Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDTRY

The pair is trading in large peaks and valleys, with the prices using the 50-day and 200-day moving averages as support levels. The overall trend is still sideways. Turkey-US relations continue to fall under strain as the two NATO allies lock horns over Turkey’s invasion of northeaster Syria and the Turkish military’s offensive on Kurdish fighters, which were left defenseless by US troops after being allies with them previously. According to US lawmakers, the Turkey-US relations had been going downhill for months over Turkey’s growing ties with Russia. More recently, the US House of Representatives passed two resolutions that barred most US weapons sales to Turkey. Meanwhile, US President Donald Trump recently thanked Turkey for its role in the operation that killed the head of Islamic State. He held an open invitation to Turkish President Recep Tayyip Erdogan to come to the White House, but Capitol Hill commented on this harshly.

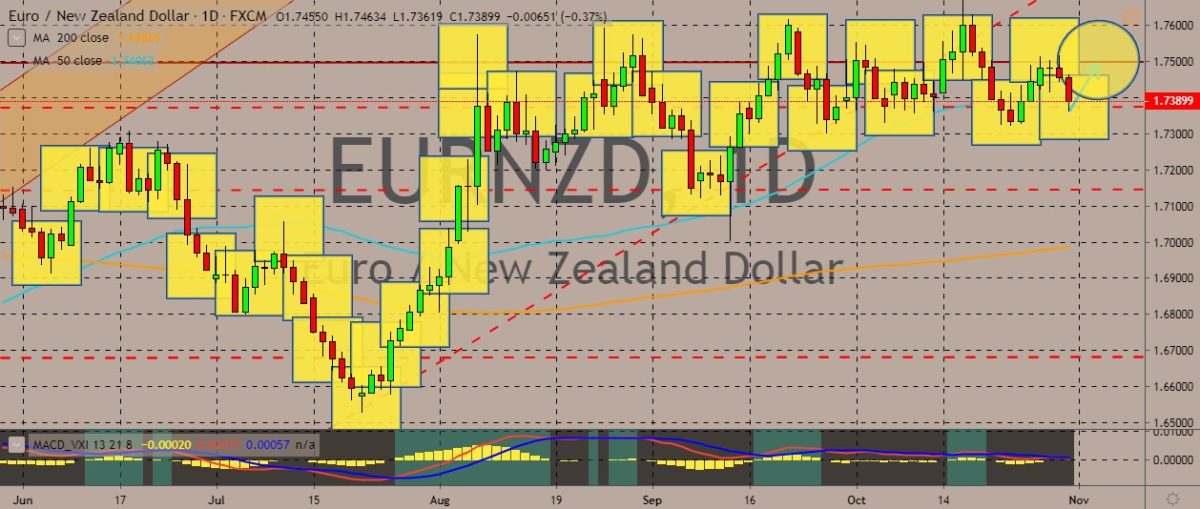

EURNZD

The pair traded in the red in the previous session, going near a weekly low. It’s fluctuating around the 50-day moving average level. Over in the eurozone, incoming European Central Bank chief Christine Lagarde criticized Germany and other thrifty eurozone members that run budgetary surpluses. She said that these countries should increase their spending to shore up growth. Over the previous five years, Germany, which is Europe’s biggest economic powerhouse, consistently posted budget surpluses thanks to Chancellor Angela Merkel’s government’s strict fiscal discipline. However, forecasts are now showing that the country could enter a recession in the third quarter. As a result, the government is facing mounting calls to spend more on investments. It could also approve tax cuts to support the economy. Germany’s budget and trade surpluses have been a point of contention between it and France, with the latter calling for the former to invest.

GPBBRL

The pair is trading in the green for the previous three sessions, sitting above the 50-day moving average as its support line. The 50-day MA is still above the 200-day MA, indicating a bullish sentiment prevailing among traders of the pair. Over in Brazil, the country’s central bank slashed its benchmark interest rate by 50 basis points, which is widely expected by the markets. The rate now sits at a record low of 5.00%. The cut is the third cut in a row for the bank, which is attempting to boost growth and stop inflation from further falling below the bank’s target. For economic figures, Brazil national debt is expected to continue rising in the coming years, reaching a new all-time high of 81.8% of the gross domestic product in 2022 before it reverses its course after one year, according to the Treasury department. The Treasury said that the forecasts were based on its spending ceiling rule staying in place.

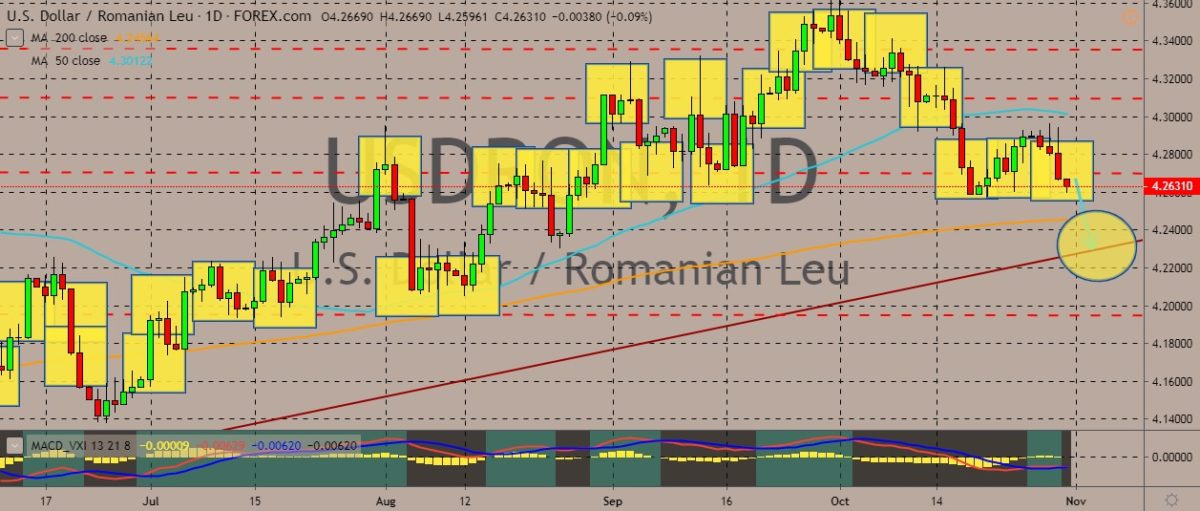

USDRON

The pair is trading in the red in the most recent sessions, trading below the 50-day moving average but above the 200-day moving average, indicating that traders are currently trading cautiously and aren’t committing any big trades on the either currency. Over in Romania, the European Commission has allowed Romania to contribute 200 million euros to the capital of the state-owned lender CEC Bank. It said that the operation wasn’t breaching the state aid regulations. The increase in capital will allow the bank to continue extending loans because it has already reached the limits allowed by the current capitalization and precautionary regulations, according to the central bank in October. Meanwhile, the country’s central bank kept its benchmark interest rates on hold, unchanged at 2.5% on Thursday, October 3, with the aim to balance the above-target inflation with the risk of worsening the country’s current account deficit.

COMMENTS