Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

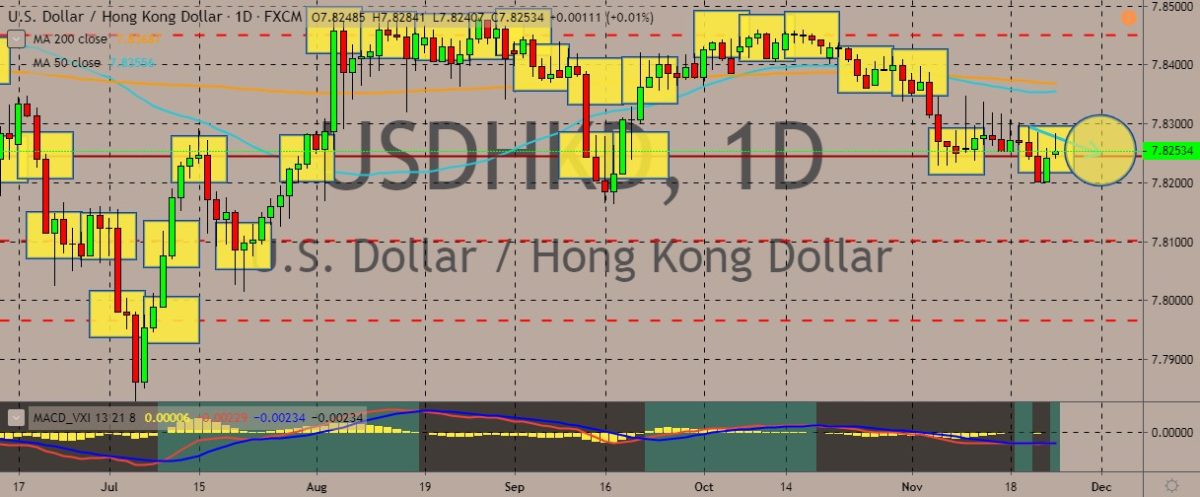

USDHKD

The pair is trading lower near a support line below the 50-day and 200-day moving averages. Prices have struggled to close higher although highs have been reached intraday. For Hong Kong, pro-democracy candidates have made major gains in Hong Kong’s district council elections, having a landslide victory. More than 2.9 million people turned out to vote during Sunday’s elections, which is described as the de facto referendum on the near six months of protests in the semi-autonomous region. According to one expert, the high voter turnout has exceeded many expectations. It also showcased the Hong Kongers’ commitment to democracy. The expert added that the people of Hong Kong are “counting on this election to point a way out of this impasse.” The majority of the 18 district councils are expected to switch to pro-democracy control in an “unmistakable message” to the city’s leader Carrie Lam.

EURDKK

The pair has slipped at the week’s first trading day, pummeling the price to lows reached last week. However, it is still trading near recent highs. The 50-day moving average is also going up, potentially serving as a support for the bulls. For fundamentals, the flash reading of the eurozone manufacturing purchasing managers index climbed to a 3-month high of 46.6 in November. This is higher than the figure of 45.9 in October. The PMI is slightly higher than economist consensus of 46.4, but it was still below the 50 level. Therefore, the report showed that purchasing managers were reporting contractionary conditions. Meanwhile, the flash services PMI slipped to a 10-month low of 51.5 in November. This one is below economists’ expectations for a 52.4 reading. According to the chief business economist at IHS Markit, manufacturing remains in its deepest downturn for six years amid the ongoing trade troubles.

