Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

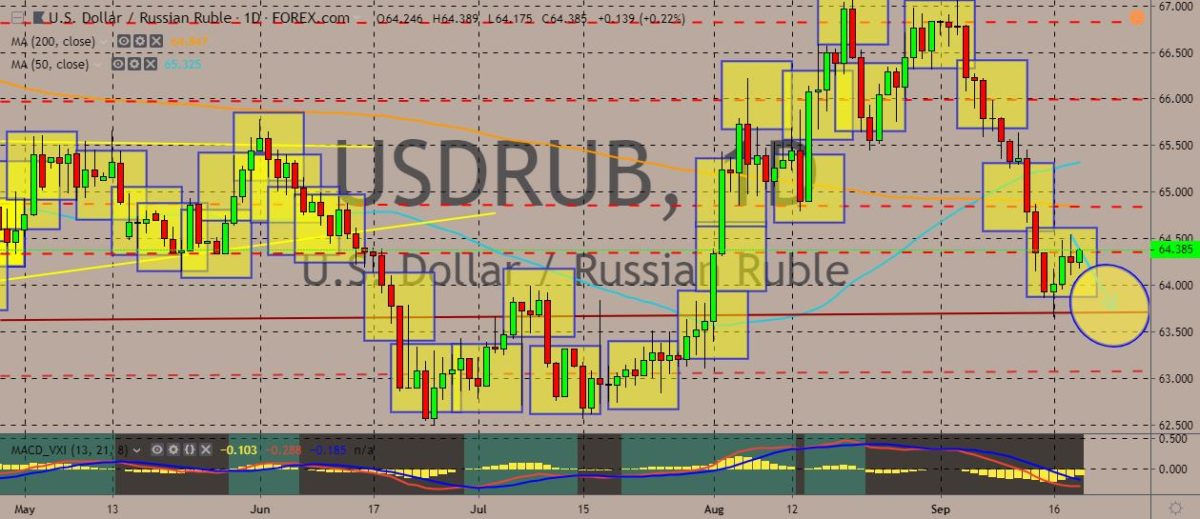

USDRUB

The pair appears to be performing a correction after recent highs, now with more room to fall. This happened after the 50-day moving average confirmed a golden cross. The relationship between the US and Russia continues to face some new possibilities. Recently, the chairman of the US Joint Chiefs of Staff has warned that the NATO military superiority over Russia has been diminishing in recent years. Such event has compelled the 70-year-old alliance to enhance its strategy to reign on Kremlin. Meanwhile, Russia and its ally Belarus are planning to form an economic confederacy by 2022, according to sources. Belarus’ integration with Russia is a hot topic now and is seen as one of the ways Russian President Vladimir Putin could avoid constitutional term limits for his planned re-election in 2024. The confederation would mean the creation of a single tax code, civil code, and various foreign trade rules.

USDCZK

The pair traded in tight ranges in recent sessions, with prices staying within the upper band of the trading channel it’s been pursuing on the daily chart. Prices recently reach record lows before settling back to the now-familiar ranges. The dollar was trading cautiously as the US Federal Reserve slashed rates by 25 basis points, as the markets expected. However, chairman Jerome Powell signaled higher bar for future cuts. The US central bank lowered the Fed funds rate to a range of 1.75% to 2.00% “in light of the implications of global developments for the economic outlook.” Powell, on the other hand, described the US prospects “favourable” and the rate move as “insurance.” Over in the Czech Republic, the central bank will keep on figuring out whether to hold or hike rates instead of easing. This comes in spite of the moves to loosen policy by the ECB and the Fed.

EURCHF

The pair managed a recovery after following a steep decline in recent months, although it is still yet to be determined whether it can totally break from the downtrend, with prices managing to break above the declining 50-day moving average, and with the relationship between the EU and Switzerland still being a central key point between the two currencies. Recently, the heads of nine German and French regions around Switzerland have spoken out and called for the de-escalation of tensions between Brussels and Bern over a delayed deal on the future of bilateral relations between the European Union and Switzerland. In a letter to European Commission President Jean-Claude Juncker and his successor Ursula von der Leyen, the heads of regions in France, Germany, Italy, and Austria described the recent tensions as “a cause for great concern.” They said that the current draft Swiss-EU deal was “just and fair.”

EURJPY

The pair recently slipped down to its 50-day moving average, with some recent lows within sight. Over in Japan, the yen showed some strength in the forex markets after the US Federal Reserve slashed key interest rates. In the country, the Bank of Japan kept the monetary policy on hold, as the markets have largely expected. However, it also hinted that it could ease and similarly slash rates next month. Central banks around the globe have been easing policies to fight the risks of low inflation and recession. The BOJ reaffirmed its promise to guide short-term interest rates at negative 0.1% and the 10-year government bond yield around 0%. Markets are going to keep close tabs on BOJ Governor Haruhiko Kuroda’s post-decision press conference later on Thursday to see how he assesses risks to Japan’s economy outlook. On the day, the Bank of England is among the central banks that will announce updates on monetary policies.

COMMENTS