Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

GBPNZD

The pair is trying to perk up after plummeting to weekly lows in the recent session. The price still trades above the 2 moving averages (50-day and 200-day) on the daily chart, indicating a bullish sentiment prevailing among traders, at least in the short term. Over in Britain, opponents are accusing Boris Johnson of fueling the division after he mocked them for surrendering to Brussels. Additionally, the British prime minister has been blocked by MPs from having a Parliamentary recess to allow the Conservative Party to hold their annual conference. Boris Johnson had t return to the House of Commons after the Supreme Court ruled against his decision to suspend the Parliament. Meanwhile, in New Zealand, RBNZ Governor Adrian Orr said that the central bank was not likely to need unconventional monetary policy tools, although it was also important to be ready.

USDCNH

The pair is seeing upward momentum now, with the price staying above the 50-day moving average, which lies above the 200-day moving average. For fundamentals, China’s industrial firms decreased 2% in August on a year-on-year basis, according to the National Bureau of Statistics. This is a change from the 2.6% gain recorded in July and the 3.1% decrease in June. From January to August, profits slipped 1.7% from a year earlier at 517.8 billion yuan, or $72.62 billion. Industrial firms’ liabilities rose 5% year-on-year to 65.81 trillion yuan by the end of August, which is higher than the 4.9% increase recorded in July. The data’s scope includes companies that have more than 20 million yuan in annual revenue coming from their main operations. This comes against a backdrop of wide expectations from policymakers to unveil measures to boost a faltering economy and sluggish consumption.

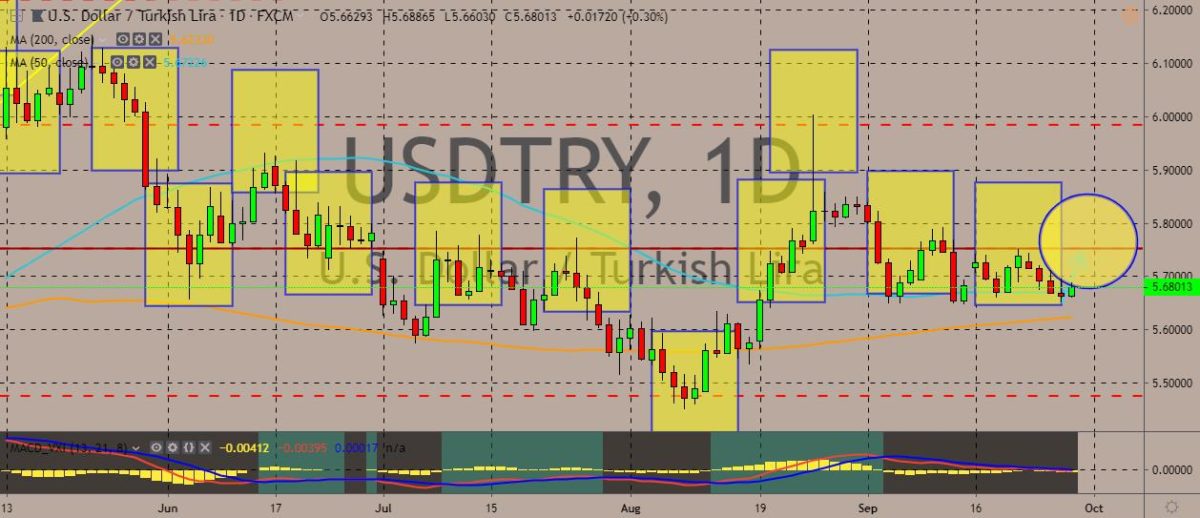

USDTRY

The pair showing signs of trading sideways, with the price staying within ranges, although it appears that traders aren’t letting the stray too far away from the 50-day moving average. Over in Turkey, the central bank governor said that the recent policy steps are “front loaded,” following the bank’s decision to cut its key interest by 750 basis points in less than two months. Governor Murat Uysal, during an industry forum in Ankara, said that the central bank has to maintain its cautious stance even while he predicted a continuing decline in inflation and moderate recovery for Turkey’s economy. Last year, the country experienced a currency crisis that resulted to inflation shooting through the roof. The central bank then had to hike rates to 24% and this tipped the economy into recession. Inflation has since slid, the in late July the bank started cutting rates to 16.5%. Markets can expect more cuts before the year ends.

EURNZD

The pair is continuing to record higher highs and higher lows with the trajectory strongly upwards. In the recent sessions, the euro saw general weakness against the New Zealand dollar thanks to the not-so-positive news coming from the European Central Bank. Recently, senior German ECB member Sabine Lautenschlager resigned unexpectedly before the end of her term. The high-profile resignation came after ECB President Mario Draghi announced the beginning of a new round of quantitative expansion and slashing in rates for the deposit facility. The ECB has been suffering from division among its ranks, and although there have been no official details as to why Lautenschlager resigned, many are seeing the move as a result of the divide over the ECB’s decision to restart quantitative easing. Lautenschlager is the third German official to exit the ECB in just eight years after policy conflicts.

COMMENTS