Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

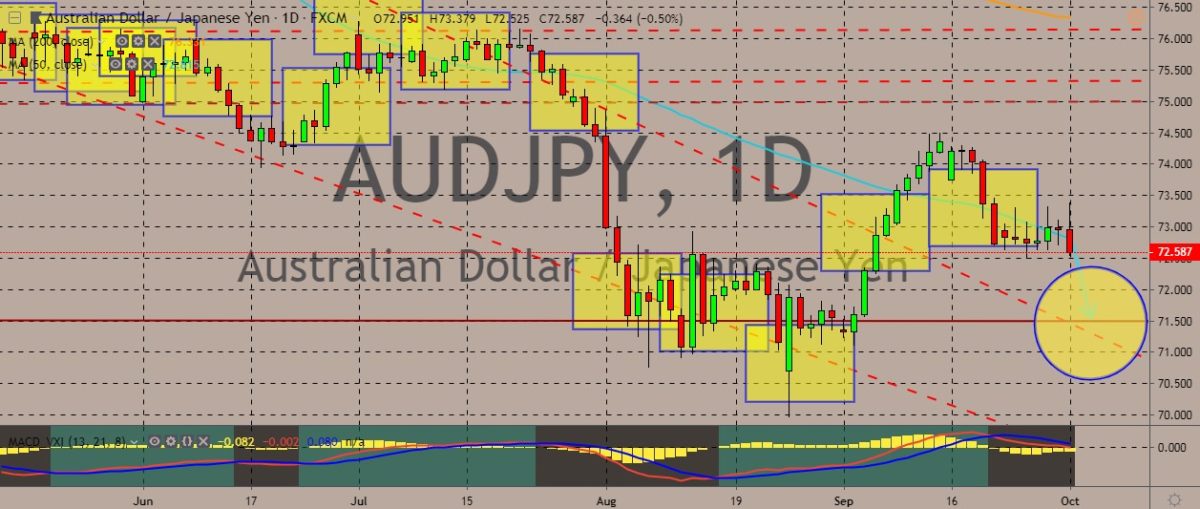

AUDJPY

The pair is trading in the red, although the 50-day moving average serves as a solid support base line for the price. It has recently reached week highs, but it then settled the trade in the negative. Over in the Australia, the Reserve Bank of Australia recently cut rates to 0.75%, a new low and the third cut since June this year. However, only two of the “Big Four” banks in the country have cut their rates. The first to cut rate was the Commonwealt Bank, which will cut variable home loan rates by just 0.13%, barely half the RBA’s cut. Meanwhile, NAB stated that it will cut rates by 0.15% on October 11. This is the first time for the country’s official cash rate to fall below 1.00%. Many experts are predicting that the rate will stay down for at least a couple more years. Rate cuts will probably happen again before the end of the year, with hints coming from Reserve Bank Governor Philip Lowe.

AUDUSD

The Australian dollar unsurprisingly fell weaker against the US dollar after the RBA’s decision to cut rates. The price has fallen to record lows after the announcement, and it appears it still more room to fall down in the coming session. According to Philip Lowe, interest rates are very low on the global scale, and markets and experts are expecting more monetary easing. Central banks are trying to battle the persistent downside risks to the global economy and the subdued inflation. According to Lowe, the board made the decision to cut rates again to support employment levels and wage growth. The decision also serves to boost confidence that inflation will fall in line with the medium-term target. He then added that the economy still has spare capacity, and that an extended period of low interest rates will be needed to reach full employment and hit the country’s inflation target.

