Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

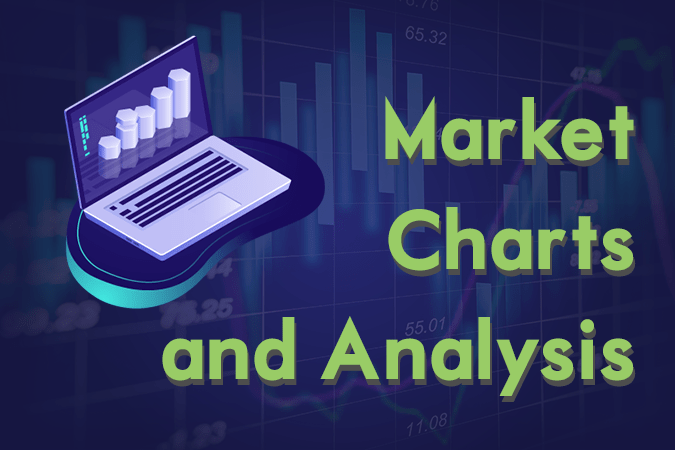

EURBRL

The pair was expected to break down from 50 MA after it broke down from a “Rising Widening Wedge” pattern and from a major support line. U.S. President Donald Trump will be visiting Japan to meet the new the Japanese Emperor Nahurito. President Trump will be the first foreign leader to personally meet the newly crowned emperor. Aside from this, President Trump will be having a meeting with Japanese Prime Minister Shinzo Abe to discuss their trade relationship after President Trump threatened to impose tariffs on Japan and EU’s auto-manufacturing industry. This will affect the European Union’s planned trade agreement with the largest trading bloc in South America, the Mercosur deal, as Brazil was trying to lobby the United States to support the country as the leader in South America and to oust the Maduro government in Venezuela. Histogram and EMAs 13 and 21 will continue to move lower.

