Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

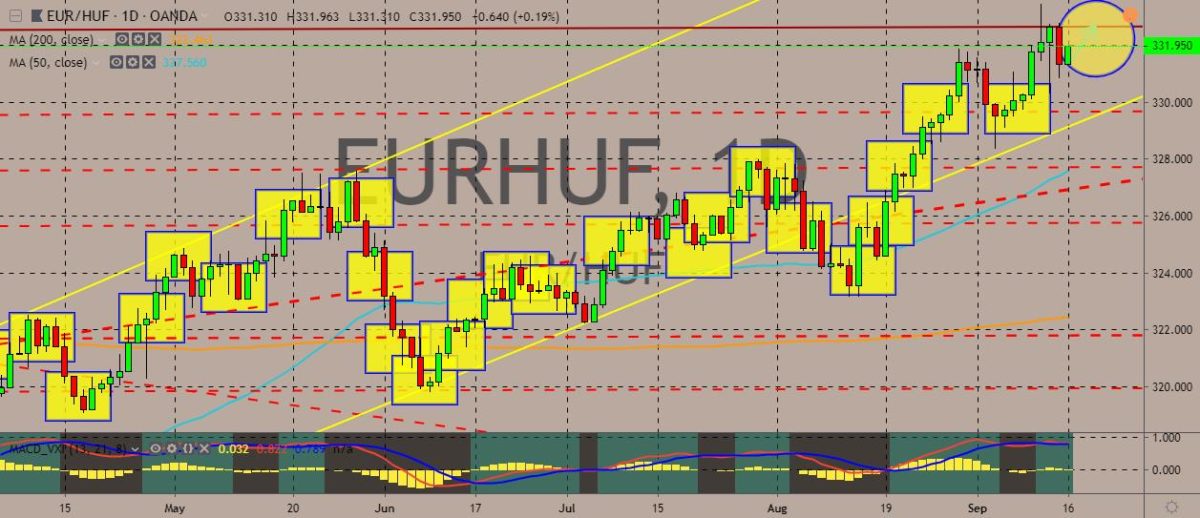

EURHUF

The pair is going up in the daily charts, traversing the areas above the 50-day and 200-day moving averages. This kind of movement indicates bullish sentiment on the part of the traders, which are likely looking for a solid support line above the recent highs of the euro against the Hungarian forint. The European Central Bank is back at its quantitative easing again after also cutting rates in its most recent interest rate meeting, announced by the outgoing ECB president Mario Draghi. Over in Hungary, the Fiscal Council, which provides opinions on budget matters, said that the economic growth may top 4.1% predicted in the 2019 budget. This also supports the meeting of budget targets for the country. Even so, the news was overshadowed by the apparent hands-on approach of the ECB to the faltering eurozone economy. Draghi has also called for Germany to take “timely and effective” fiscal action.

