Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

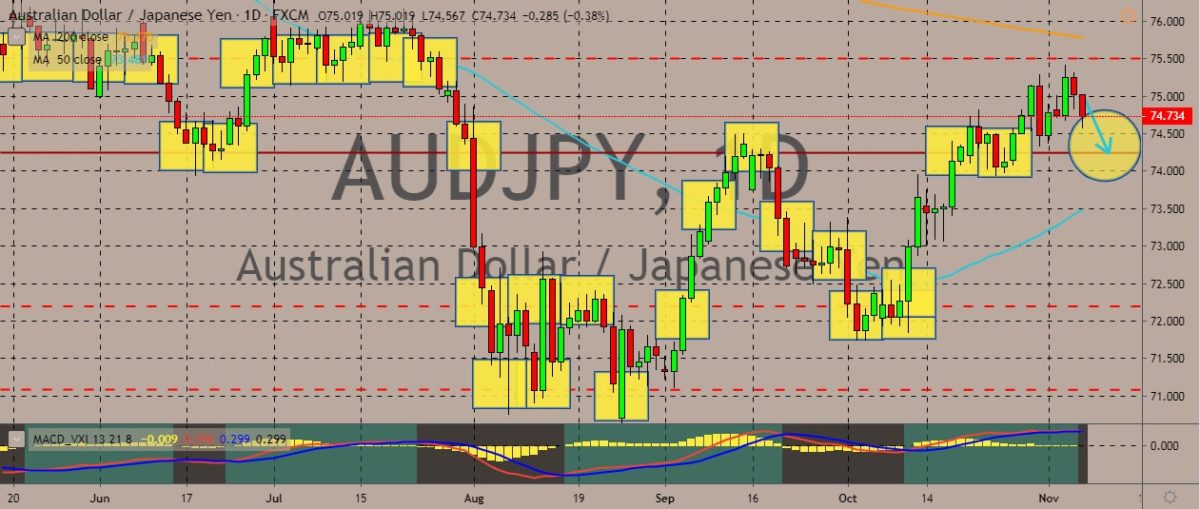

AUDJPY

The pair is trading on the higher portion of the chart, with the price coming closer to the 200-day moving average. Movements appear reluctant to continue going up, with candlesticks showing red. Primary drivers of price movements are the interest rate decisions from both currencies’ central banks. Recently, the Reserve Bank of Australia decided to keep the official interest rates on hold at its record low of 0.75%. Since June, the bank has cut rates three times. This triggered a spike in house prices as mortgage interest rates decline. The Bank of Japan did the same, keeping the monetary policy steady as the markets largely expected. However, the BOJ gave the strongest indications of its intention to cut rates if necessary. These actions further highlighted the concerns that risks abroad could undermine the recovery of Japan’s export-reliant economy. According to BOJ Governor Haruhiko Kuroda, the bank still has room to take negative rates lower.

