Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

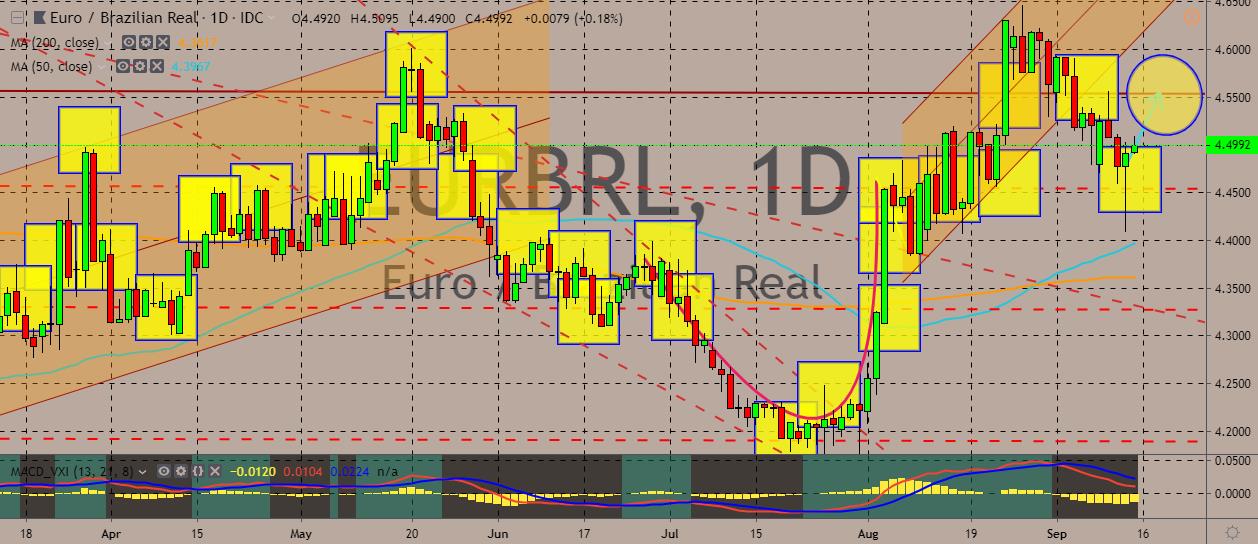

EURBRL

The pair is trading up on the day as the euro gained traction against the Brazilian real. Daily charts show that the euro plummeted during the previous trading session, nearly touching the 50-day moving average before going back up and finishing the trade in the green. The 50-day MA still goes above its 200-day counterpart, indicating a rather bullish trend for the pair. Over in Europe, the European Central Bank approved a fresh stimulus package, meeting market expectations. The bank cut rates and gave the go signal for a new round of bond purchases to support the euro zone growth and stop a worrisome drop in inflation expectations. Now, the deposit rate is at a record low of -0.5% from -0.4%. The bank will restart the bond purchases of 20 billion euros per month from November. This comes as Germany skirts a recession, inflation falls, and global trade war dampens domestic confidence.

