Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

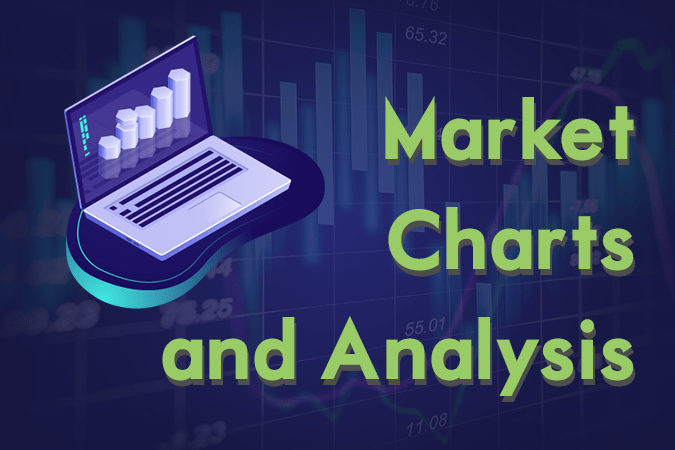

EURCZK

The pair was seen to continue its steep decline and to break down from a major support line, sending the pair lower towards a major support line. The Eastern and Nationalist bloc, the Visegrad Group, was seen sliding out from the European Union’s influence, following the efforts of the United States to lobby each group’s member states. Czech Prime Minister Andrej Babis accused the European Union’s anti-fraud office, OLAF, of trying to “destabilize” the country on after an estimated 120,000 people crammed into a Prague square to demand his resignation. PM Babis’ accusation demonstrates the growing division between the European Union and central and eastern members of the bloc, whom the EU has accused of failing to tackle corruption. The members of the Visegrad Group have long criticized the EU for what they view as interference in their domestic affairs. Histogram and EMAs 13 and 21 will move lower in the following days.

USDHUF

The pair was expected to recover after being sold down heavily in the past few days, sending the pair higher towards a major resistance line. The United States and Hungary’s relationship had seen its best in the past few months after U.S. President Donald Trump lobbied Eurosceptic countries as it bid to increase its influence inside the European Union, and in Europe as a whole. President Trump had already met with Hungarian Prime Minister Viktor Orban to commemorate the country’s 15th year of membership in the NATO (North Atlantic Treaty Organization) Alliance. This celebration is symbolic following the uprising of Russia’s military, which had caused the Eastern and Nationalist bloc to meet with U.S. Secretary of State Mike Pompeo. However, not only did the U.S. need to outshine the EU, but also China who was seeking to increase its influence in Europe. Histogram and EMAs 13 and 21 was expected to reverse.

