Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

NZDCAD

The pair was expected to continue going up towards a major resistance line after it found a strong support line. New Zealand and Canada’s fate move in contrast in the previous months with Canada’s relationship with the Kingdom of Saudi Arabia and China being strained, while New Zealand became sensational following the Christchurch mosque bombing, which makes New Zealand Prime Minister Jacinda Ardern a darling of the Muslim community, with her image comforting a victim’s family member being shown in Burj Khalifa, the tallest building in the world, situated in the United Arab Emirates. The pair will continue moving up until Canada reduce its exposure to the United States, which was one of the main causes of the country’s slow growth following the ratification of the NAFTA (North American Free Trade Agreement). Histogram and EMAs 13 and 21 was poised to further go up.

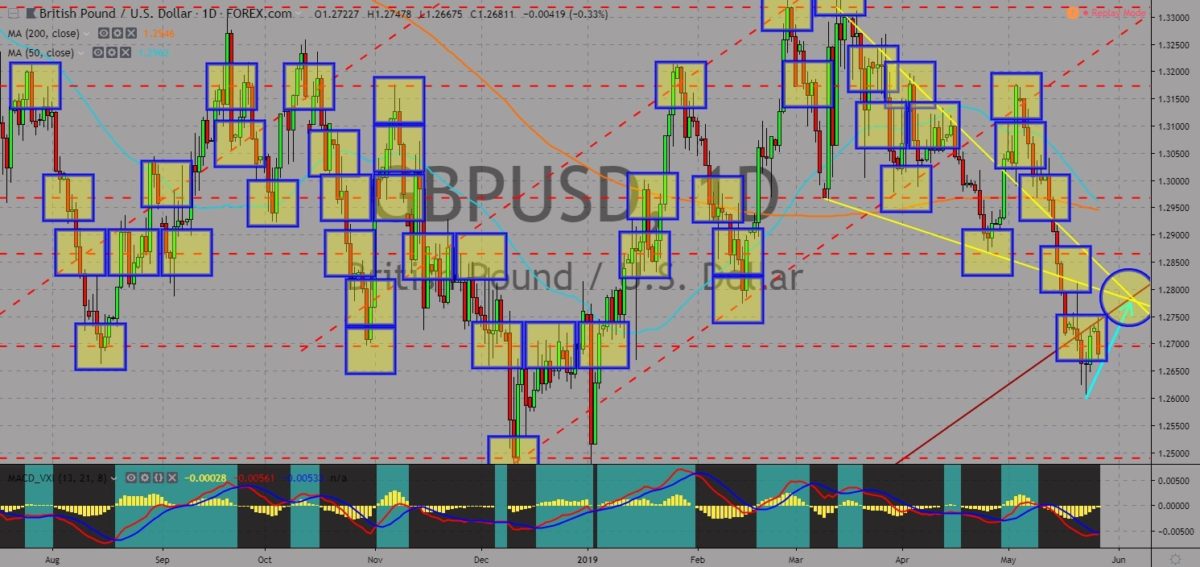

GBPUSD

The pair was seen to continue moving higher to reach the tip of the “Falling Wedge” pattern. U.S. President Donald Trump will be heading to the United Kingdom next week as the two (2) countries will try to draft a bilateral trade agreement following the UK’s looming departure from the European Union until October 31. This will be the biggest deal for a post-Brexit UK as the country struggles to strike a deal with some pro-EU allies. President Trump was now in Japan as he was the first foreign leader to visit the new Japanese Emperor Nahurito. He was also in talks with Japanese Prime Minister Shinzo Abe regarding the possibility that the U.S. will sign a bilateral trade agreement with the Japan. Japan on the other hand, had ratified the EU-Japan free trade deal, which became the largest trading zone in the world. Histogram and EMAs 13 and 21 was expected to reverse in the following days.

