Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

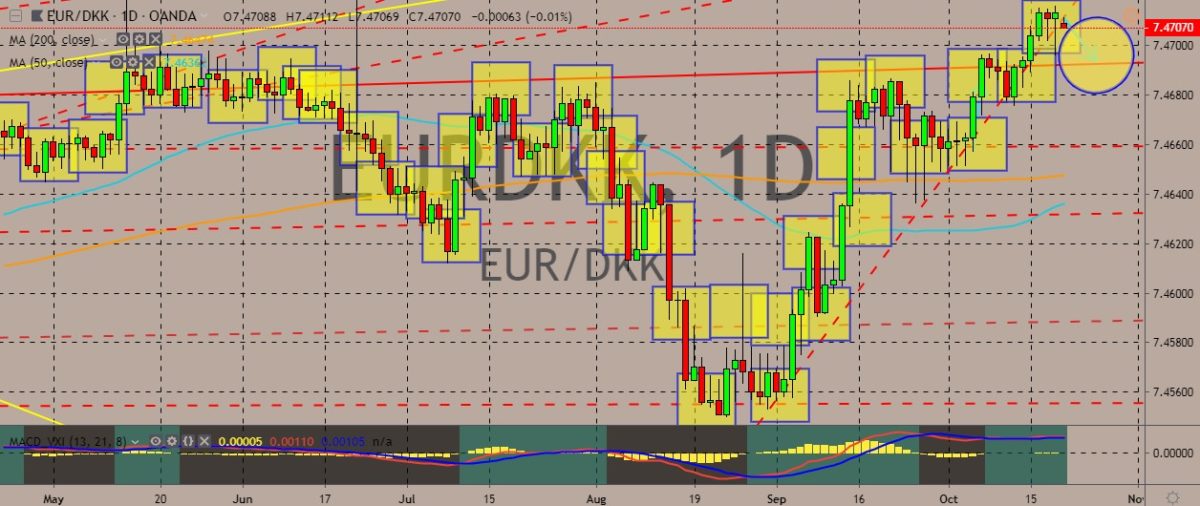

EURDKK

The pair is going on in an uptrend, with the prices going above both the 200-day and 50-day moving average on the daily chart, indicating a bullish momentum for the pair. Also, the 50-day moving average, which lies below the 200-day moving average, is starting to point upward, attempting to cross above the longer-term moving average. Over in the eurozone, inflation has decline to its slowest pace in three years and this triggered fears over the future of the euro region. In Germany, inflation rates have slipped to 0.9% from 2.2% in September last year. Over in Denmark, the government announced that it will restart conducting identity checks on its border with Sweden, which garnered unwelcome reactions from other European leaders. This came as a surprise amid the close ties between the two Scandinavian countries. This is in stark contrast to the frictionless travel of European citizens across national borders of member states.

EURTRY

The pair has traded in the red in the previous sessions. Initially, it traded on monthly highs and then settled in the red. Afterwards, it traded even further down and slumped to weekly lows. Still, the 50-day moving average appears ready to cross above the 200-day moving average. Meanwhile, Turkey is embroiled in a military campaign in Syria and is locking horns with the US. The lira has been a pinball of geopolitics between Ankara and allies in the West. The pressure on the lira and attempts to stabilize it could exacerbate the danger to the country’s foreign currency reserves. This could leave the country with little room to protect the lira more sanctions were imposed. The lira steadied last week as the prospect of severe sanctions from the US dimmed after Turkey agreed to a ceasefire in northern Syria. This also raised the expectations of an interest rate cut by the central bank in the coming week.