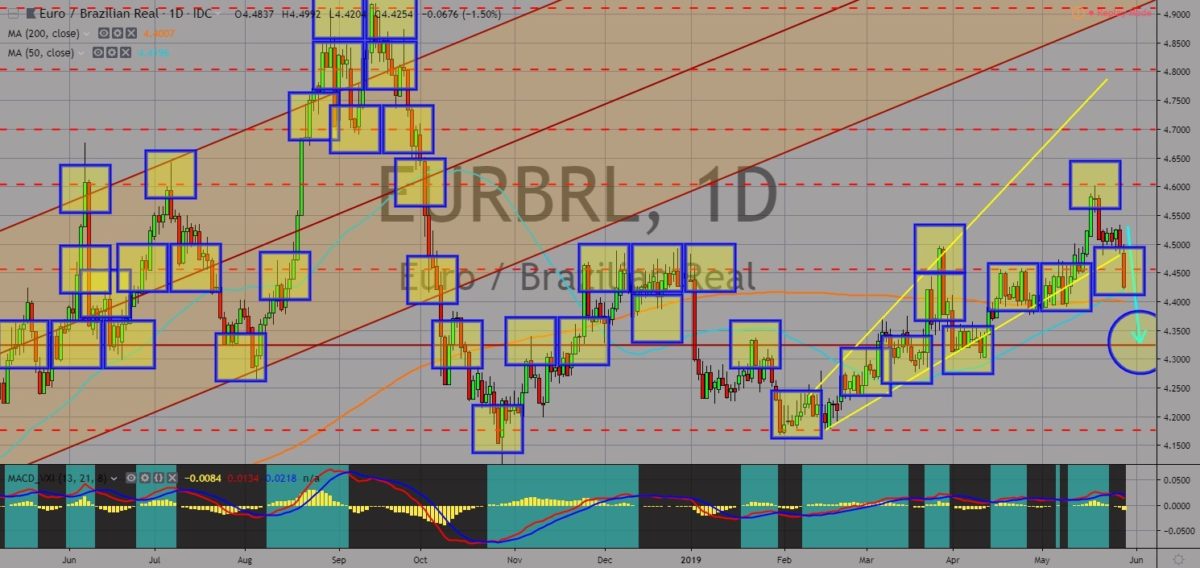

USDBRL

The pair was seen to move lower towards its previous low with the pair expected to break down from the “Rising Widening Wedge” pattern support line. Following the trade war between the United States and China, with the U.S. imposing 25% tariffs on $200 billion worth of Chinese goods and threatening to impose another round of tariffs to 25% of the remaining $300 billion worth of Chinese goods, China might move away from the United States and leverage its large import from Brazil against the United States. Brazil was U.S.’ main ally in South America, however, the country was also China’s largest trading partner in South America, accounting to 80% of total Chinese soybean import by 2018. The tariffs impose by the United States was expected to hit the country back with more demand for Brazilian agriculture than to the U.S. Histogram and EMAs was expected to move lower in the following days.