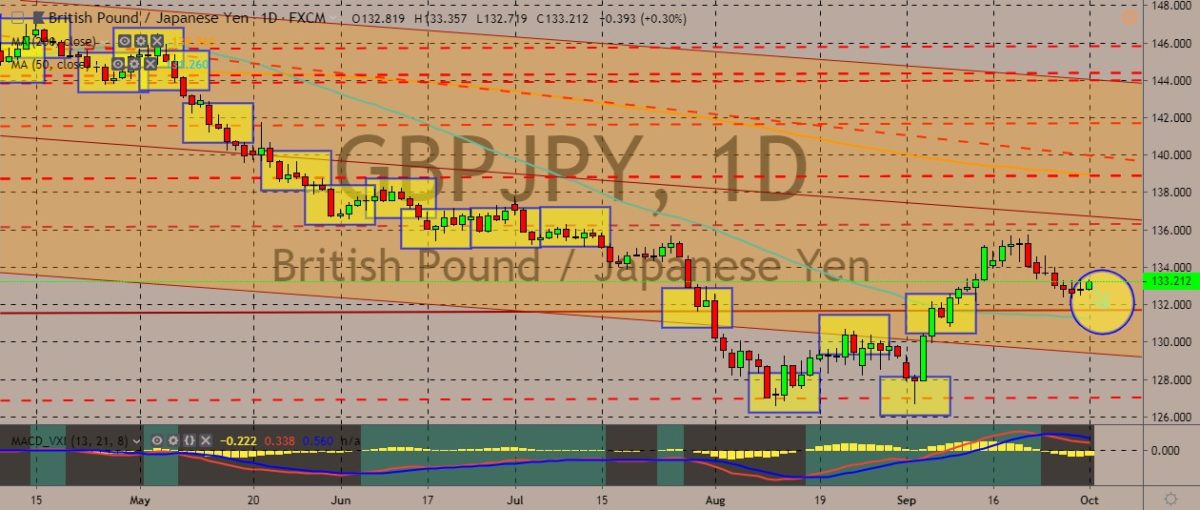

GBPJPY

The pair is trading slightly in the green after recently managing a breakout at the lower level of the trading channel it has been following. The British pound has recently weakened against the Japanese yen, although before that it appeared as though it would continue climbing up post-breakout. Trading above the 50-day moving average and below the 200-day moving average, the pair appears to be balancing between the risks over in the United Kingdom and the US-China trade war that has affected the global economy and spurred anxiety in the forex markets, thus providing a huge boost for the Japanese yen, it being a safe-haven asset. Regarding the Brexit saga, British Prime Minister Boris Johnson has defended his proposal for an amended divorce deal with the European Union. Some media outlets have already reported parts of the new plan, and these extracts have gathered criticisms from the Republic of Ireland.

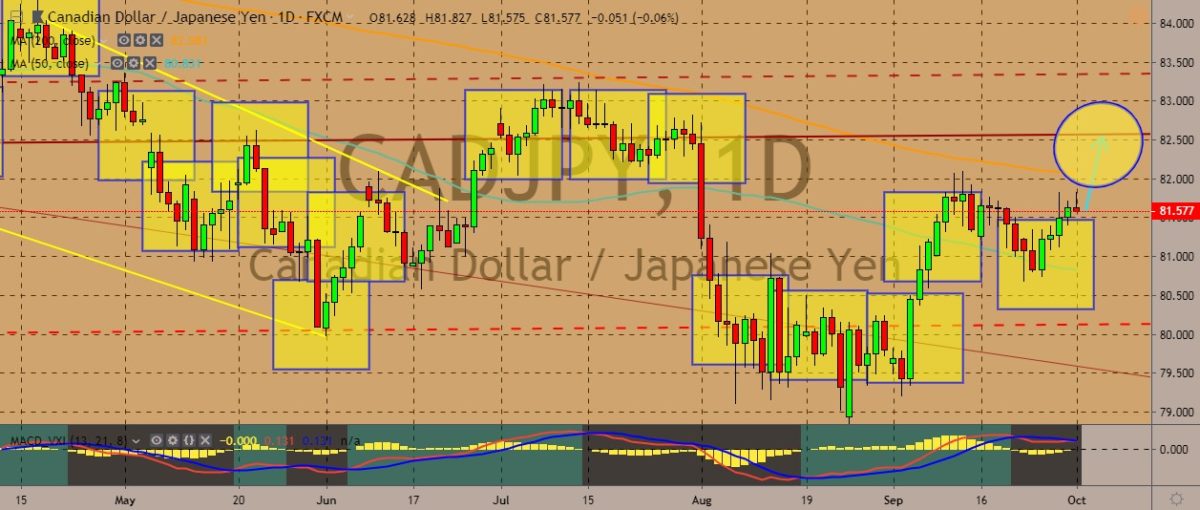

CADJPY

The pair has traded in the bullish territory in recent trading sessions, with the price recently dropping towards the 50-day moving average but bouncing back up, coming nearer to breaking above the 200-day moving average. The Canadian dollar has been tagged as the best performing major currency of the year on Monday, but that title could be short-lived if the loonie loses steam, which could happen if the tensions over the Saudi Arabian oil production capacity persist. The Canadian currency is a commodity currency, which means its performance has a lot to do with the performance of the commodities market. Recently, a drone strike blasted on a Saudi Aramco facility, and the attack has since hampered production. This could result to worsened concerns over global oil supply. This could be a boon for the Canadian dollar, but the broader global financial and political environment doesn’t do much for the continued strength of the loonie.

COMMENTS