Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURSEK

The pair has traded in the red in the previous trading sessions, with movements indicating that it could go lower if given enough catalyst. Prices have previously plummeted intraday to monthly lows. A similar event could likely happen. That’s because the eurozone recently got some fresh evidence that the US-China trade war impacted the economy adversely. According to data, the eurozone economy grew 0.2% in the quarter that ended in September, unchanged from the previous quarter. However, the eurozone still had a slightly stronger growth than what markets have been expecting. This indicated that Germany, which is the eurozone’s top economic powerhouse, has narrowly avoided a recession in the third quarter. Germany is the eurozone’s most affected country when it comes to trade war. In the second quarter, it contracted by 0.1%, spurring speculations that the third quarter data next month would paint the same picture.

EURCZK

The pair is trading near monthly lows, with the prices fluctuating above and below a solid resistance line far below the 200-day moving average on the daily chart. Price could move sideways, with very tight ranges. For fundamentals, Advocate General of the European Court of Justice Eleanor Sharpston threw criticisms at Czech Republic, along with Poland and Hungary, after it failed to comply with the EU national migration quota. Sharpston said that the countries being sued by the European Commission could not cite fear for their internal security when rejecting the solidarity acceptance of migrants. The stance of the advocate general is not binding, but it has great impact on the decision. EU member countries introduced in 2015 the program of compulsory redistribution of migrants to help with the situation in Greece and Italy, which were the avenues for thousands of asylum seekers.

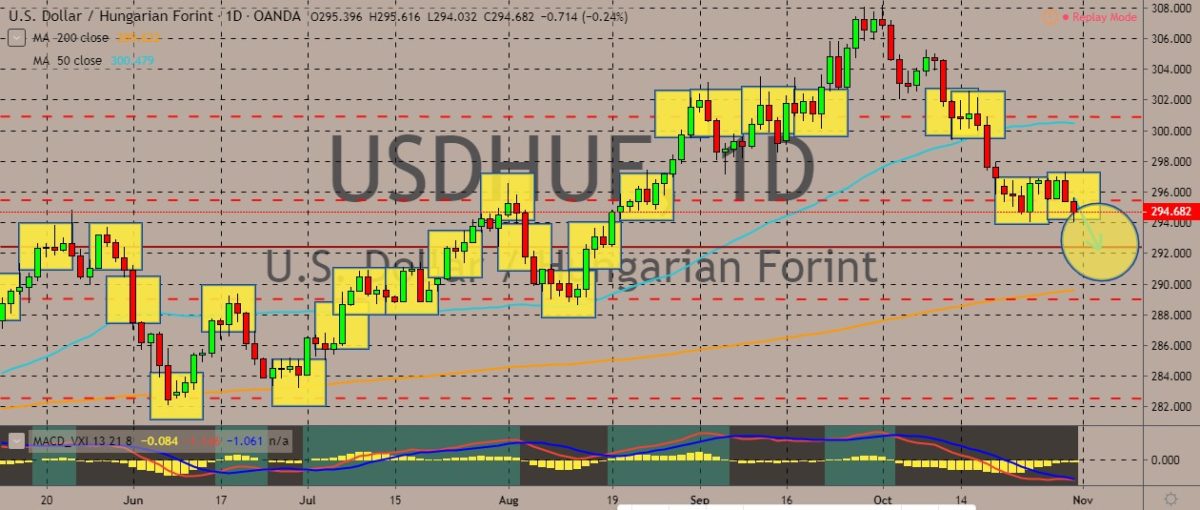

USDHUF

The pair is trading lower on the daily charts, with the movement generally subdued as the week heads to an end. The price slipped below the 50-day moving average in October after hitting highs in September, indicating that the bullishness on the dollar remains largely unsustainable as trade war negotiations are under way. Meanwhile, in Hungary, Prime Minister Viktor Orba’s Fidesz party is encouraging the government to stand up to any calls “legally or otherwise disguised” on the issue of European Union migrant quotas. His statement came as a reaction to this week’s opinion by a Sharpston that Hungary, Poland, and Czech Republic broke the bloc’s law by refusing to accept migrants under the 2015 resolution. According to the prime minister, the Hungarian people have repeatedly rejected the mandatory settlement of migrants. Meanwhile, according to Poland, a similarly accused country, it rejected the plan because it was faulty.

USDMXN

The pair traded in the green during the previous trading session, with the price creeping closer to the 200-day moving average. Still, the price is still hovering near multi-month lows. As for the US-Mexico relationship, the US House of Representatives is turning in some progress on a daily basis in relation to the trade agreement worked out by the US, Canada, and Mexico, according to House Speaker Nancy Pelosi. The agreement was signed nearly a year ago, and Pelosi said that the House is on a “path to yes.” She added that the ongoing impeachment inquiry on Trump has “nothing to do” with the chamber’s work on the USMCA. Trump’s government has been negotiating with the House Democrats to address their concerns over the deal, which would take the place of the $1 trillion North American Free Trade Agreement (NAFTA). Mexico has already ratified the trade deal, while Canada is yet to do that.

COMMENTS