Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

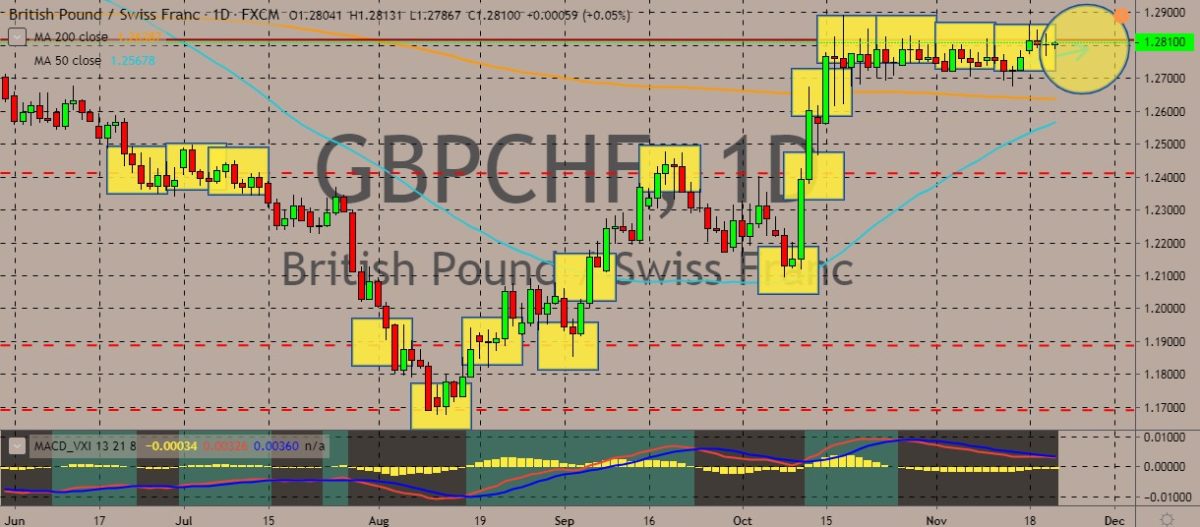

GBPCHF

The pair is still trading sideways as traders await clearer directional drivers for both currencies. Moving averages, both long- and short-term, are heading up, with the 50-day moving average gearing to cross above the 200-day moving average, possibly attracting longer-term technical traders. Over in Switzerland, Swiss National Bank Governing board member Andrea Maechler said that negative interest rates remain “absolutely necessary” for Switzerland. This comment comes as pressure mounts on the central bank to change course from its ultra-expansive monetary policy. The Swiss franc stays “highly valued” as investors treat it as a safe-haven investment, according to Maechler. The SNB has been charging a negative rate of -0.75% for almost five years, and this is one of the lowest rates in the world. Previously, Maechler said that the SNB remains ready to purchase foreign currency to support the monetary policy.

EURAUD

The pair is trading upwards above both the 50-day and 200-day moving averages, treading back to its monthly highs after slumping to monthly lows. Over in Europe, Italian Prime Minister Giuseppe Conte aims to cancel the reform of the European Stability Mechanism (ESM) at the European Union’s December summit. In June, eurozone finance ministers agreed on a draft of the reform, and it’s scheduled to be finalized in December. According to reports, Conte is planning to propose some changes to the ESM reform package. For Bank of Italy Governor Ignazio Visco, a debt restructuring mechanism could “trigger a perverse spiral of expectations of default, which may prove to be self-fulfilling.” The opposition party Lega also agrees with this view, accusing the government of conceding to ESM reform, undermining Italian sovereignty and endangering Italian savings, according to Lega leader Matteo Salvini.