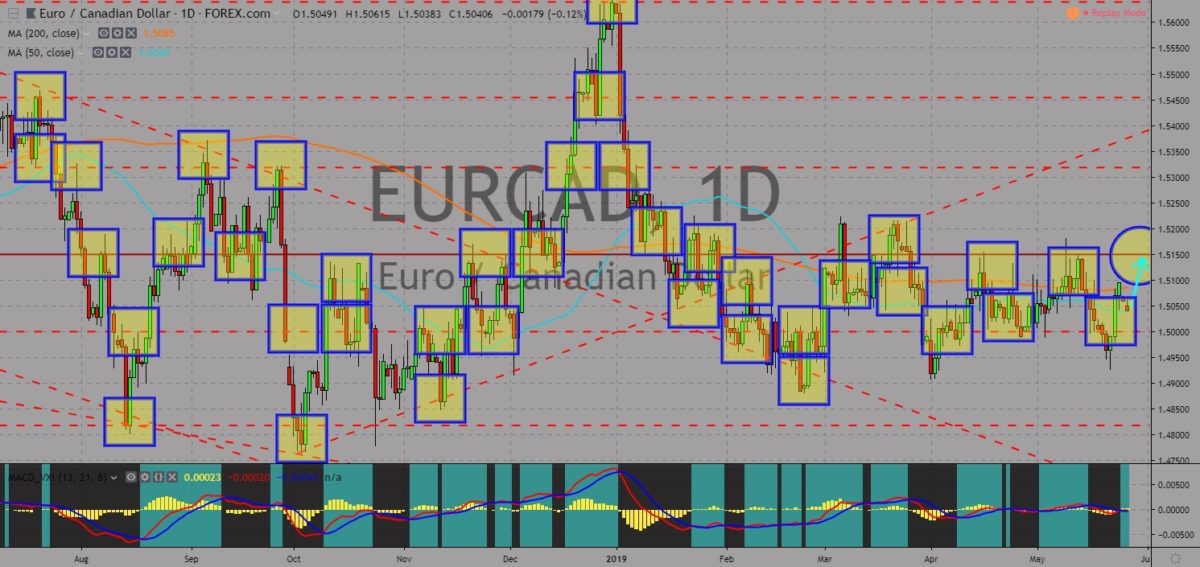

EURCAD

The pair was expected to bounce back from 50 MA, which will end the pair higher towards its previous highs. Before the European Parliamentary Election, the 8th EU Parliament gave a green light to a future bilateral trade agreement between the European Union and the United Kingdom. Following the lead of Germany’s European People’s Party (EPP), the possibility of the two (2) economies striking a bilateral trade agreement is now higher. Canada and Japan had also recently joined the Germano-Franco led “alliance of multilateralism”, which was seen as a group of powerful economies trying to get rid of its U.S. exposure after U.S. President Donald Trump wage trade war against countries it suspected of unfair trade practices. President Trump had delayed imposing tariffs to EU and Japan for 180 days. Histogram and EMAs 13 and 21 will go higher in the following days.

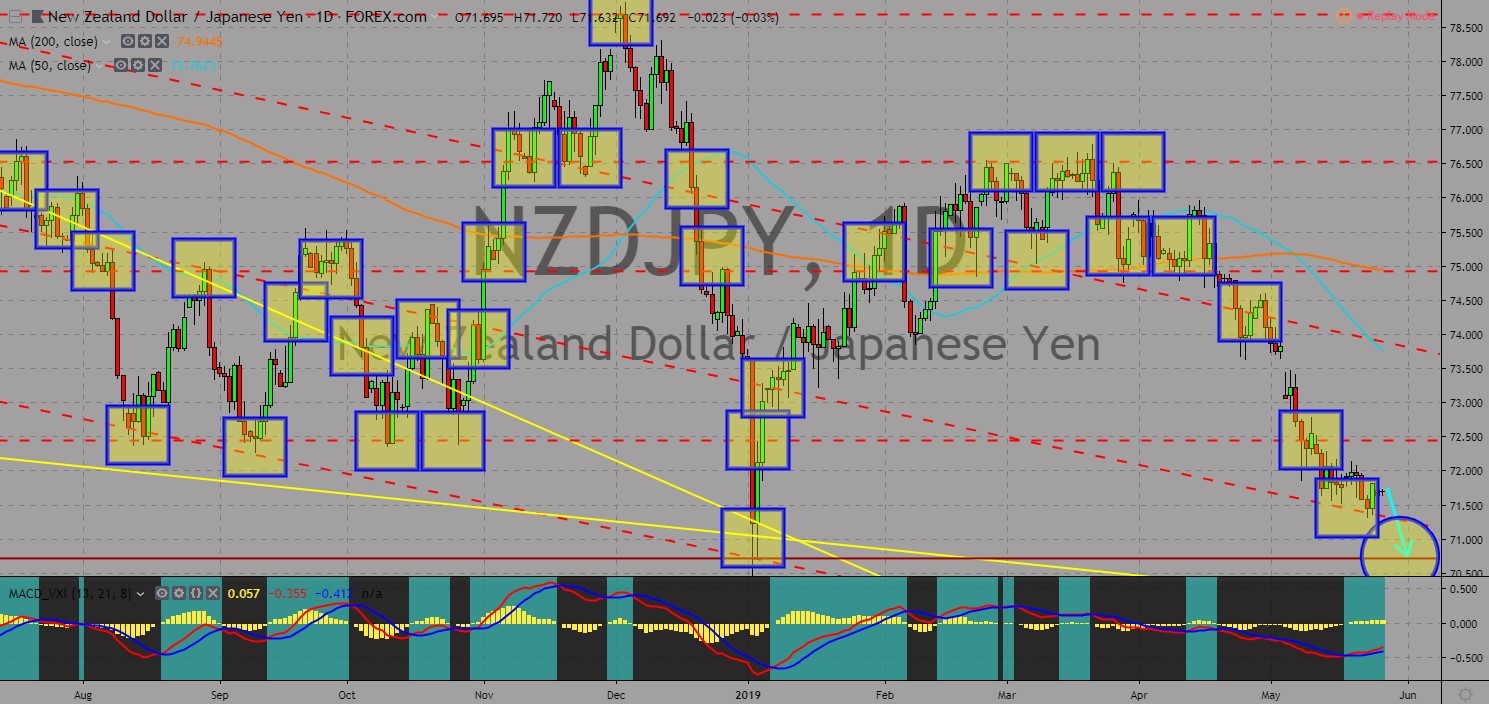

NZDJPY

The pair will continue to move lower in the following days and to reach its year-to-date (YTD) low. Despite New Zealand being put into limelight in the previous months, the country was not able to materialize its plan to boost its economy after the country departed from the United States and the United Kingdom’s influence. The country’s visit to China to meet Chinese Premier Li Keqiang was not also able to materialize, which worries investors betting that the country can replace Australia to become a regional power and to become a major player on the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Japan on the other hand had been leading the CPTPP since the U.S. withdraw. The country had also ratified the EU-Japan Free Trade Deal, which became the largest trading one in the world. Histogram and EMAs 13 and 21 will reverse back in the following days.

COMMENTS