Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

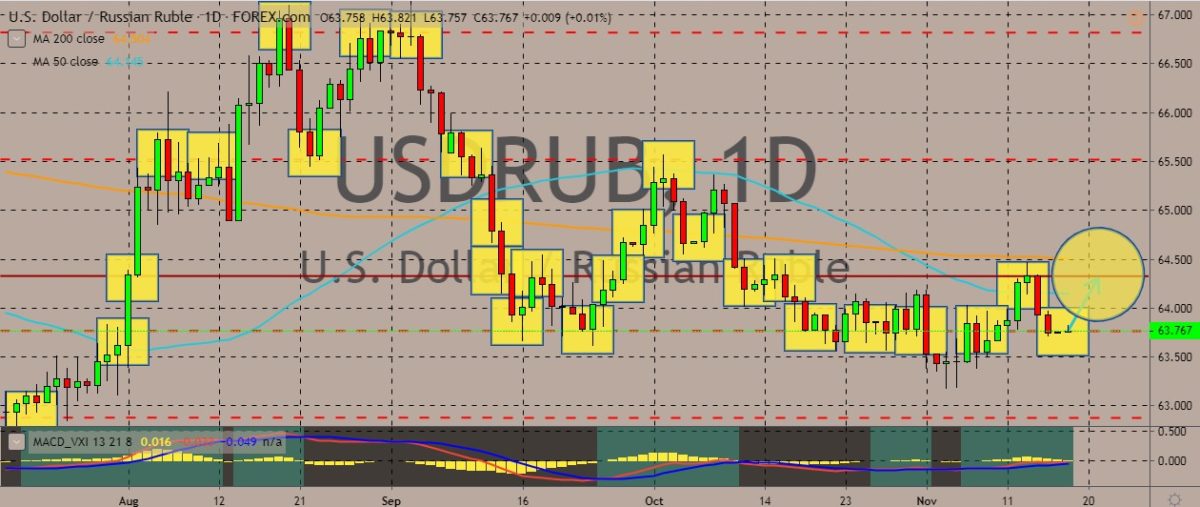

USDRUB

The pair is sticking to its current support line, apparently reluctant to let go and go lower. At present, trading has been thin after price broke above and then reversed down from the 50-day moving average. As for fundamentals, the relationship between the US and Russia remains cold. Recently, the US accused Russia of meddling with conflict in Libya, in which allegedly the Russian mercenaries unofficially backed by Moscow are tipping the conflict in favor of military leader Khalifa Haftar. Meanwhile, according to the Russian Defense Ministry’s Zvezda TV channel, the Russians have landed attack helicopters and troops at an air base in northern Syria left by US troops. According to Zvezda, the facility would serve as a center to distribute humanitarian aid for local residents. He added that the military air base was now controlled by Syrian government forces with ties to Moscow.

USDCZK

The pair has recently converged with the 50-day moving average and failed to break above it, reversing the path of the pair towards the 200-day moving average area. Over in Czech, interest rates correspond to the current stage of the economic cycle, though they have yet to reach normal levels after the exit from non-standard policies, according to central bank governor Jiri Rusnok. According to Rusnok, the Czech central bank managed to exist the exceptional monetary tools much faster than the ECB, and it has switched in the direction of normal interest rates. Two weeks ago, the bank’s board voted to keep the main interest rates flat at 2.0% in spite of its economic forecast painting a hike this quarter and another one in the next quarter before easing again by the latter part of 2020. Meanwhile, Czechs and Slovaks are celebrating the 30 years of democracy since the Velvet Revolution toppled communism in the then-Czechoslovakia.