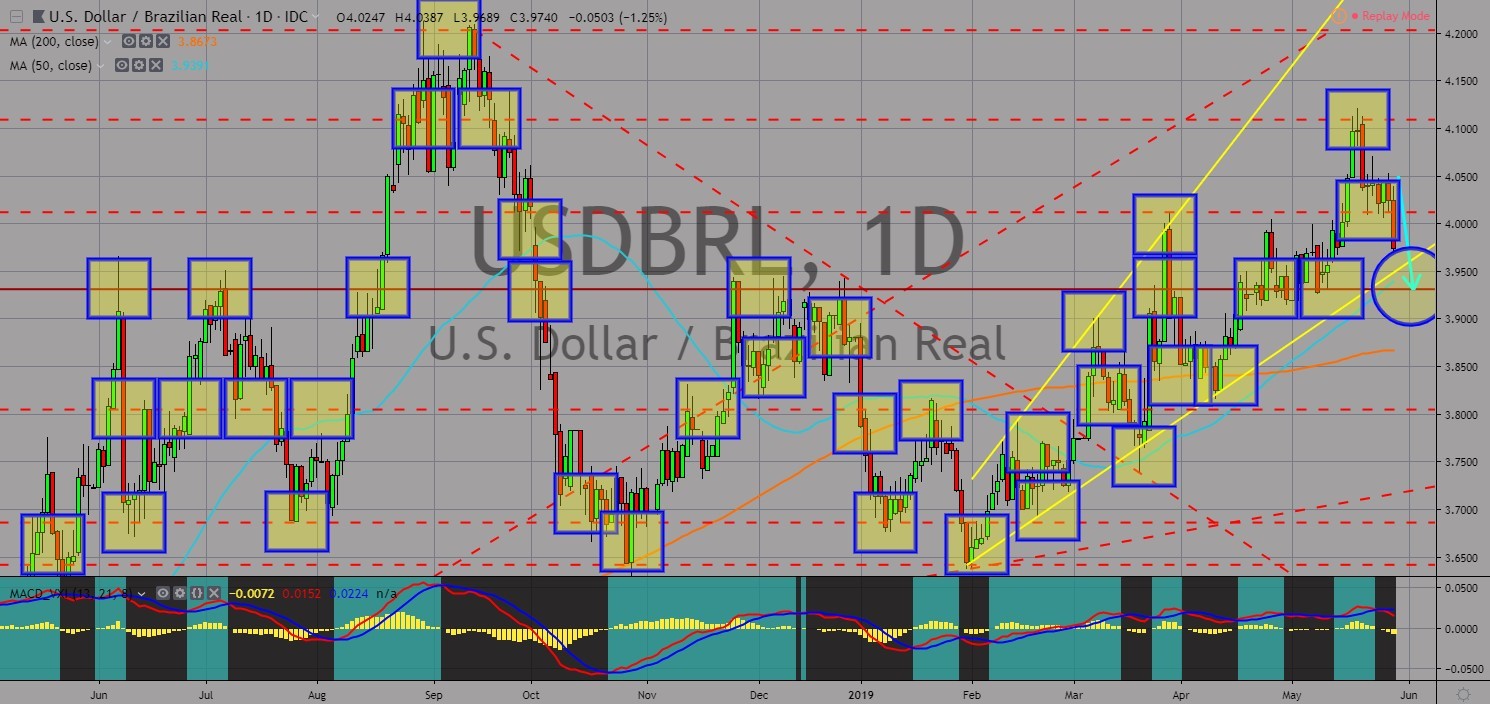

USDRON

The pair was expected to have a healthy pullback, sending the pair lower towards the nearest support line. The United States was trying to contain any efforts by Russia to influence countries surrounding the Black Sea and the Baltic Sea. Following the fallout of the relationship between the U.S. and Turkey amid Turkey’s decision to purchase Russia’s S-400 missile defense system, which was seen to compromise the defense sharing agreement of the NATO (North Atlantic Treaty Organization) Alliance. The United States was now turning to its non-traditional allies, Poland and Romania, to sell its F-35 fighter jets after America decided to halt its selling of fighter jets to Turkey. The U.S. will also set-up the Terminal High Altitude Area Defense (THAAD), an American anti-ballistic missile defense system, to Romania. Histogram and EMAs 13 and 12 will fail to crossover and will continue to fall lower.

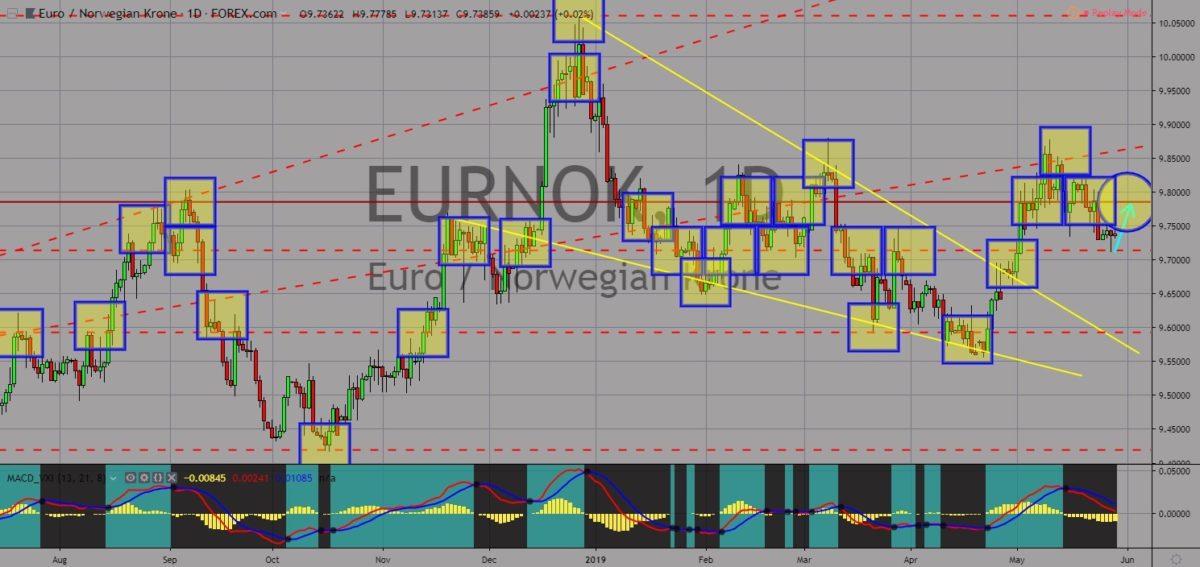

EURNOK

The pair was expected to move higher in the following days after it bounced back from a support line. Following the planned withdrawal of the United Kingdom from the European Union until October 31, Norway had extended its arms to the UK with its proposal to include the country on the European Free Trade Association (EFTA), on which the United Kingdom was a former member. The EFTA currently consist of non-EU European countries – Norway, Iceland, Liechtenstein, and Switzerland – which have a bilateral trade agreement with the European Union. However, following the win of the European People’s Party during the recent election, the EU might gain an upper hand on the Brexit negotiations, which it could prevent the United Kingdom from joining the EFTA as member countries was able to access EU’s Single Market. Histogram and EMAs13 and 21 was expected to reverse in the following days.

COMMENTS