Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

AUDUSD

The pair has hit another solid resistance that it failed to break out of before. The pair is attempting another breakout. If it manages to go up this resistance line, the pair will probably tread higher towards the 200-day moving average level. Over in Australia, former prime minister Paul Keating says that the country’s economy is “idling at the lights” and needs a government-led infrastructure spending boost. The boost must include a fast train between Sydney and Newcastle, according to Keating. As he spoke in an interview, he accused the government of having a budget “surplus virus” that was stopping it from using record low interest rates to lift the economy out of its limp. The Reserve Bank of Australia has urged all governments to use low rates to expand their infrastructure programs while attempting to push down the unemployment rate and lift wages. The official cash rate is at a record low of 0.75% while government debt rates are at near-record lows.

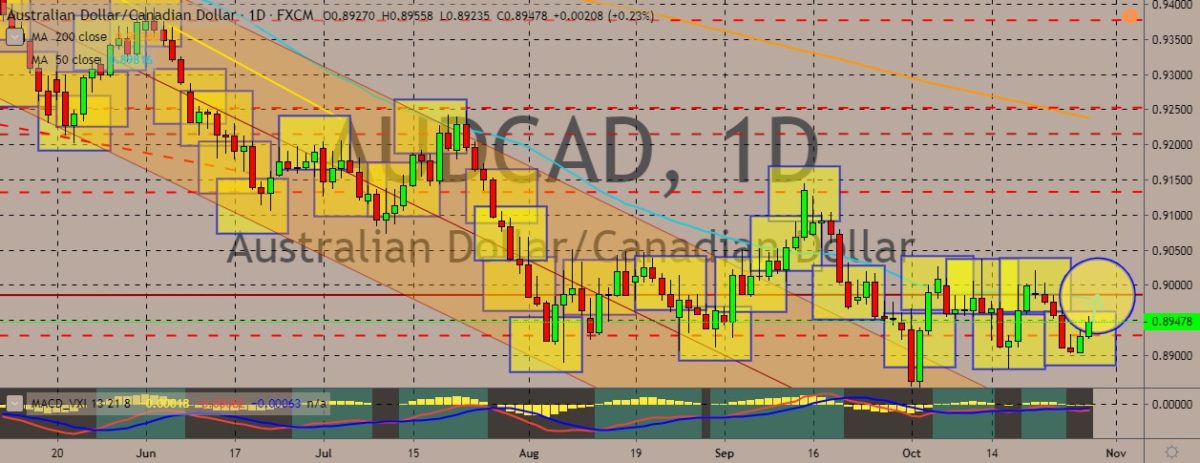

AUDCAD

The pair has been trading sideways since it broke away from its down-trending trading channel. It now moves up and down under the 50-day moving average. Over in Canada, the Bank of Canada is expected to keep interest rates steady on Wednesday in its first policy announcement coming after the federal election. The steady rates are expected in spite of the fact that investors are looking for higher-yielding currencies and shifting more of their money into Canadian dollars. Last week, Prime Minister Justin Trudeau and the Liberal Party won a second term. However, it lost its majority in the House of Commons. Trudeau has already indicated that his priority was a tax cut for the middle class. Although higher fiscal spending could improve Canada’s economy, a strengthening currency would make it difficult to increase the export-led growth, which is more sustainable. Bank of Canada Governor Stephen Poloz has been counting on this.