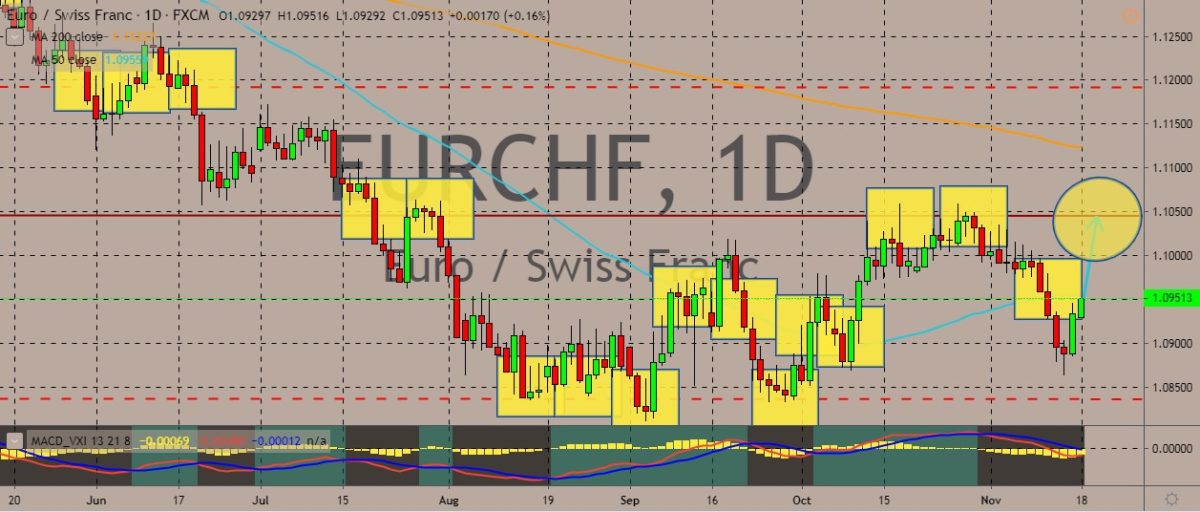

EURCHF

The pair is trading in the green right now after falling under the 50-day moving average. It at first looked as if it was going to land again to its monthly lows previously recorded, but it managed to shift directions, widening the ranges it has been treading since plummeting in late July. As for economic data, Switzerland just saw its unemployment rate underperform relative to the European Union in the third quarter. According to recent stats, the country’s overall unemployment rate in the third quarter climbed from 4.2%t to 4.6% on a year-over-year basis. For comparison, the unemployment figure from the same source for the EU was 6.2% from last year’s 6.5% during the same period. On another matter, the Swiss National Bank refuses to adopt an active stock-picking strategy that might impair its neutrality, even though climate change and its effects are a factor in its assessment of the economy.

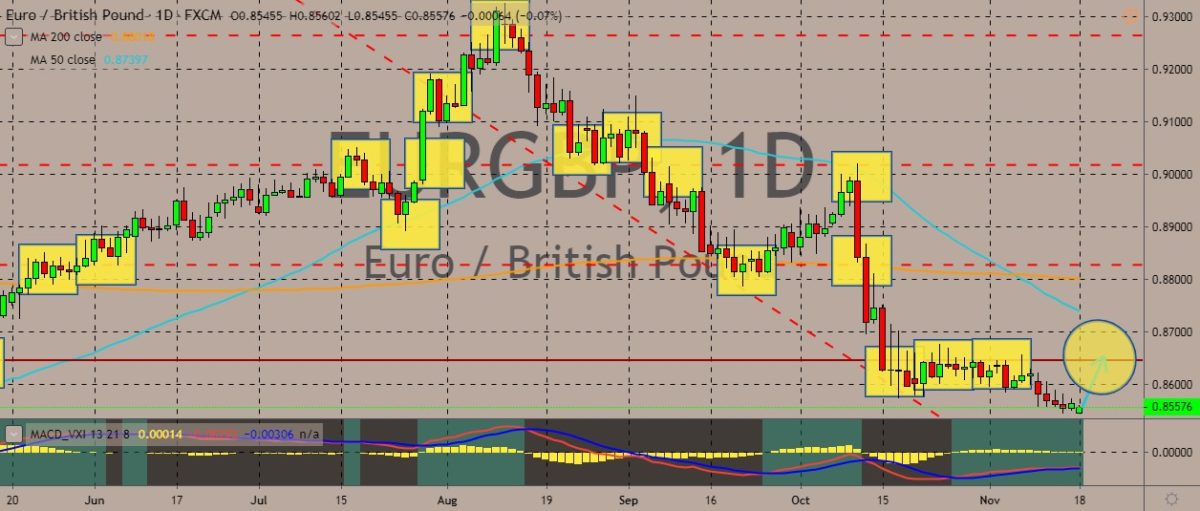

EURGBP

The pair is still generally treading the downwards, as indicated by the death cross by the 50-day and 200-day moving averages. The slump, however, is seen slowing down, as the euro gains some strength against the royal currency. Over in the eurozone, a flurry of economic data last week boosted up the euro. Germany managed to sidestep a technical recession, while other economies boasted robust quarter-over-quarter growth, such as Poland and Hungary (non-eurozone members but EU member states). Over in the United Kingdom, the British government failed to release reports on Russia’s interference in the country’s politics, and the questions this failure conjured continue to follow Prime Minister Boris Johnson. Critics said that leaks from the document raised concerns about the security of this December’s elections. Report from the Parliament intelligence committee concluded that Russian meddling may have affect the 2016 referendum on Brexit.

COMMENTS