubt about the need to relaunch asset purchases. Over in New Zealand, the new chief said that he was “pleased” with the current status of the policy, having slashed interest rates by a sharp 50 basis points earlier this month. RBNZ Governor Adrian Orr said that the cut to 1% let the bank to rein on any economy slowdown and reduce the chances of more work later on.

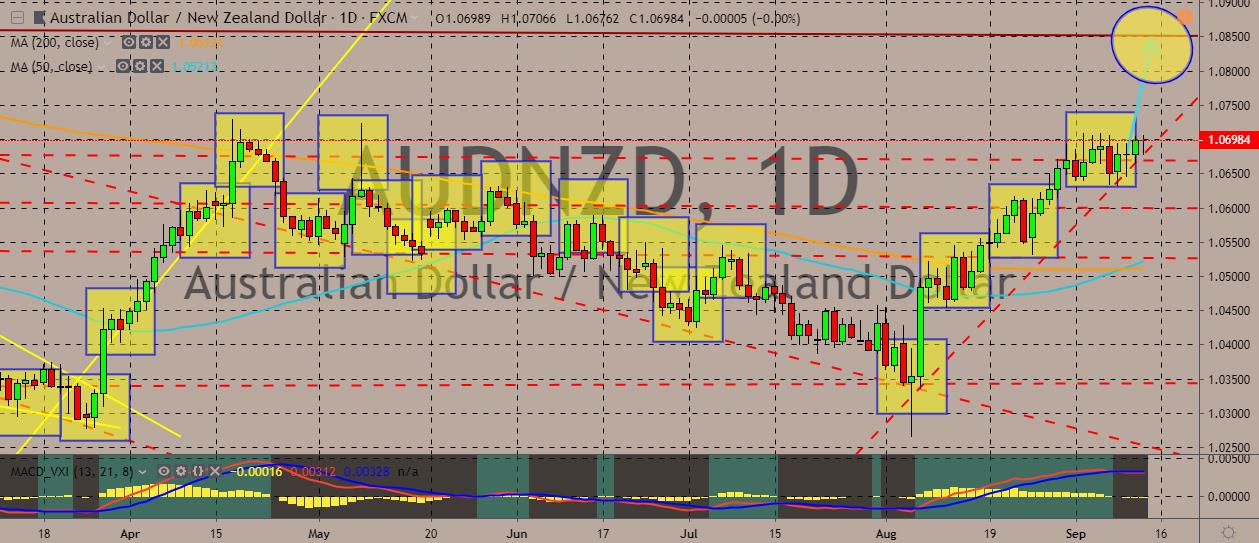

AUDNZD

The pair is trading up, with bullish signals prominent on the daily charts. The 50-day moving average just crossed above the 200-day moving average. The Australian dollar is stronger enough against its New Zealand counterpart to continue an uptrend, trading near a pretty solid support line. Over in Australia, the Reserve Bank of Australia said that not all types of unconventional monetary stimulus tools used abroad would be needed in the country. Recently, the RBA decided to keep official interest rates on hold in spite of the indications that the economy slowed steeply over the quarter ended in June. The cost of borrowing is held at a historic low of 1%. The weak retail sales figures that came days ago indicated that previous rate cuts did little to boost the economy.

COMMENTS