Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

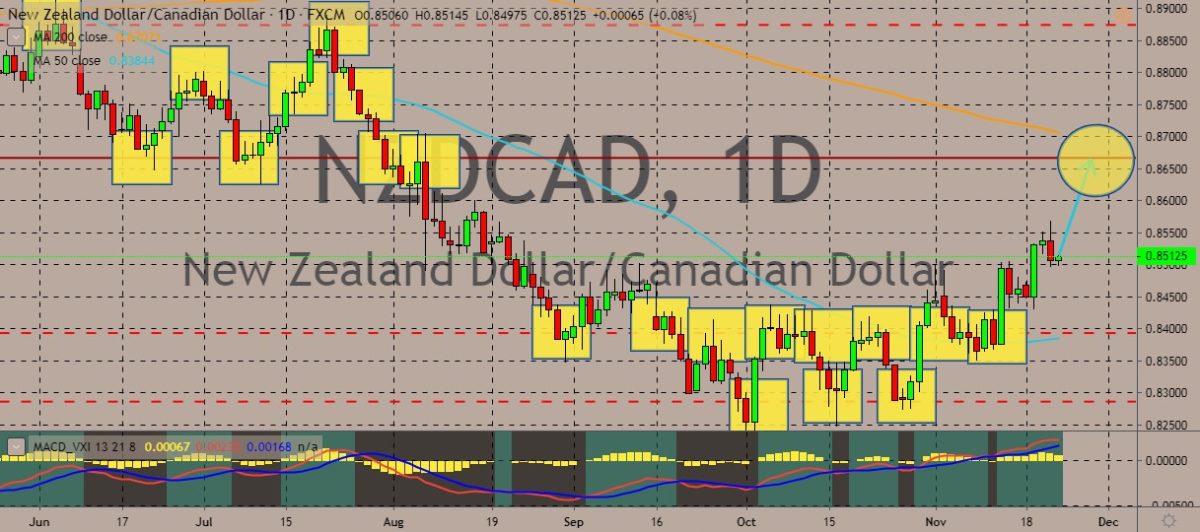

NZDCAD

The pair is perking up on the daily charts, recovering from the recent slump and breaking above its tight ranges recorded in October. For fundamentals, the Organization for Economic Cooperation and Development (OECD) forecast puts New Zealand’s growth ahead of seven other countries including Australia, Canada, the US, the EU, Sweden, Norway, and Japan. New Zealand economy is expected to grow between 2.4% and 2.7% across the three years of 2019 to 2021. According to Finance Minister Grant Robertson, this is further evidence that “the economy is in good shape.” The business investment is set to expand. Robertson explained that although the US-China trade war, geopolitical tensions in the Middle East, and the Brexit uncertainties weigh on the economy, the country can counter the pessimistic global situation using low interest rates, low unemployment, and low government debt.