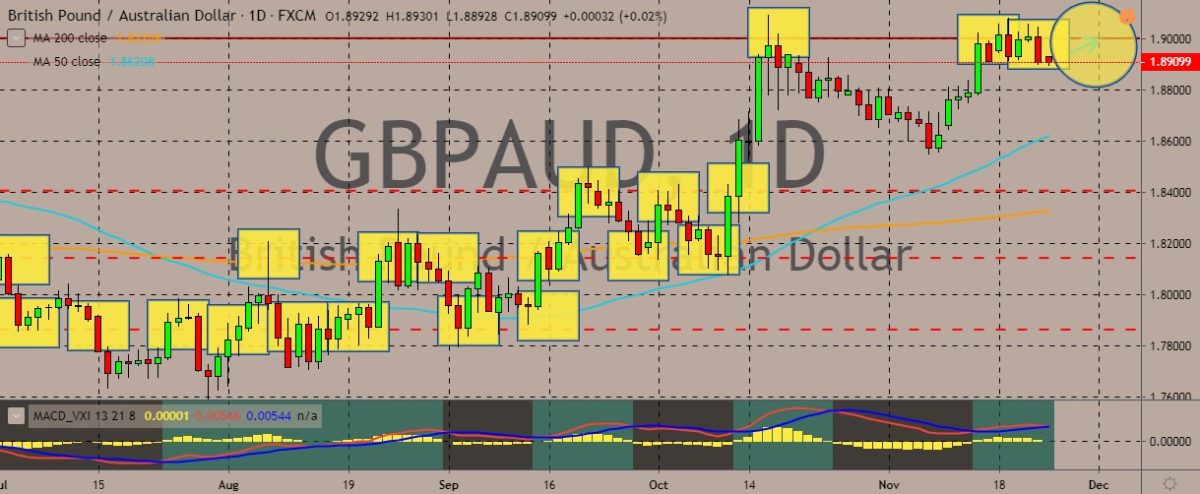

GBPAUD

The pair is trading near multi-month highs, still driving bullishly even though it has experienced a slump earlier this month. Meanwhile, over in Australia, the retail industry is urging the government to cut taxes to stimulate the economy. This comes after retail sales volume slipped 0.2% in September on a year-over-year basis. The pessimistic view is dominant across the economy, which has failed to go up even after three interest rate cuts by the Reserve Bank of Australia since June. The key rate is now at a record low of 0.75%. For other economic figures, the jobless rate was 5.3% in October, compared to the 4.9% recorded in February. The country’s gross domestic product grew at 1.4% in the year to June. The Liberal-National government is facing increasing pressure to ditch its election pledge to return the budget to surplus for the first time in more than a decade and unleash fiscal stimulus in the form of tax cuts and infrastructure spending.

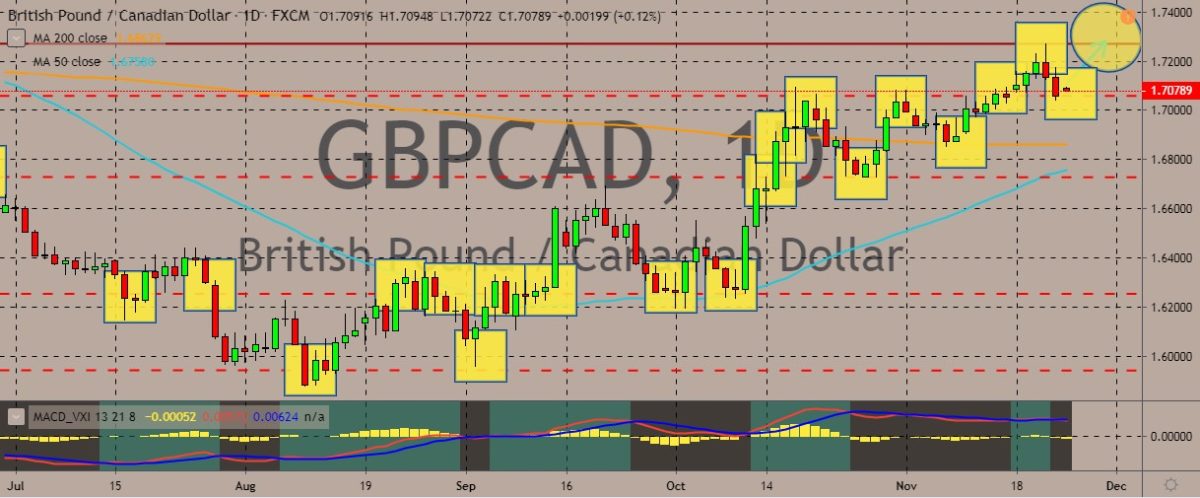

GBPCAD

The British pound is trading near multi-month highs against the Canadian dollar, clocking in higher highs and higher lows, indicating a bullish uptrend. On the Brexit front, British Prime Minister Boris Johnson recently launched the Conservative Party platform and used the opportunity to claim that his is the only party in next month’s election that will complete the Brexit process. “Unlike any other party standing in this election, we are going to get Brexit done,” he said to reporters. According to Johnson, the Liberal Democrats and the Labour Party would only bring more delay and eventually betray the will of voters as expressed in the 2016 referendum that resulted in favor of the European Union departure. The prime minister spent more time poking fun at opposition Labour leader Jeremy Corbyn than outlining the details of the party platform. He has promised to bring his deal back to Parliament before Christmas.

COMMENTS