Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

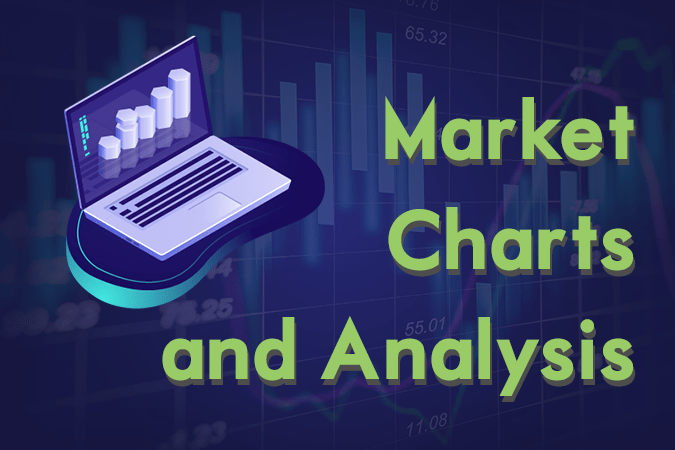

AUDCAD

The pair was expected to breakout from a major resistance line, which will send the pair higher towards another major resistance line. The Liberal/National coalition was seen leading the poll, which makes its leader Prime Minister Scott Morrison to be still the leading candidate for the premiership. Australia entered recession (based on GDP per capita) for the first time in 27 years. The country was also struggling between two (2) world powers, the United States and China, following their escalating trade war. However, the current election poll showed that the people was satisfied with PM Morrison’s ability to lead the country. Canada had the similar case with Australia. However, Canadian Prime Minister Justin Trudeau’s government was embattled with several issues, which could weaken PM Trudeau’s chance of being re-elected on October 2019. Histogram and EMAs 13 and 21 will continue to go up in the following days.

AUDCHF

The pair will continue to move lower in the following days after it broke out from a major support line. Australia and Switzerland were some of the most affected countries, who signed a post-Brexit trade agreement with the United Kingdom, following the Brexit extension until October 31. Aside from this, UK Prime Minister Theresa May failed to get the UK out from the European Parliamentary Election amid its responsibility based on the European Union law to participate during election, until the country officially leaves the bloc. Australia, unlike Switzerland, however, was also in the midst of the tension between the escalating trade war of the United States and China, which caused the country to enter a recession (based on GDP per capita) for the first time in 27 years and for investors to get rid of Australian Dollar. Histogram and EMAs 13 and 21 was expected to fail to cross over.

