Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

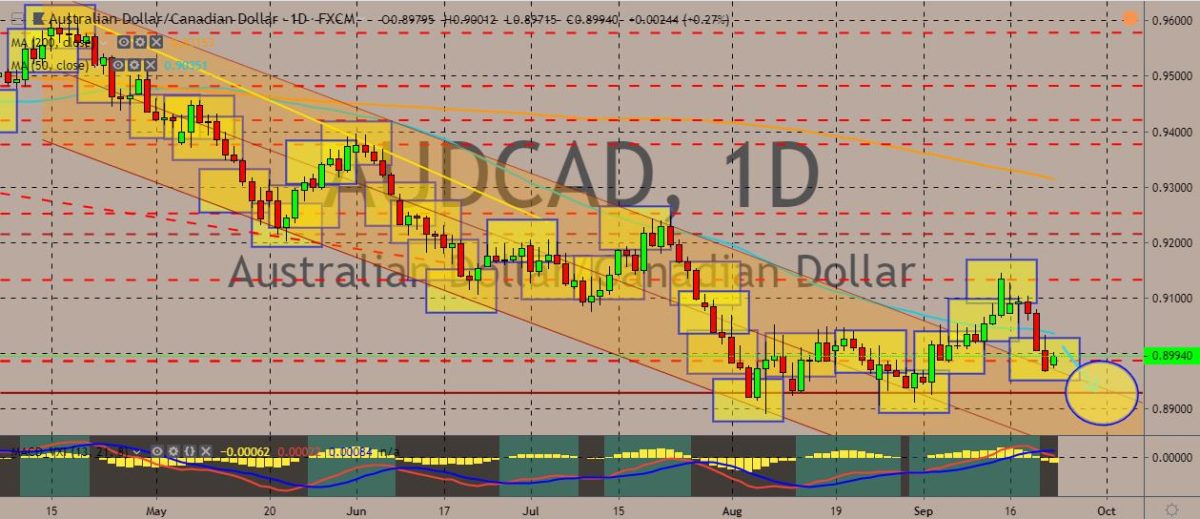

AUDCAD

The pair pulled back from recent highs after it broke below the 50-day MA, with the Australian dollar weakening amid concerns of an economic slowdown. Unemployment rate in the country rose from 5.0% at the start of the year to 5.3% in August. The recent GDP figures also showed slower growth. Reserve Bank of Australia Governor Philip Lowe will give a speech on Tuesday evening. Markets are expecting him to indicate another rate cut at its next meeting. Traders are betting at an 80% chance of a rate cut to 0.75% during the October meeting. Meanwhile, in Canada, the central bank wants to avoid making any possible influence on the federal election. The Canadian campaign also rolls mid global trade conflicts weigh on the world. Central banks have been implementing new policy actions, like cutting interest rates, to support the faltering global economy.

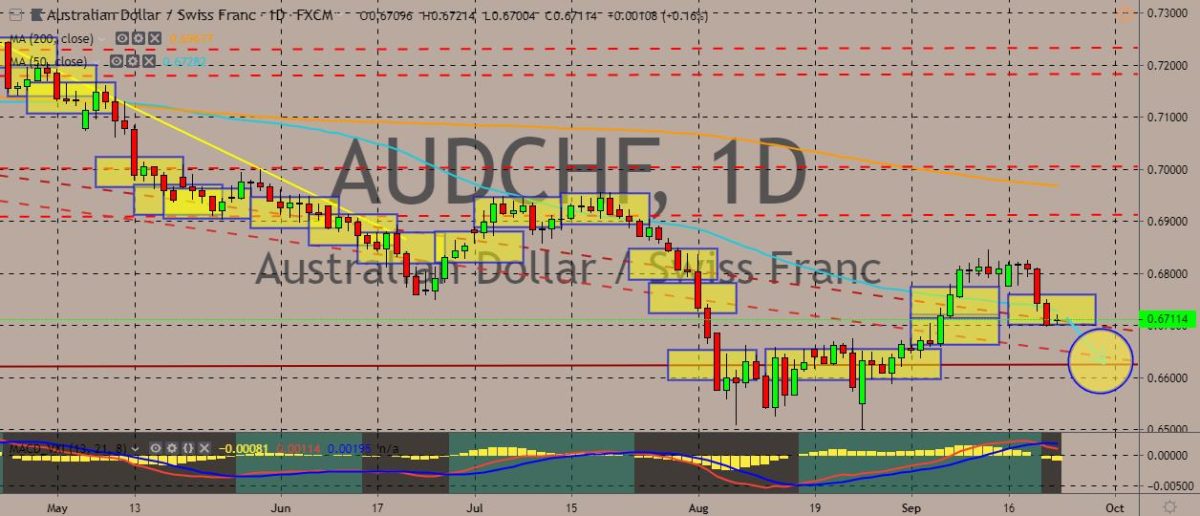

AUDCHF

The pair is attempting a pullback after a recent slump in the previous two sessions. It recently broke above the 50-day MA, only to turn back below it on the back of weakening Australian economy. Over in Switzerland, the Swiss National Bank has held interest rates steady. That’s despite of its slashing of growth forecast for the year amid increasing global risks. The rate is left unchanged at -0.75%. Inflation forecast has been reduced because of weaker prospects abroad and the stronger swiss franc. The expectation is now between 0.5% and 1% for this year. That’s lower from about 1.5% in June. For the whole year, the SNB revised down its inflation prediction to 0.4% from an earlier forecast of 0.6%. In 2020, the bank predicts a rate of 0.2%, compared to the 0.7% it estimated during the previous quarter. The rate is expected to rise to 0.6% in 2021, which is lower than the previous expectations of 1.1%.