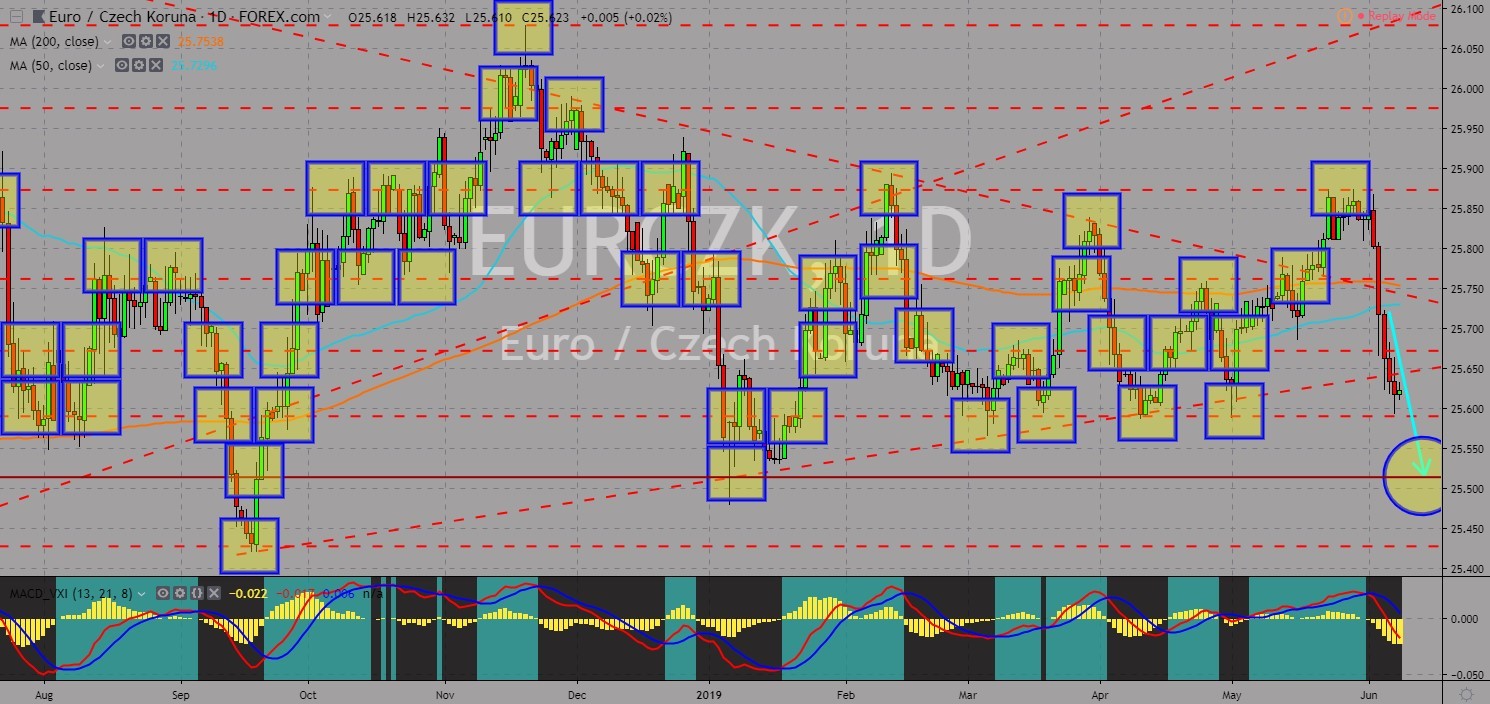

USDMXN

The pair was seen to continue moving lower towards 50 MA after it failed to breakout from a major resistance line. After the failed negotiation talks between the United States and China, the U.S. was now waging war on its allies including Mexico, the European Union, and Japan. Trump had recently imposed 5% tariffs on all Mexican exports to the country to pressure both the U.S. Congress and the Mexican government. After the midterm election brings back the Democrats, who now control the House of Representative, key policies of U.S. President Donald Trump had been on pending, including the ratification of the NAFTA (North American Free Trade Agreement) and the border wall between the U.S.-Mexico border. The U.S. government had also seen pressuring the Mexican government to contain immigrants coming from Central America. Histogram and EMAs 13 and 21 will crossover in the following days.

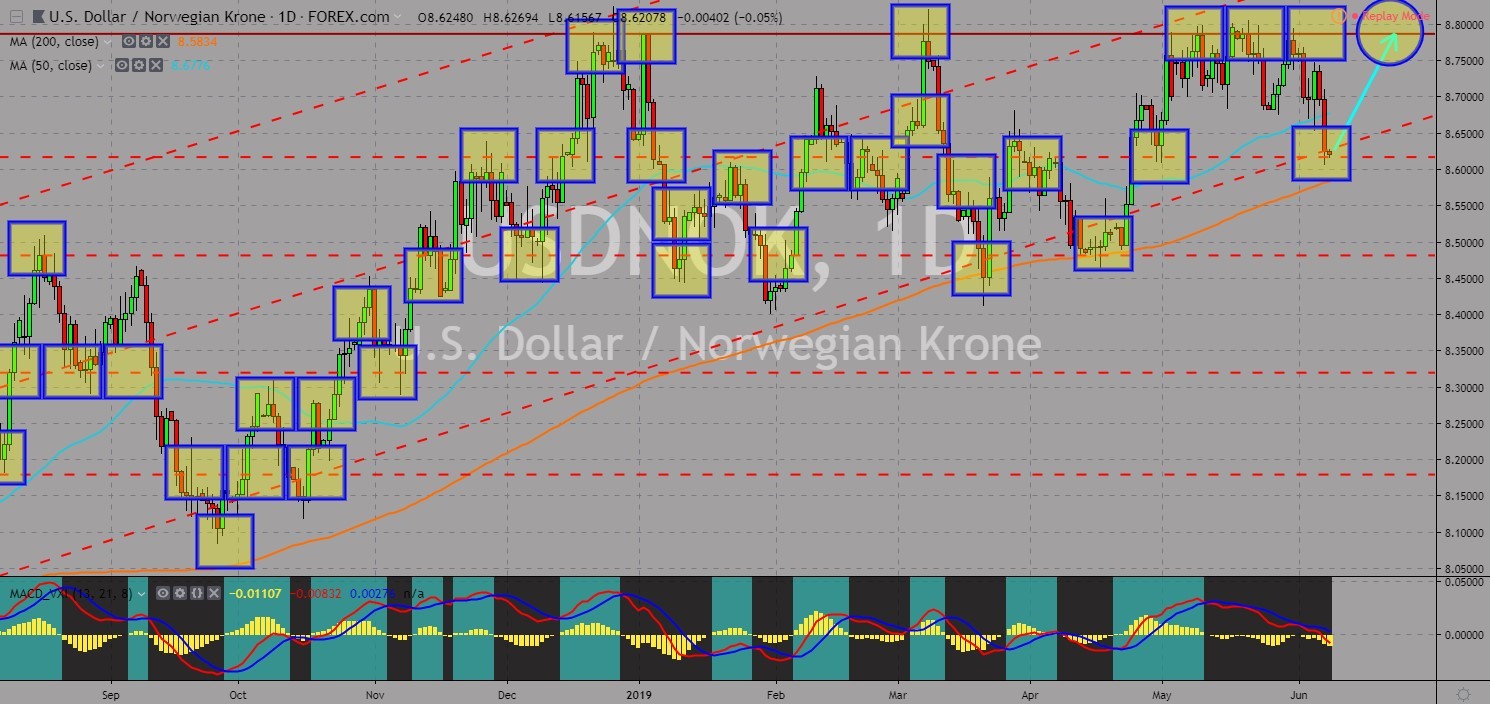

USDNOK

The pair was seen to bounce back from an uptrend channel support line and from a major support line, which will send the pair higher towards a major resistance line. Norway was expected to be more dependent from the U.S. military following the sighting of a spy whale, which was suspected to be trained in Russia. Norway was one of the claimants on the to-be contested region in the Arctic Ocean together with Denmark, Canada, the United States, and Russia. Canada had officially submitted its claim with the United Nations. Aside from this, Norway is not a member of the European Union, which was planning to establish their own military. But the country is a member of the U.S. led NATO (North Atlantic Treaty Organization) Alliance. Norway owned the Svalbard territory, which was the northernmost inhabitant place. Histogram and EMAs 13 and 21 was expected to reverse back in the following days.

COMMENTS