Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURCZK

The pair is trading in tight ranges after climbing to multi-month highs recently, having found a solid support line above the 50-day moving average price. The 50-day MA also recently confirmed a golden cross, indicating that traders’ sentiment on the pair remains bullish. Over in Europe, European Central Bank chief economist Phillip Lane recently defended the monetary stimulus package that it launched last week. Lane them emphasized that the bank was ready to cut rates again, pushing them further into negative territory if necessary. The ECB’s decision to unveil its stimulus efforts has been divisive has drawn criticisms, as it happened just weeks before Mario Draghi hands the bank’s leadership to Christine Lagarde. Even so, Lane reiterated that the bank would do “whatever it takes” to hit our inflation target, describing the mandate to do this to be “unconditional” and the motivation to do it “unwavering.”

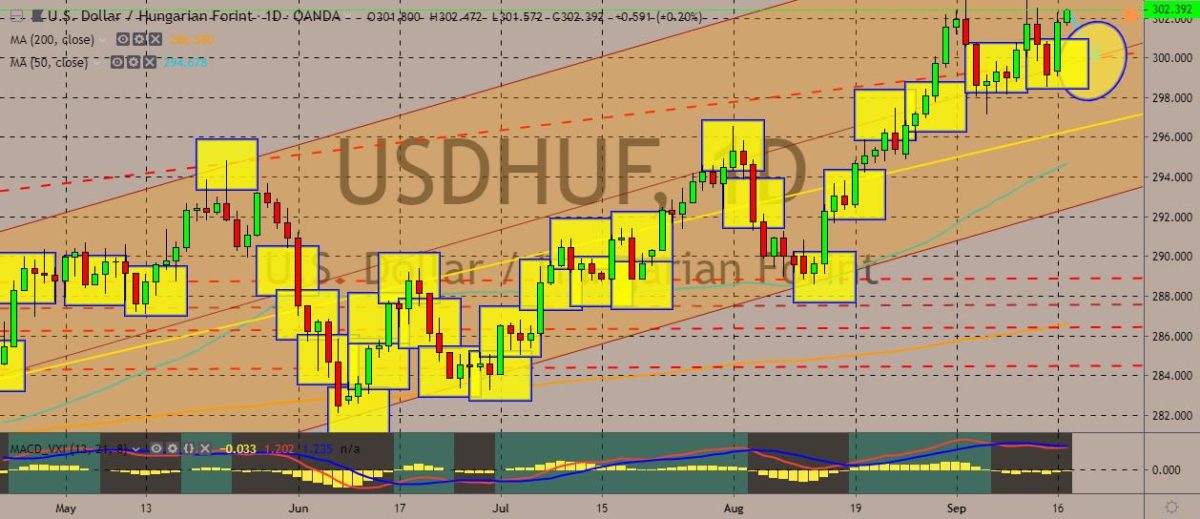

USDHUF

The pair strengthened in recent trading sessions in what appears to be a start of a higher-high-higher-low patters, with the pair still trading within the trading channel it’s been traversing. The pair also sees some bullish sentiment supporting its force, as indicated by the 50-day moving average. The US dollar started the week strong on the back of the latest economic data, which showed better-than-expected results. Consumer sentiment rebounded slightly in the month of September, clocking in a reading of 92 from the sharp decline recorded in August, according to a survey conducted by the University of Michigan. Meanwhile, in Hungary, a top minister said that Hungary on its own will not veto a new delay to Britain’s departure from the European Union. According to Gergely Gulyas, who chief of staff of Prime Minister Viktor Orban, said that there was no Hungarian government decision that would veto a delay in Brexit.

USDMXN

The pair has fallen from recent peak and plummeted steeply in the recent trading sessions. The price has also converged with the 50-day moving average after trading above it for some time, indicating bearishness on the pair. Over in Mexico, markets are expecting the central bank to consider cutting rates again this year, with the annualized inflation in August slipping to nearly three-year lows. The economy appears to be struggling to pick up steam. Other reports, on the other hand, say that Mexico’s housing market continues to strengthen. The nationwide price index rose by 4.78% during the year to Q2 2019, which is the biggest increase in the Q2 2016. On a quarter-on-quarter basis, the prices increased 2.31% during the latest quarter. The real estate market has been driven by the strong demand in resort communities, according to the International Consortium of Real Estate Associations (ICREA).

USDNOK

The pair pulled back from recent highs, with prices slipping after peaking recently. The 50-day MA also appeared to lose momentum, indicating that traders are being cautious in trading the dollar and giving it a boost against the Norwegian krone. Over in Norway, however, the prime minister of Norway has signaled that her government is happy having a weak currency. PM Erna Solberg said that the weaker krone is supporting the country’s export industry. Solberg leads a center-right government in western Europe’s oil producer. She said that Norway’s ability to compete in global trade has been “greatly improved” by the krone’s steady decline. Despite the interest rate hikes, the krone has retained its weakness amid the economy’s expansion, which is much faster than the rest of Europe. Inflation has also been close to target. The weaker currency provides the central bank with smore scope to raise rates.

COMMENTS