Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDDKK

The pair recently reached two-week highs, coming closer to its October highs. Prices have been pursuing an uptrend, following the trajectory of the 50-day and 200-day average. Traders can time this trend to buy during price dips before going back up. Over in Denmark, the central bank told other banks to reconsider their capital targets, following stress test results that showed underperformance by lenders. Meanwhile, central bank governor Lars Rohde said he expects interest rates to stay around present negative levels in the coming five to ten years. In September, the Danish central bank slashed its key deposit rate to -0.75%, continuing the negative trend that started in 2012. This trend has sent mortgage rate and the entire government bond yield curve below zero, and Rohde was quoted saying that there’s nothing which indicates in a five or ten-year horizon that “anything should be significantly different.”

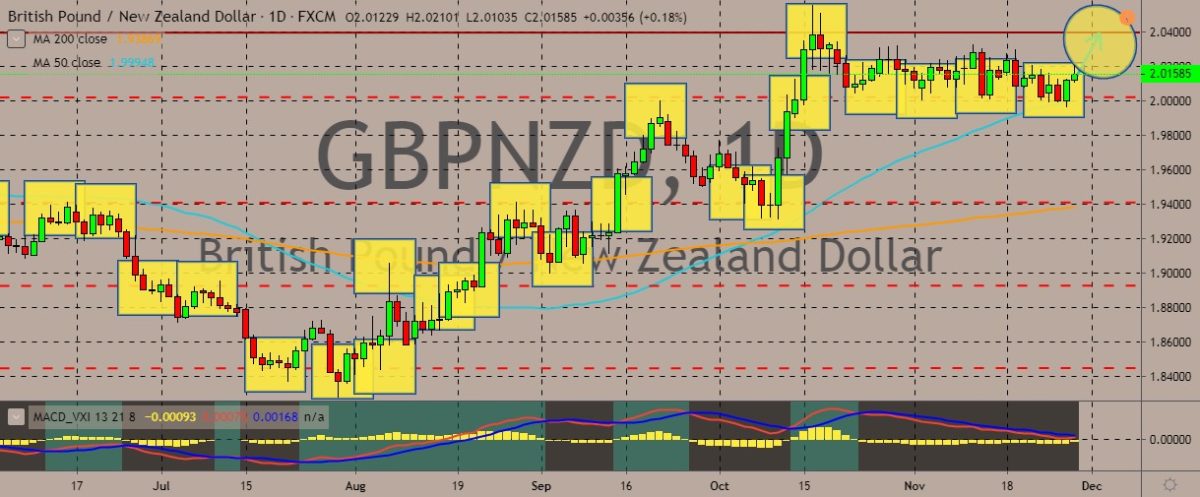

GBPNZD

The pair is trading in the green today after trading relatively sideways in recent trading sessions. The pound’s strength against the New Zealand dollar still appears to be robust, with the 50-day moving average indicating continued upward momentum. Over in the New Zealand, the NZD is facing increasing pressure after the Reserve Bank of New Zealand released its financial stability report, which took note of the heightened sense of risk. As for the British pound, sentiment could turn sour if November’s consumer index shows one more month in the negative. Since softer consumer confidence could limit the strength of the retail sector, a weak figure from this index could trigger new concerns over the country’s economic outlook. On the flipside, the GBP could still get a boost if there is an uptick in October’s UK net consumer credit figure. As per forecasts, consumer credit growth is on 0.9 billion on the month, meaning higher confidence.

USDCNH

The pair is moving up, with prices nearing the 50-day moving average as trade news between the US and China hits up headlines. US President Donald Trump just signed an act in support of the protest movement in Hong Kong despite the likelihood of backlash from China, as Beijing views the said conflict as being between China and Hong Kong only. Anti-government protesters in the semi-autonomous Chinese city have long campaigned in support of the bill, which would let Washington slap sanctions or even suspend Hong Kong’s special trading status due to rights violations. This is the latest big event since the lack of new details over the progress of the phase one deal between the two warring countries. According to experts, a partial trade deal will likely be signed next year, after the supposed signing in Chile was cancelled after riots and demonstrations in the country.

USDTRY

The pair is trading in the red in the present session after days of rallying and breaking above the 50-day moving average. the pullback appears to be temporary, as the 50-day MA might serve as a support line for the pair. Over in Turkey, President Recep Tayyip Erdogan called on Turkish citizens to use the local currency, Turkish lira, rather than the US dollar when conducting transactions. This came during a speech at the parliamentary group meeting of ruling Justice and Development part. According to the country’s statistics, inflation rate in October was 8.55% down from 9.26% in the month of September. Turkey’s central bank is scheduled to adjust a tool it introduced this summer to improve lending in specific sectors of the economy which has been hit by recession. This plan could be one of the most daring moves to kickstart growth after the currency crisis last year.

COMMENTS