Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURTRY

The pair has broken above its down-trending trading channel in recent sessions. However, the price appears to be slipping back in the area after paring back most of its gains. More importantly, though, the 50-day moving average recently crossed above the 200-day counterpart, indicating bullish sentiment among traders. Over in Europe, Mario Draghi recently bid farewell as the outgoing European Central Bank president. In his farewell speech, he called for “a euro area fiscal capacity of adequate size and design.” Meanwhile, Turkey military and government are facing additional sanctions from the United States after the country’s military operations against Kurdish forces in northeast Syria. The vote came in at 403-16 from the House of Representatives, in defiance of Trump’s decision to withdraw US forces from northeast Syria. The withdrawal left America’s Kurdish allies without military support.

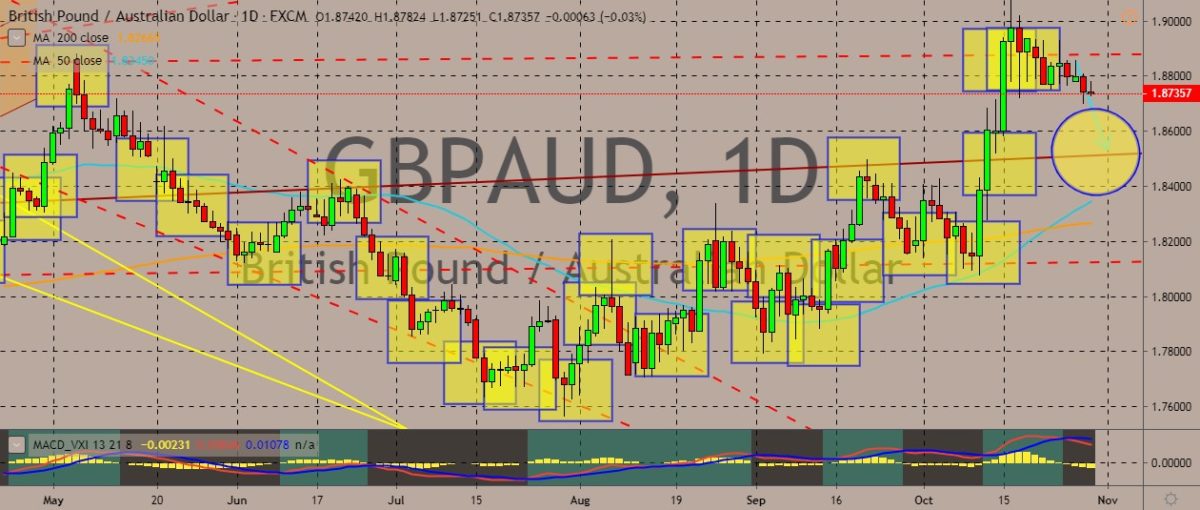

GBPAUD

The pair is inching down from recent highs, generally heading south, after the recent upsurge in the pound’s value. Over in the United Kingdom, a Brexit deal looks like not impossible at all, with the Labour Party agreeing to a general election. UK citizens will be heading to the polls in the second week of December to determine the next UK prime minister. After the EU agreed to extend the Brexit until the end of January 31, the UK now has to do its part: in the form of a general election or a referendum. Over in Australia, the Reserve Bank of Australia has cut key rates three times this year in an effort to lift Australian growth and inflation. However, the broader markets and economists are expecting the central bank to impose another rate cut this year, which could lead to a record low of 0.5%. At the same time, the two cuts announced by the US Federal Reserve and the next policy changes could lead to further disadvantages for the Australian dollar.

USDDKK

The pair has traded lower in the recent sessions after attempting to pull back up. It’s now trading below the 50-day moving average, indicating that traders are being bearish on the pair’s movements. Over in Denmark, Danish lender Jyske Bank lowered its full-year profit outlook and said that it would not provide annual dividends. It cited negative interest rates and higher compliance spending after it posted a decline in third-quarter results. The bank said that it now expects after-tax profits of around 2 billion Danish crowns or $298 million, lower than the 2 to 3.3 billion Danish crowns previously expected. In the energy sector, the Danish government approved the Baltic Pipe project, which aims to send gas from Norway to Denmark and Poland. Denmark continues to ignore Russia’s Nord Stream 2 pipeline. According to the Danish Energy Agency, the offshore pipeline project can proceed “without an unacceptable impact on the environment.”

USDCNH

The pair is trading sideways with a bias in the negative as trading sessions go on. It currently trades below the 50-day moving average, with traders trading cautiously as trade war developments come in the headlines. Speaking of the trade war, Trump recently suggested that the “Phase One” of the US-China trade deal is coming ahead of schedule. He said that he expected to sign a significant part of the trade deal with China, although he did not elaborate on the timing. According to Trump, the Phase One would “take care of the farmers” and will also “take care of a lot of the banking needs.” Agricultural products are a major area of discussion between the two warring sides. China wants the US to cancel some of the existing tariffs on Chinese imports, according to the people with information regarding the matter. The Asian country asks that in exchange of the promised purchases of US commodities like soya beans.

COMMENTS