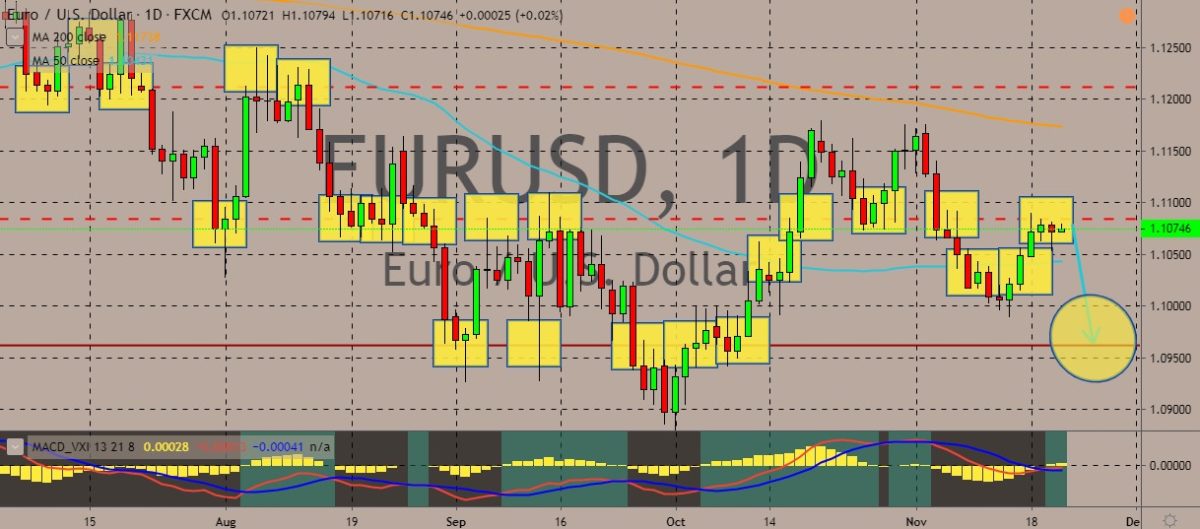

EURUSD

The pair is trading near a resistance line above the 50-day moving average. The recent rally by the euro was cut short, and the rally came after the price slumped below the 50-day moving average. Forex strategists from Morgan Stanley are forecasting that the euro-to-dollar rate will rally in 2020, with European economic growth picking up and starting to outperform that of the US. Eurozone growth has been stunted this year, largely because of the slowdown in German manufacturing sector, which has suffered the brunt of the US-China trade tensions. Brexit has also taken its toll on Germany’s export-driven and manufacturing-heavy economy. But the data in the third quarter indicates that the eurozone economy might have bottomed, and a reversal may be on the horizon. According to Morgan Stanley, improved economic performances in the eurozone will translate increased bond yields on eurozone sovereign debt.

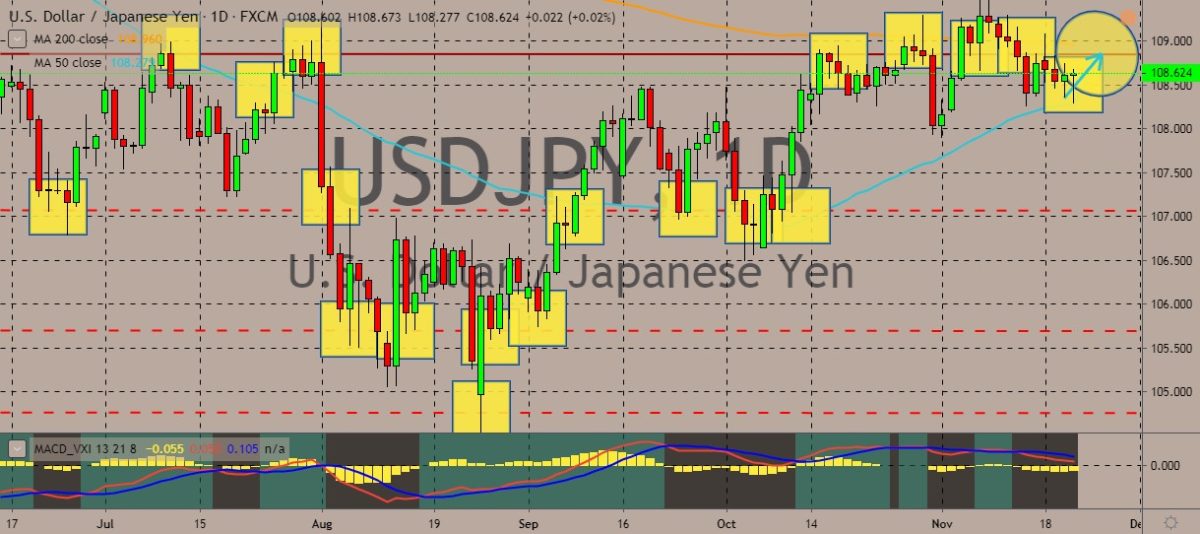

USDJPY

The pair is trading within tight ranges with the 200-day and 50-day moving averages serve as resistance and support lines, respectively. The price has dipped below the 50-day MA and if previous pattern should be followed, it is likely set for a reversal, going up and near the 200-day MA. Recently, House Democrats lambasted the Trump administration for not consulting enough with the Congress while negotiating and mini trade deal with Japan, failing to offer details about it, and declining to testify during a congressional hearing. Over in Japan, the Lower House signed off the trade deal that slashes tariffs on farm and industrial products, taking a step to be in effect next year. The ruling Liberal Democratic Party and coalition partner Komeito are trying to ratify the trade deal before the end of the current Diet session on December 9. That would allow the government to accommodate Washington’s goal to kick off the deal on January 1.

COMMENTS