Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

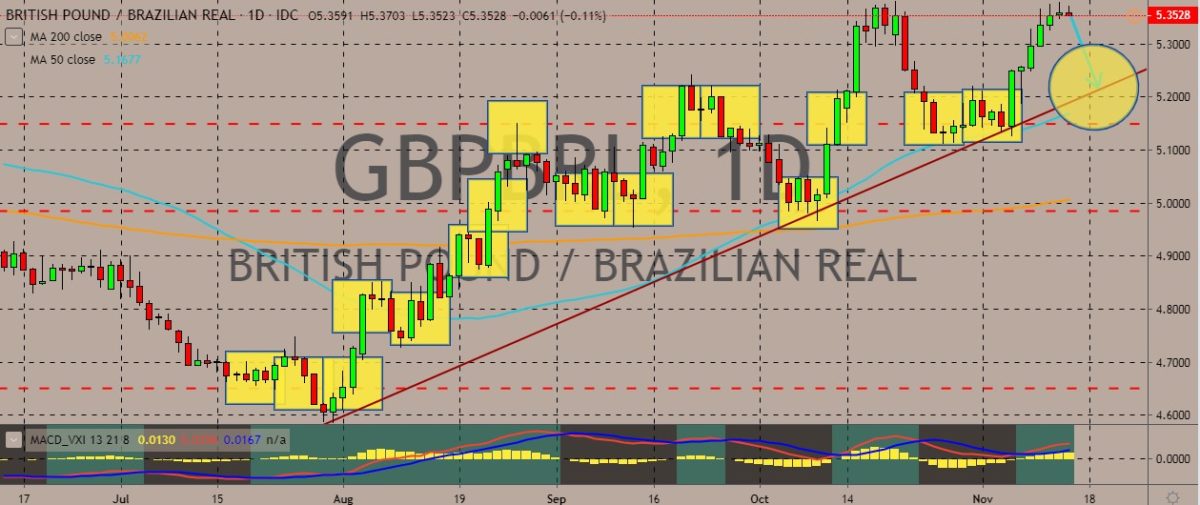

GBPBRL

The pair is continuing an uptrend in the latest trading session, with the price recently recording higher highs in sessions and higher lows. The next swing in price will be a downswing, with the 50-day moving average indicating a buy signal. For fundamentals, European Council President Donald Tusk recently commented that Britain will lose influence in international affairs, warning that it will become a “second-rate players” after it pulls out of the European Union. Supporters of the 2016 vote to get out of the EU claim that the country will achieve a new global status not tied with the EU rules and closer relationship with the United States. Tusk also claimed that only a united Europe could confront an assertive China and play an effective global role. As for Brazil, the country is hosting the BRICS summit. President Jair Bolsonaro is balancing the country’s diplomatic ties with the US and China, boosting ties with China while staying with the US.

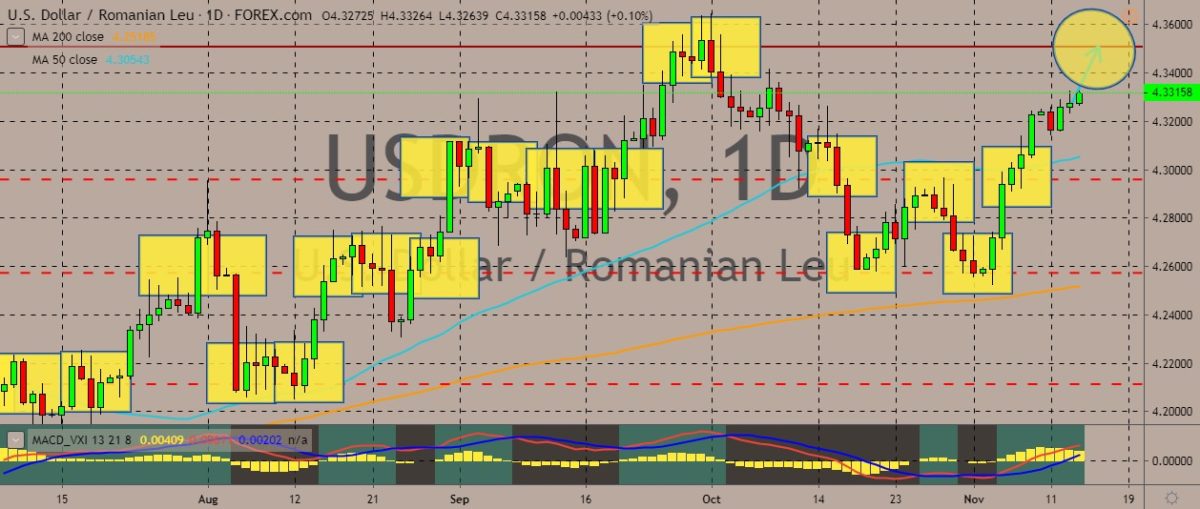

USDRON

The pair bounced back from recent slumps recorded earlier this month. Price is now trading above the 50-day moving average, which also shows a buy signal for traders. Over in Romania, the country’s central bank signals that production in the automotive sectors will slow down in 2019, which would be the first time in the previous 19 years. The BNR points to Germany’s industry as the main source of risks for this sector and recommends better infrastructure and investments in the research and development. Over in the eurozone, industrial production grew for the second straight month in September, according to official figures, topping analysts’ expectations. However, the slump in Germany’s factory sector continued. Output has fallen 1% as Europe’s largest economy slips into recession. Meanwhile, industrial production in the 19-member eurozone gained 0.1% in September on a month-on-month basis.

EURHUF

The pair traded in the red during the previous session, capping the latest uptrend in price after slumping to monthly lows by the end of October and beginning of November. The 50-day moving average presents a buy signal as it continues to creep up. Over in Budapest, the National Bank of Hungary appears ready to keep interest rates unchanged during its monthly policy meeting next Tuesday, according to a unanimous forecast from economists. This survey also predicts no change in official rates before 2021. The NBH is the most dovish bank in central Europe, and it left its base rate at 0.9% and the overnight deposit rate at -0.50% in October. At the same time, the bank affirmed its accommodative stance, flagging downside price risks because of the weakening European activity. Previously, the NBH said that the development of inflation outlook would dictate changes to its monetary policy framework.

EURPLN

The pair recently completed a bullish cypher pattern, with point D trading higher than point X. The price is now on a reversal mode, and there are chances that the price will enter a trading channel soon. Over in Poland, the Monetary Policy Council of the National Bank of Poland said that they decided to retain key reference rate at a record low of 1.5%. Previously, the change was a half-basis point reduction in March 2015. Lombard rate was left unchanged at 2.5% and the deposit rate was at 0.5%. Lastly, the rediscount rate was unchanged at 1.75%. The central bank has also increased its inflation forecast for 2019 to 2.2% to 2.4% from a previously expected 1.7% to 2.3%. It also slashed the forecast growth rate to 3.9% to 4.7% this year from 3.9% to 5.1%. Meanwhile, Financial Minister Jerzy Kwiecinski said that the third quarter was slightly “lazier” than the first half of the year.

COMMENTS