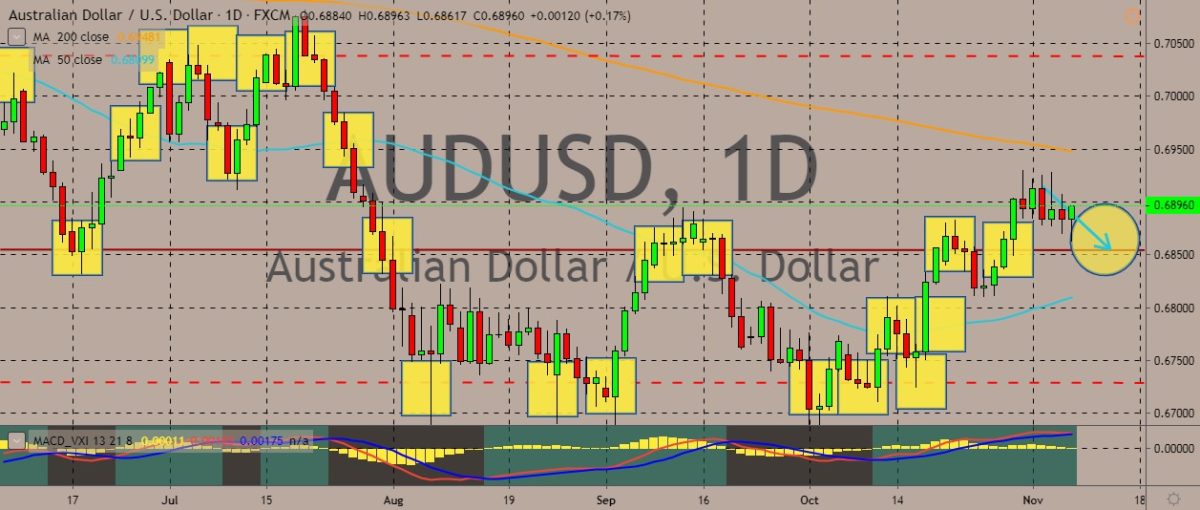

AUDUSD

The pair appears to be reversing its course after an uptrend above a key resistance line. Still, the 50-day moving average appears to be going for a bullish trend. The weakness in the Australian dollar comes from the latest decision by the Australian central bank. Meanwhile, the US dollar moved in part because of the Federal Reserve Bank’s decision to cut rates for the third time this year, which is something the market largely expected. However, the main price action driver for the US dollar is still the progress on the US-China trade war. This week, market sentiment perked up after the US and China showed signs of meeting halfway. The markets now hope that the two sides are patching things up enough to officially sign a Phase One trade deal. Latest reports today suggested that the signing could occur in December, as parties still discuss some specific terms and venues. The optimism largely remains cautious until a written, signed agreement comes out.

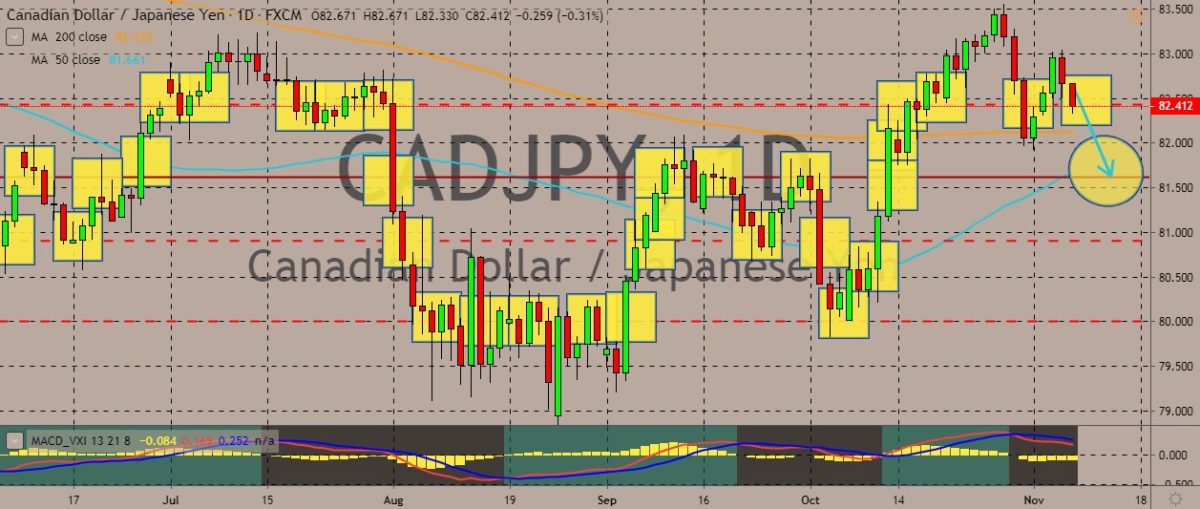

CADJPY

The pair is trading in the red in the most recent trading sessions, although the price is still near multi-month highs and above both the 200- and 50-day moving average. The 50-day MA, for that matter, appears to be perking up, as the Canadian dollar gathers some strength after the Bank of Canada decided to keep interest rates on hold too. However, risk aversion still benefits the Japanese yen as the BOC forecasted a weaker outlook for the domestic economy because of tense global downside risks. This likely gives the bank some leeway to slash interest rates. The current policy rate is at 1.75%, which is described by the bank as “appropriate” even after the lower growth forecast for the next two years. At the same time, the language of the central bank has changed. Now it claims that it’s aware “the resilience of Canada’s economy will be increasingly tested as trade conflicts and uncertainty persist.”

EURUSD

The pair is trading at the neckline of the most recent double top it formed on the daily chart. The price is currently near to cross the 50-day moving average, with still a lot of room to fall in the near future. The main drivers of movements are the European Central Bank developments for he euro and the US-China trade war for the US dollar. Over in Europe, ECB Vice President Luis de De Guindos recently commented that eurozone regulators should think about requiring banks to build larger capital buggers as protection against an even bigger downturn that could result in a credit crunch. After building capital over the last decade, Guindos believes that the bloc’s biggest banks can now weather an economic downturn. However, most of them still lack an extra capital buffer that they could free up in times of financial stress. De Guindos warned that the global economic outlook is deteriorating, and uncertainty is rising.

COMMENTS