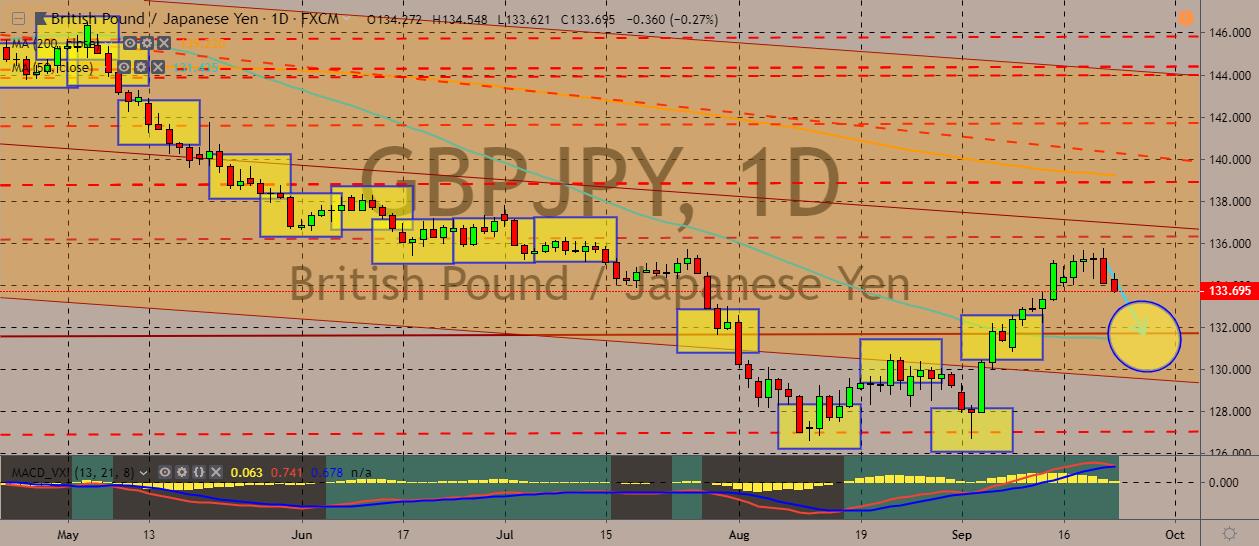

GBPJPY

The GBPJPY pair slumped in the previous two sessions, with the price still trading below the 200-day moving average and above the 50-day moving average. This indicates a generally bearish mood in the shorter term. Over in the United Kingdom, Jeremy Corbyn is locking horns with the Labour’s membership after he attempted to stop the party campaigning to stay in the European Union at a general election. Meanwhile, the previous Brexit-positive comments from European Commission President Jean-Claude Juncker fell behind the pessimism looming over the GBPJPY pair. Juncker has recently provided hope to British Prime Minister Boris Johnson after he indicated he was ready to turn down the Irish backstop if Britain has good alternatives. The Japanese yen showed off its safe-haven appeal as other factors such as geopolitical tensions and lack of progress in the US-China trade negotiations weigh the market.

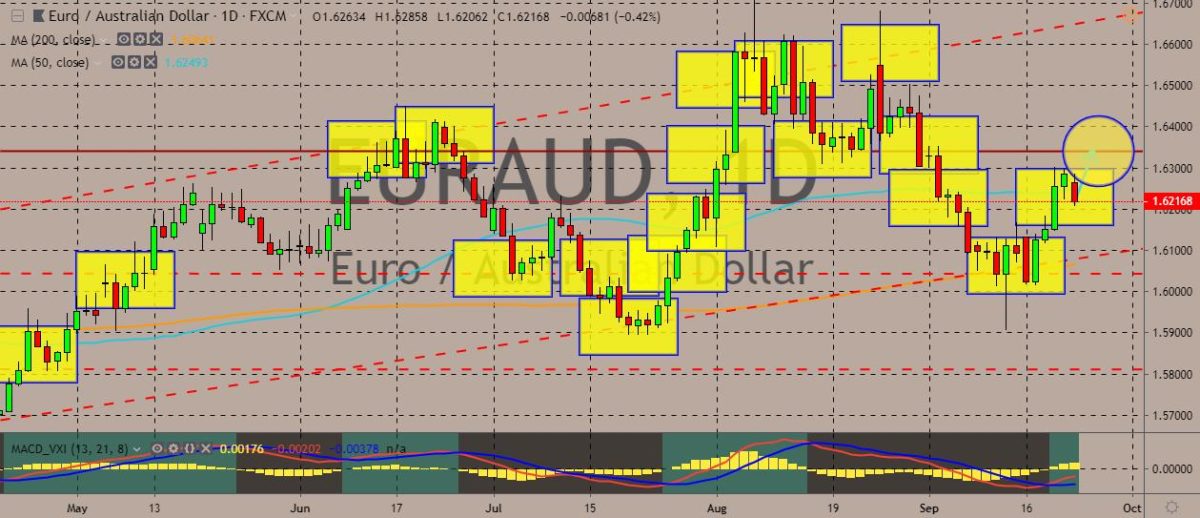

EURAUD

The pair traded in the red in the previous session after breaking above the 50-day MA, apparently not able to sustain the upward momentum. The pair appears to attempt a pullback that would retrace its previous upward gains. For this week, the euro will be moved by economic data as focus shifts on economic reports. In the previous month, the manufacturing PMIs ticked up in both the euro area and Germany. The market can expect the PMIs for the two speed-economies to remain broadly stable at 47.0 in September. On the other hand, we can expect downside potential for the service print after the drop of business expectations last month and expect it fall to 53.0. If the markets don’t see a pickup in US PMIs, this means that the third quarter showed the most sluggish growth since 2009. Draghi is scheduled to make an appearance later in the day, with the markets looking for possible clues over monetary policy stance.

COMMENTS