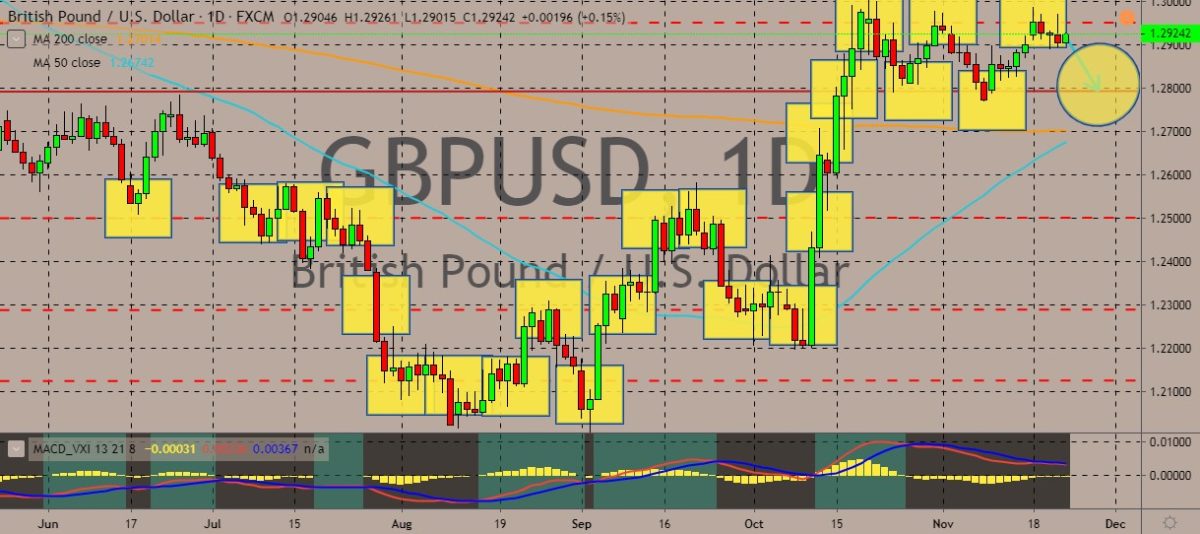

GBPUSD

The pair is still trading near its recent highs, moving within ranges and with the 50-day and 200-day moving averages nearly confirming the golden cross. Traders will be looking forward to viewing data on the UK budget. The budget deficit ballooned in September to 8.7 billion pounds, which was the highest deficit since November 2016. As for the US dollar side, the US Federal Reserve Bank released the minutes of the October policy meeting. Policymakers said that the Fed would stay on pause from further rate cuts. It would only change if there was a substantial change in economic conditions. Even though the Fed slashed rates at the October meeting for a third straight time, the cut came with a hawkish language as the policymakers wanted to reassure investors that the economy is still in good shape. The minutes of the meeting reiterated that the economic conditions were positive while the outlook sees a moderate rate of growth.

EURCAD

The pair has hit the upper ranges of its trading channel on the daily charts after recently soaring. It’s trading above the 50-day moving average and now appears to be reversing back down as the Canadian dollar gathers some strength. The boost came from Bank of Canada Governor Stephen Poloz’s comments that doused expectations of an interest rate cut as soon as next month. Poloz said that Canada’s monetary conditions were just about correct when considering the present economic situation that is being pressured by the global trade tensions. According to one analyst, the Poloz comment was “powerful” given that it came after BoC Senior Deputy Governor Carolyn Wilkins’ comments that the global economy was facing immense challenges that could spill over to Canada. Wilkins had also said that the Canadian central bank had enough room to move lower. In October, the bank left its benchmark interest rate unchanged at 1.75%.

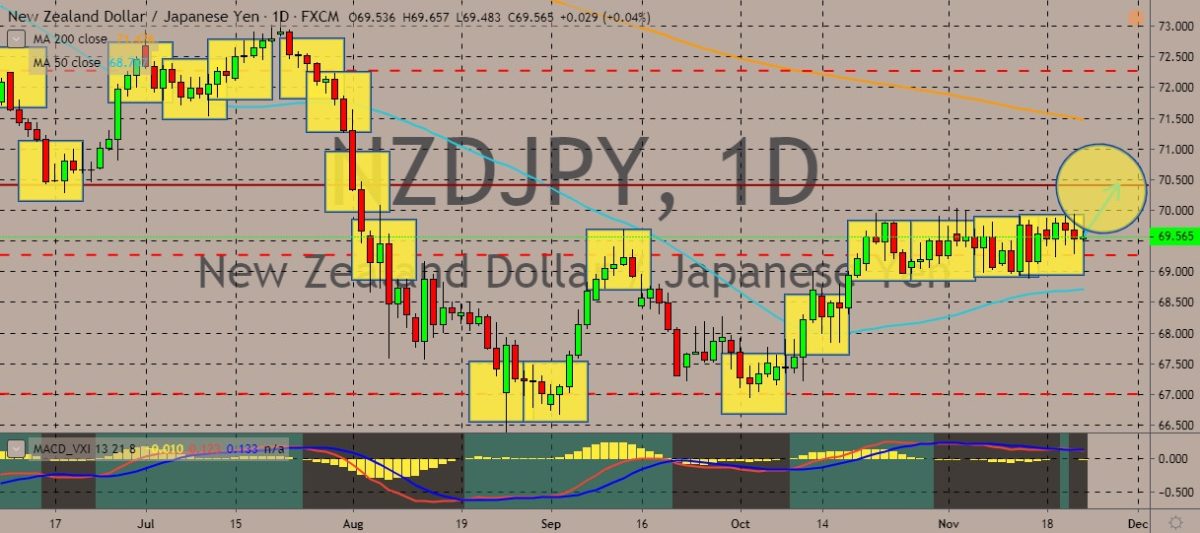

NZDJPY

The pair is trading sideways on the daily charts, with the bulls and bears struggling to take control of the direction of the trend. Over in Japan, the country’s factory activity shrank for a seventh consecutive month in November, with domestic and export and demand remaining in the doldrums and reinforcing the challenges that policymakers face trying to push up an economy which is growing at its slowest pace in a year. The Jibun Bank Flash Manufacturing Purchasing Managers’ Index (PMI) inched up to a seasonally adjusted 48.6 from a final 48.4 in the prior month. The index was below the 50.0 threshold that separates contraction from expansion for a seventh month. If the final reading that will come out next month confirms the contraction, it will signal the longest such run since a nine-month period from June 2012 to February 2013. The survey showed that factory output and total new orders shrank again.

COMMENTS