Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

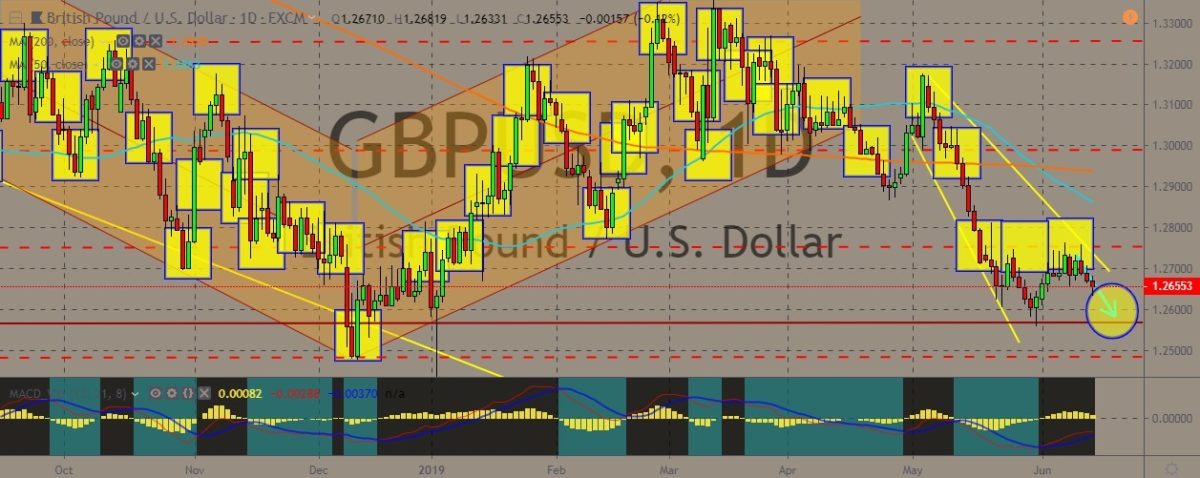

GBPUSD

The pair sees a semi-solid support at current levels, although it’s still seen going downward. The British pound is still facing amounts of pressure after the first round of the Conservative Party leadership contest, which resulted to Boris Johnson being the obvious favorite candidate. Charts show the royal currency going weaker against the greenback, coming right before by the speech by Bank of England Governor Mark Carney. As for the Brexit saga, Cabinet Secretary Sir Mark Sedwill said that there had been ‘a lot of preparation’ for a no-deal Brexit, claiming that the government was in “pretty good shape” to endure a no-deal Brexit. Meanwhile, the dollar showed some mixed performance on various factors. In the US, a letter in which hundreds of companies including Walmart and Target signed encouraged US President Donald Trump not to push through with his plan to impose tariffs on extra $325 billion Chinese imports.

EURCAD

The EURCAD pair still traded within a sideways pattern, with the 50- and 200-day moving averages still converging with the candlesticks. On the European front, the EUR awaits investors’ reaction to news that European finance ministers are aiming to make the common currency stronger to compete with other major currencies, including the US, as the world’s most dominant currency. Meanwhile, the Canadian dollar is fighting off the euro’s flex thanks to the rally in oil prices as well as the persisting expectations that the US Federal Reserve will start slashing interest rates this year. It helps that the market right now is dividing its attention between the US-sparked trade war and the rise in oil prices. Every time this happens, the Canadian dollar usually benefits and perks up against other rival currencies. On the charts, the EURCAD pair could be expected to continue trading within tight ranges.

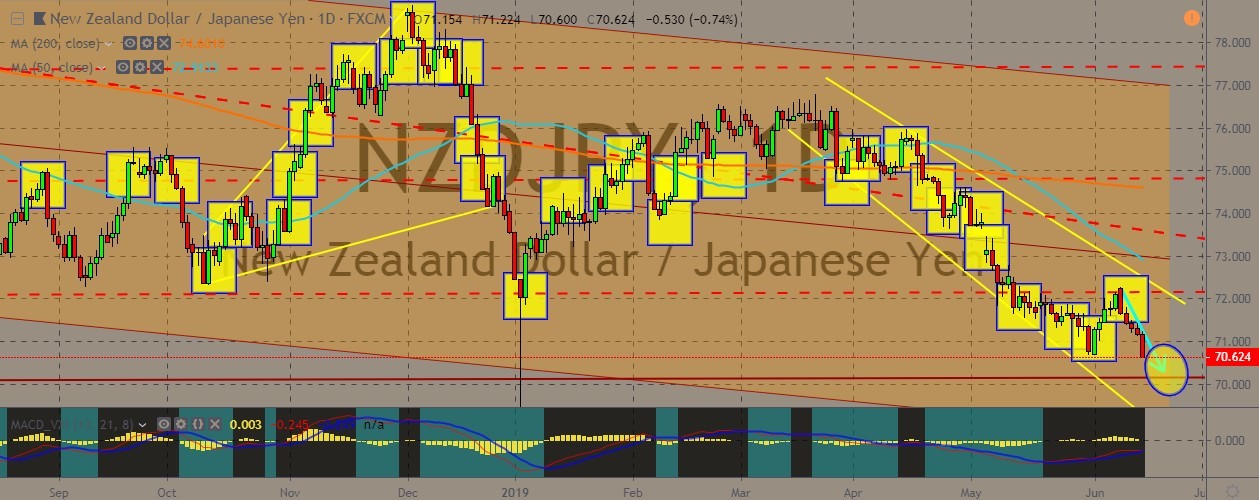

NZDJPY

The pair is seen spiraling down to new lows as the New Zealand dollar traders absorb negative news about the country’s producers’ manager index data showed that the PMI expanded at its slowest since December of 2012. It’s at 50.2, and close to contraction. Even though this could also just be a blip on the radar, it’s not too encouraging to look at its 12-month average, which indicates that the business cycle has already peaked. Meanwhile, on the broader lens, the Japanese yen flexes its safe-haven muscles as the markets absorb more economic data. More negative news are bugging currencies, compelling traders to adopt a more risk-off mood. The JPY is a safe haven asset that sees its value grow in times of market uncertainty and conflict, and traders are flocking safe haven assets right now to protect themselves from the disruptive trade war.

USDHKD

The pair is still under within December lows as the dollar fails to sweep the HKD even though Hong Kong is currently dealing with an extradition turmoil that has seen massive protests in the city. Hong Kong banks’ rates at which they lend experienced another massive surge and hit levels that were only last seen during the global financial crisis. According to economist, this could have been more brought about seasonal swings in cash demands. The pair historically didn’t have any real catalysts that affected its movements—until the trade war between the United States and China that has bogged down financial markets and blurred the outlook for the many economies. The 50-day moving average is still riding higher than the 200-day moving average, indicating that the market could expect the pair to continue in the lower territory.

COMMENTS