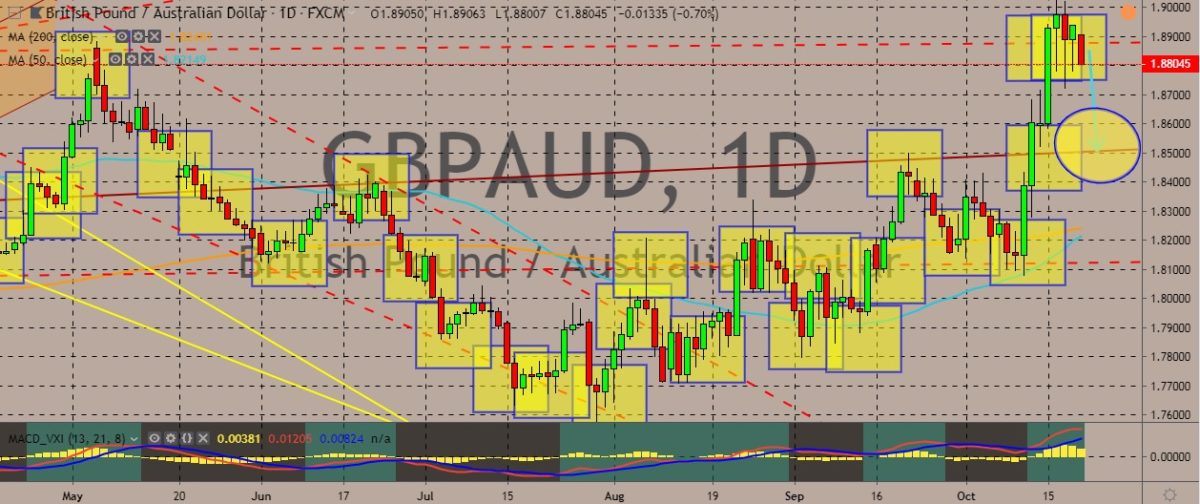

GBPAUD

The pair traded in the red in the previous session with prices still close to multi-month highs. The 50-day moving averages also appears ready to cross above the 200-day counterpart, indicating some solid bullish momentum for the pair. Over in the United Kingdom, the British pound is on a wild ride. At the last minute on Saturday night, British prime minister Boris Johnson asked the European Union for a Brexit delay. This surprised spectators and sent the market reeling from shock. Now, the UK is facing another Brexit delay after members of the British parliament voted to withhold approval for the Brexit deal that he had hammered with EU officials last week. Under a law passed last month, the vote meant that Johnson had to send a letter to the EU to ask to delay the Brexit to January 31, 2020 from October 31 this year. The UE Council Head Donald Tusk said that EU leaders will consider the request.

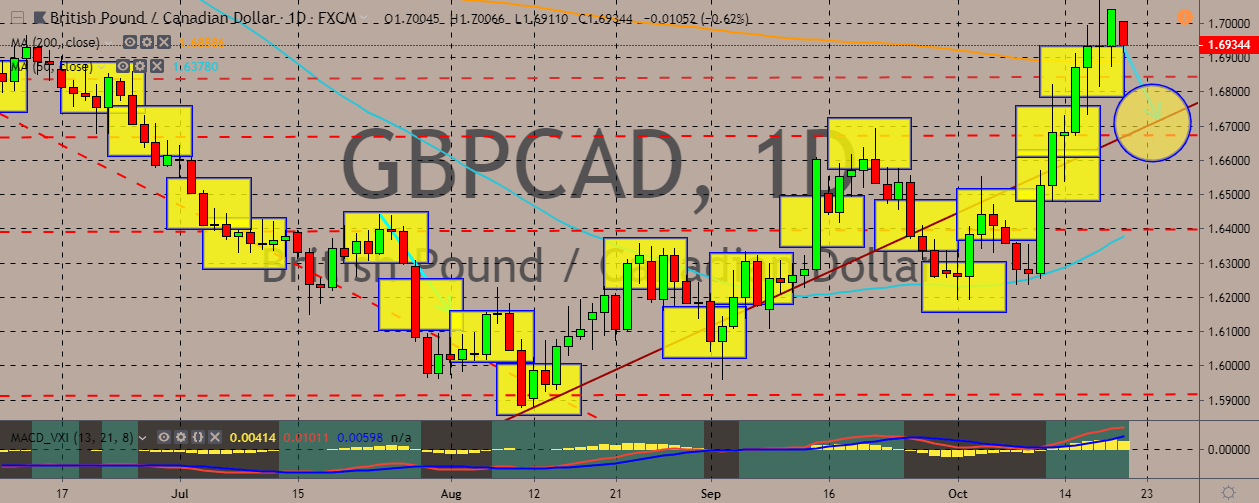

GBPCAD

The pair has retraced its most recent gains after trading to monthly highs. However, it stayed above the 200-day moving average, indicating that traders are trying to be bullish amid the weakening of the pair. Over in Canada, the annual inflation rate was 1.9% in September for a second month in a row. The rate is still close to the central bank’s target rate of 2%. At present, Canada is busy having its federal elections, with the final round of polling indicating a deadlock between the Liberals and the Conservatives. The Liberals, Conservatives, and NDP each took some more support from Saturday. The NDP made the biggest jump of 2.3 percentage points in support. In terms of the country’s preferred prime minister, Liberal leader Justin Trudeau has a lead over the Conservative Leader Andrew Scheer. According to the survey, 30.5% of respondents wanted Trudeau to serve as Canada’s prime minister, leading Scheer by 4.1%.

COMMENTS