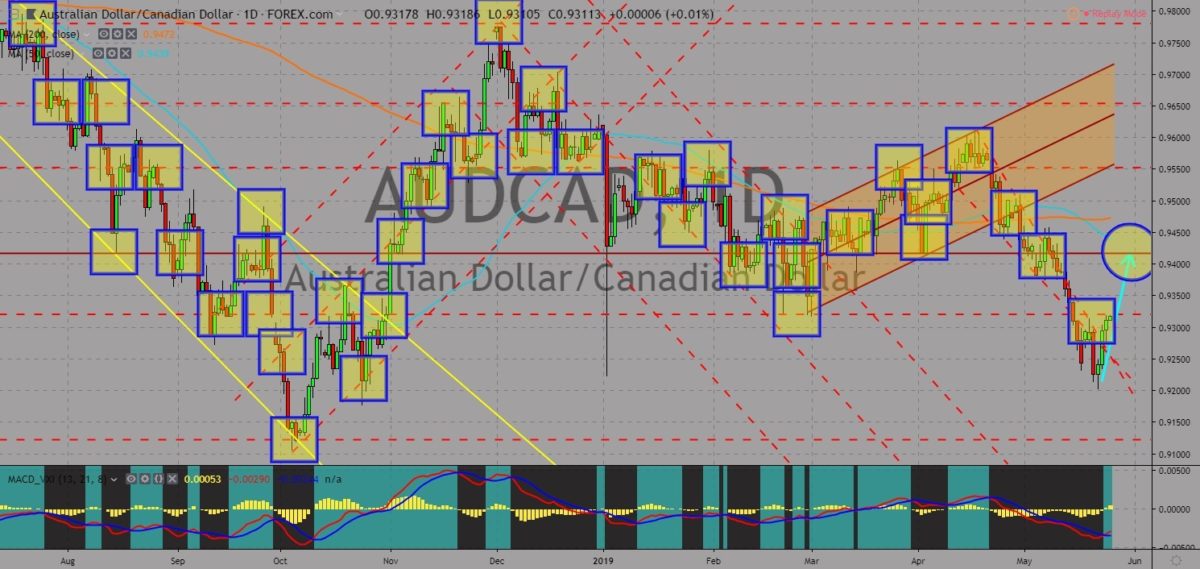

GBPJPY

The pair broke out from a major support line, which will send the pair lower towards the nearest support line. The Brexit’s shadow falls on the relationship between the United Kingdom and Japan. The divorce between the UK and the European Union had forced their Asian allies to take sides between the two (2) powerful economies. Australia had sided with the United Kingdom, Japan with the European Union, and New Zealand signing a post-Brexit trade agreement with the UK, while maintaining its existing trade relation with the EU. The United Kingdom, however, reiterated that the country will not sign a trade agreement with Japan until the UK finally leaves the European Union, which causes Japanese firms in London to pull their company out from the UK amid the uncertainty surrounding the Brexit negotiations. The EU-Japan deal became the largest trading zone in the world. Histogram and EMAs 13 and 21 will fail to crossover.

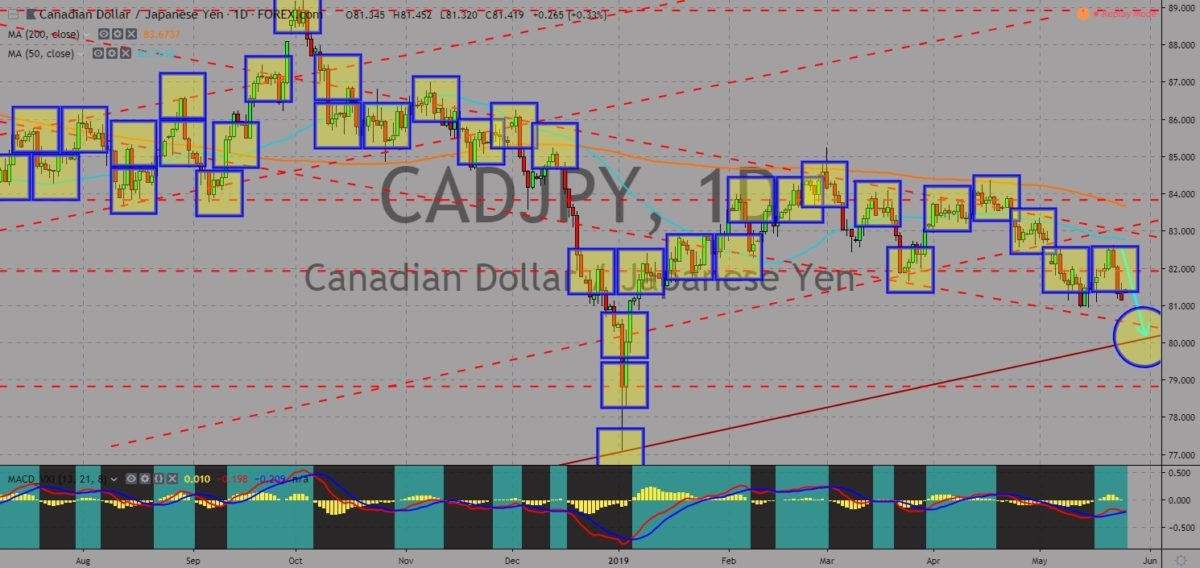

CADJPY

The pair failed to breakout from 50 MA, which will send the pair lower towards the uptrend channel support line. Canada found an ally with Japan after the country was advised to shift it focus from China to its economy. Japan had also lifted its last trade restriction in Canada following the escalation of trade war between the United States and China, which caused the world order to be disrupted. Japan heads the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), together with Australia, on which Canada was also a member. Japan and Canada had also joined the Germano-Franco led “alliance of multilateralism” as world powers are getting away from the escalating trade war between the United States and China. Japan will also host this year’s G20 Leaders Summit. Histogram and EMAs 13 and 21 was expected to crossover in the following days.

COMMENTS