Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

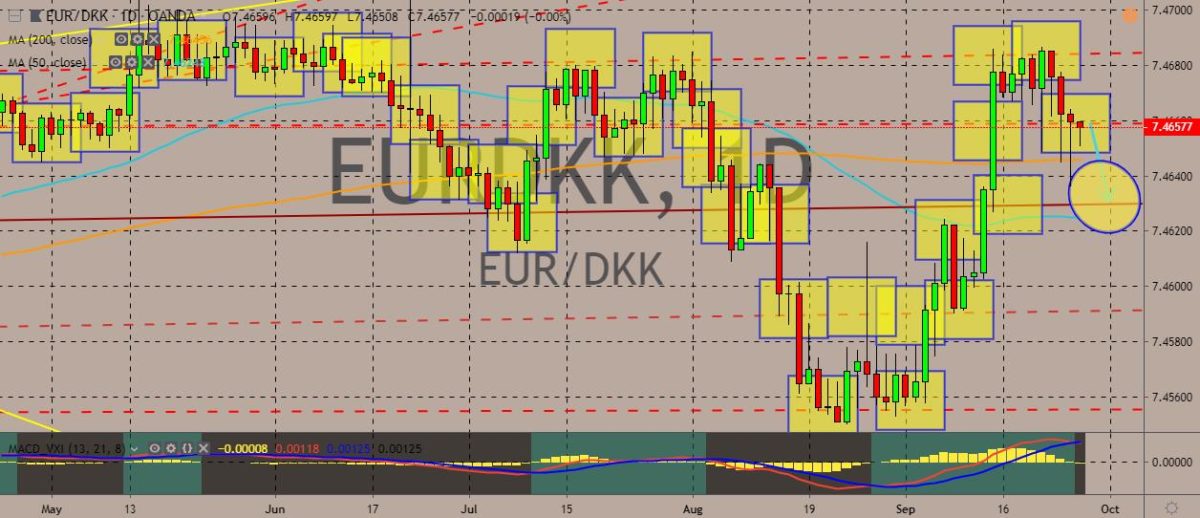

EURDKK

The trading pair EURDKK has fallen to weekly lows in recent sessions. Two sessions ago, the price has plummeted to monthly lows, nearly reaching the 50-day moving average line after breaking below the 200-day moving average line. As for central bank news, the currencies’ two central banks have a lot going on. Over in the European Central Bank, a top official resigned after publicly questioning the central bank’s need for stimulus efforts. Over in Danske Bank, the former head of the Estonian branch of the central bank was found dead a few days after he went missing. Aivar Rehe went missing since he left his home in Talinn on Monday. Rehe was a witness in an ongoing investigation on money-laundering, although he was not a suspect. The body was found near Rehe’s home, with police saying that there was no sign of violence and no indication of accident.

EURTRY

The pair rose slightly in the last session but did not pare back all its recent losses. The price is presently hovering above the middle band in the trading channel and below a key resistance level that also happens to be where the 50-day moving average is. If the price breaks above this level, it could lead to a possible breakout above the upper band of the channel. Over in Turkey, the lira benefited from various media reports that said the United States was getting ready to offer the country a trade package that could include proposals over the US F-35 warplanes and Patriot missiles. David Satterfield, who is US ambassador to Ankara, was reported to have given a presentation about a proposed package at the presidential palace before Turkish President Tayyip Erdogan’s current visit to the United States. The reports also noted the existing target for quadrupling bilateral trade between the two countries.

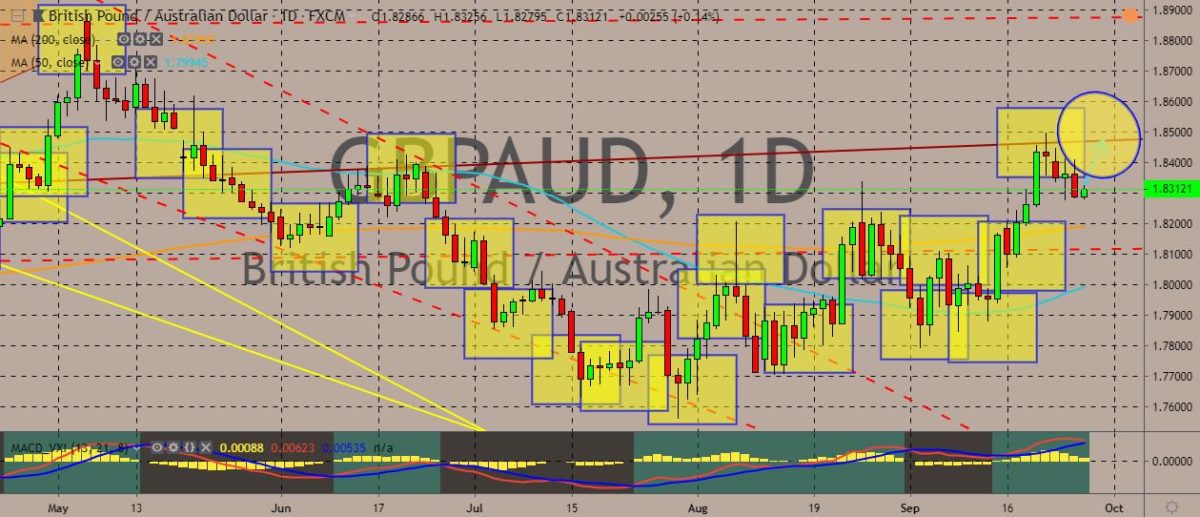

GBPAUD

The pair has recently strengthened after plummeting to weekly lows, although further back beyond that the price has reached multi-month highs. The pair is trading above both the 200- and 50-day moving averages, indicating a bearish sentiment prevailing over the pair’s traders. The British pound’s strength comes from the lower chances of a no-deal Brexit. This comes after the UK Supreme Court ruled that the prorogation of the Parliament by British Prime Minister Boris Johnson was unlawful. Meanwhile, over in Australia, Reserve Bank of Australia Philip Lowe recently suggested that the economy is currently at a gentle turning point. It’s highly likely that the RBA will cut interest rates again this year after having slashed it two times already. On top of this, the ongoing problems between the United States and China in terms of the trade war could mean the markets may see another rate cut as early as next week.

GBPCAD

The pair recently plummeted down after attempting to break above the current trading ranges. Trading above the 50-day moving average, the overall trajectory of the pair appears to be upward, although it could manage a breakout soon. Over in Canada, Canadian Prime Minister Justin Trudeau said that Britain’s focus on Brexit is undermining the country’s needed leadership in global affairs. In his words, the UK is “so consumed” by the issue that it is interfering with their ability to lead on so many other things “where the UK’s leadership…is so necessary.” Meanwhile, Trudeau is being embroiled with tons of issues, including criticisms of his campaign to save the environment. In that case, opponents of the liberal prime minister mocked his campaign by distributing an email statement that read only “You. Bought. A. Pipeline.” Trudeau is also facing criticisms over the unearthed records of him wearing “brown face.”

COMMENTS