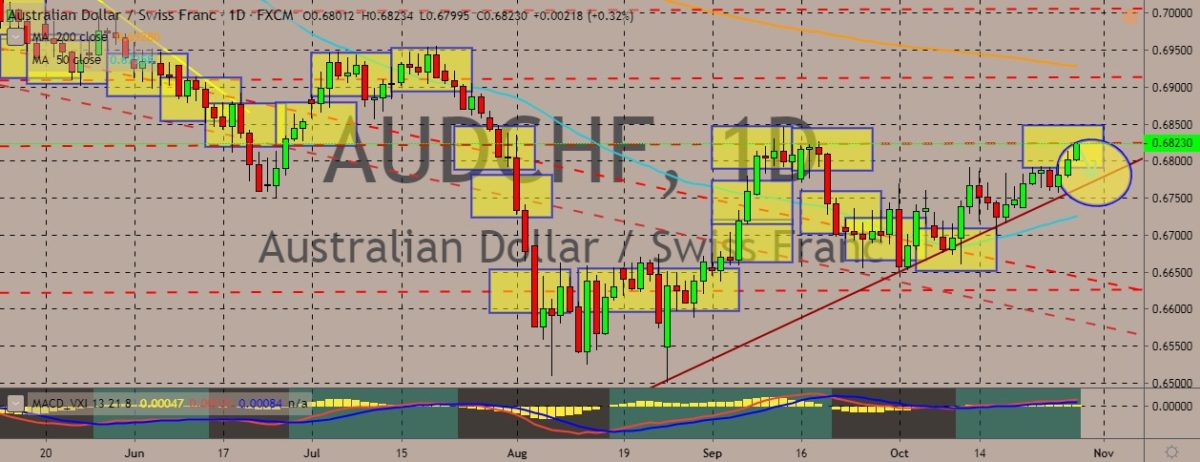

AUDCHF

The pair appears to be pursuing an uptrend as it creeps closer to the 200-day moving average and farther away from the 50-day moving average. However, it may be facing heavy pressure right as it is right below a resistance line. For the fundamentals, Switzerland’s GDP growth is already negatively affected by the faltering global growth, as well as trade rows, weak growth in Germany, and uncertainties all around the world. Following two quarters of negative growth at the end of 2018, growth crept back to the positive territory in the first half of this year. Still, a lot of uncertainty looms large and investments are weakening at a fast pace. In September, composite Purchasing Managers Index slipped to 43.4, which was its slowest level since 2009. In 2019, analysts expect the country’s GDP growth to reach 0.9% in 2019, well lower from the growth observed in 2018, which was 2.8%.

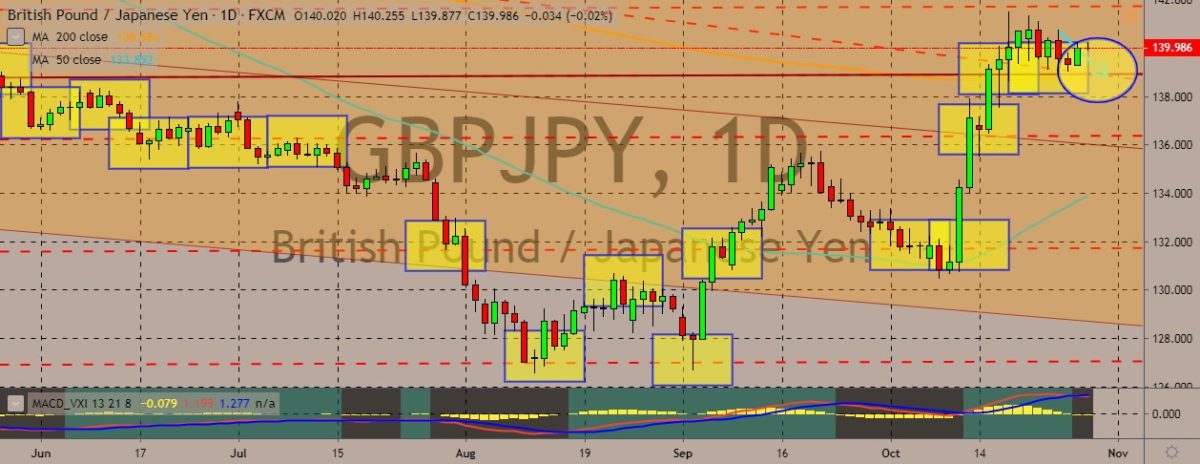

GBPJPY

The pair is still benefitting from the previous boost in the strength of the British pound. There were consecutive jumps in prices, although now the levels are slowly paring back some of gains. Still, the pound is near multi-month highs against the yen. Over in the UK, British Prime Minister Boris Johnson failed to get his Brexit deal ratified in the UK Parliament, following his success of hammering one out with the EU in Brussels. He has also failed to get the election he wants to get out of the deadlock. Over in Japan, manufacturers are growing frustrated again over another delay in Britain’s withdrawal from the European Union. Many Japanese companies have been stocking parts in anticipation of a worst-case scenario, as supply chains for manufacturers would be affected greatly in the event of a no-deal Brexit. The trade ministry and the Japan External Trade Organization set up a hotline earlier in the month to support Brexit-affected companies.

COMMENTS