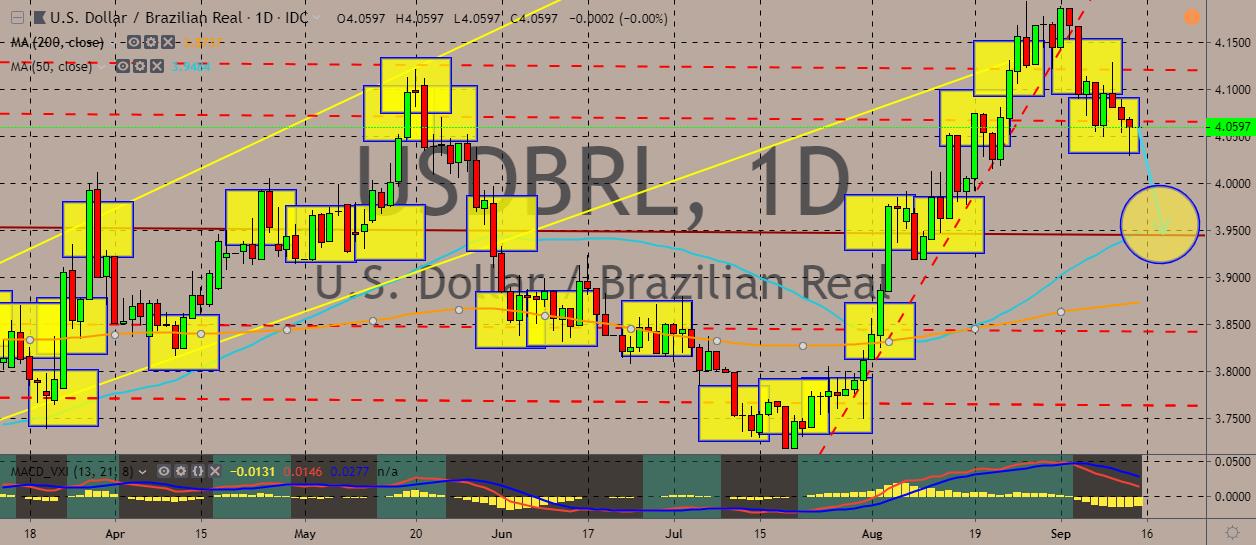

USDBRL

The pair has recently fallen and broken away from an uptrend that saw the price climb to multi-month highs. It’s currently trading near a support line above the 50-day moving average, which still indicates bullishness on the part of the traders. The greenback weakened after investors received a flurry of economic data. Last week, jobs data showed that jobless claim slipped 15,000 to 204,000 from the previous week. This reading is near five-month lows. Over in Brazil, July services activity rose at the fastest pace in the year. Brazil is the largest economy among Latin America, and it shows that it kicked off the third quarter on solid grounds. The government statistics said that the service sector activity gained 0.8% in the month and 1.8% in year, both exceeding market polls and forecasts. The average forecast was for a flat growth on the month and 0.2% growth on the year.

USDRON

The pair still stays within the trading channel it’s been traversing for months, generally going for an upward trajectory around the middle band of the channel. Prices still stay above the 50-day and 200-day MAs, indicating a generally bullish sentiment for traders. Over in Romania, the economy grew with strength last year but the macroeconomic imbalances still exist, leaving the country vulnerable to shocks, according to the International Monetary Fund. Last year, the unemployment reached record lows. The growth was 4.1% of gross domestic product, while the National Bank of Romania met its inflation target of 1.5% to 3.5% in December. However, policy shocks of sharper-than-expected external slowdown could still render Romania’s moderate reserves “insufficient.” The IMF’s executive directors recommended the country shift to “countercyclical fiscal policy.”

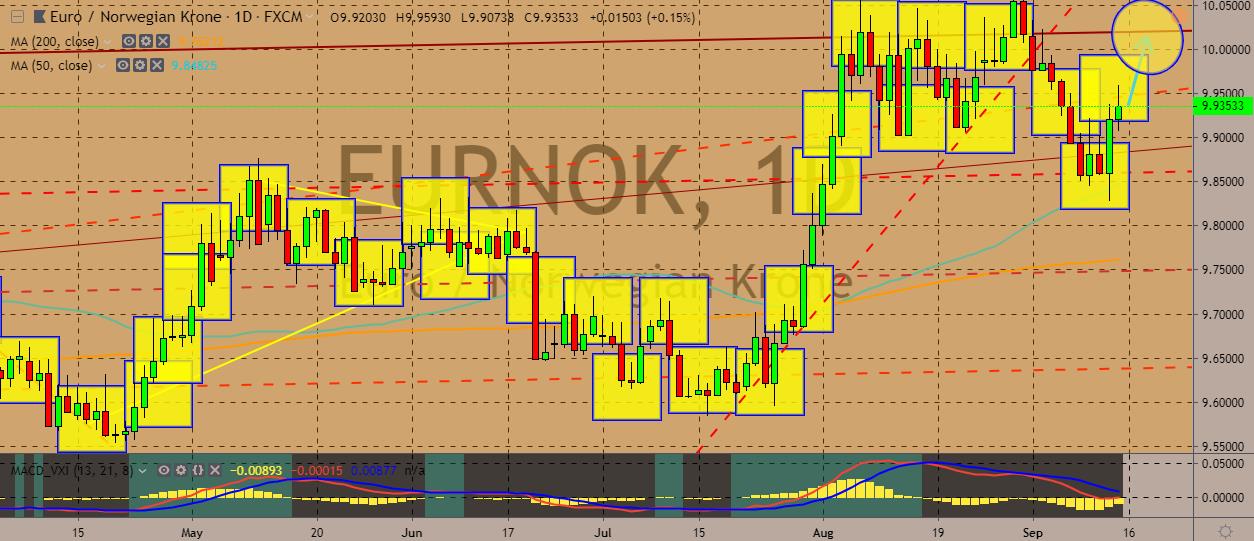

EURNOK

The pair has managed a recovery from recent slumps thanks to the news of the ECB cutting rates and propping up the economy by providing quantitative easing. The pair previously slumped near to the level of the 50-day moving average before finishing the session up from the session before. Over in Norway, Norwegian companies are expecting weaker growth ahead of a strong recent expansion, according to a central bank business survey. The results show slightly lower growth over the next six months, specifically in the oil services sector. Retail trade and export industry also expect slower growth. The survey will be one of the key factors that will determine the outcome of the Norges Bank’s monetary policy, which will be announced on September 19. After the survey’s release, the Norwegian krone weakened against the euro, after having fallen after the lower-than-expected inflation report for August.

COMMENTS