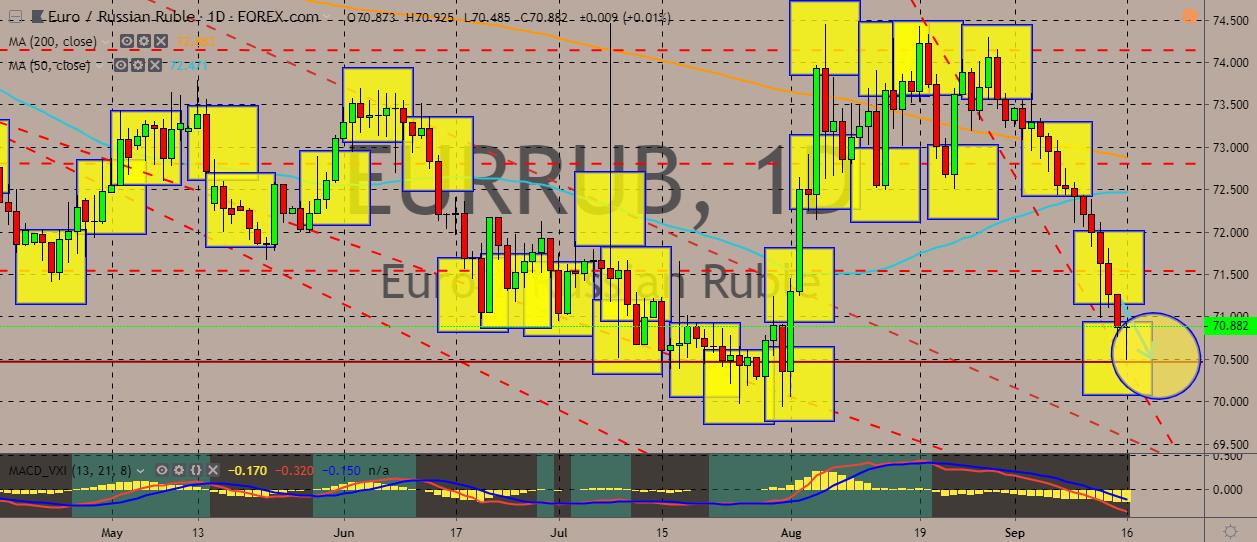

EURRUB

The EURRUB pair has plummeted down to steep levels under both its short- and long-term moving averages, showing a highly bearish sentiment for the euro against the ruble. The steep plummet started at the beginning of the month, although the effect of the ECB’s rate cuts and quantitative easing will probably show itself later. Over in Russia, the Russian central bank slashed its key interest rate to 7%, decreasing the cost of borrowing for the third time this year. The bank also indicated that another rate cut was possible in the upcoming board meetings. The cut came as inflation slows down, which is something the central bank carefully watches over. Because of this, the central bank was compelled to revise down its gross domestic product forecasts. Economists and analysts are altogether expecting the Russian central bank to be cutting rates by 25 basis points.

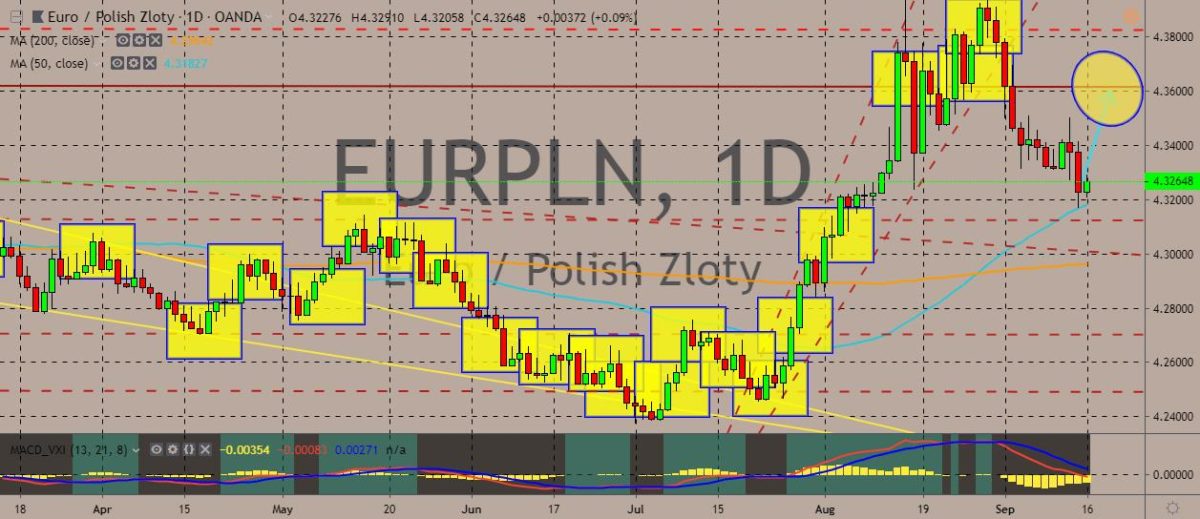

EURPLN

The pair has slumped down from previous highs, breaking away from an uptrend. Traders are now looking for a solid support near its previous highs, set to converge near the 50-day moving average. Over in Poland, the central bank maintained its key interest rate at a record low of 1.5% as the market expected. According to the National Bank of Poland, the country’s inflation will likely slow and stay near the target after reaching its peak in the first quarter of 2020. This played down fears that planned hikes in the minimum wage could driver stronger price growth. Ahead of the October 13 parliamentary election, leader of Poland’s ruling nationalist Law and Justice party Jaroslaw Kaczynski said that the minimum wage would be raised almost double to PLN 4000 by 2023. The NBP Monetary Council, meanwhile, chose to keep the key reference rate on hold at its record low 1.5%.

EURSEK

The pair is trading in tight ranges now, with prices traders looking for clues on which direction the trade would go. The price recently converged with the 50-day moving average, which lies still above the 200-day counterpart, still indicating bullish bias from the traders. Over in Sweden, Riksbank seems to stick with its plan to increase its main interest rate in the next coming months in spite of the looming recession concerns. This hawkish plan goes against the prevailing trend among major central banks. On the other hand, the central bank said that it would increasing its key interest rates at a slower pace than it had expected. Other major central banks, like the US Federal reserve and the European Central Bank are considering further monetary easing to handle and reign over the slowing economic growth spurred by the US-China trade tension in the US and the Brexit uncertainty over in Europe.

COMMENTS