Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

GBPBRL

The pair is still testing a resistance level and might even be able to go lower as the trend line suggests. The 50- and 200-day moving averages are also pointing toward a downward slope, after confirming the golden cross last April on the daily chart. Last Monday, the Brazilian Economy Ministry said that it has appointed Gustavo Montezano as the new head of the country’s development bank BNDES. This comes after Joaquin Levy resigned on Sunday following Brazilian President Jair Bolsonaro’s public criticisms of Levy. Meanwhile, the British pound was pressured by the UK political uncertainty, with UK PM leading candidate Boris Johnson at the center of the situation. Brexit fears also remained heightened ahead of the second round of vote for the Conservative leadership. Traders of the royal currency seem to start pricing in the likelihood of a hard, no-deal Brexit.

USDBRL

The Brazilian real gained a bit against the buck (a movement also seen among other Latin American currencies) ahead of the US Federal Reserve meeting this week. The meeting is expected to provide more clues as to the future of the almost-certain interest rate cut this year. Lower US interest rate bolsters the relative appeal of emerging market assets, typically funneling broad inflows into the said markets. For traders, the meeting would serve as some sort of reassurance that there would be a rate cut, which leaves the only question to ask to be ‘when?’ Meanwhile, the Brazilian real has somehow absorbed the news of a new BNDES leader. Additionally, markets apparently believe that the controversial pension reform bill is already in the bag. The Brazilian real managed to gain some strength from the assumption that Bolsonaro will sign the new pension law in the coming months.

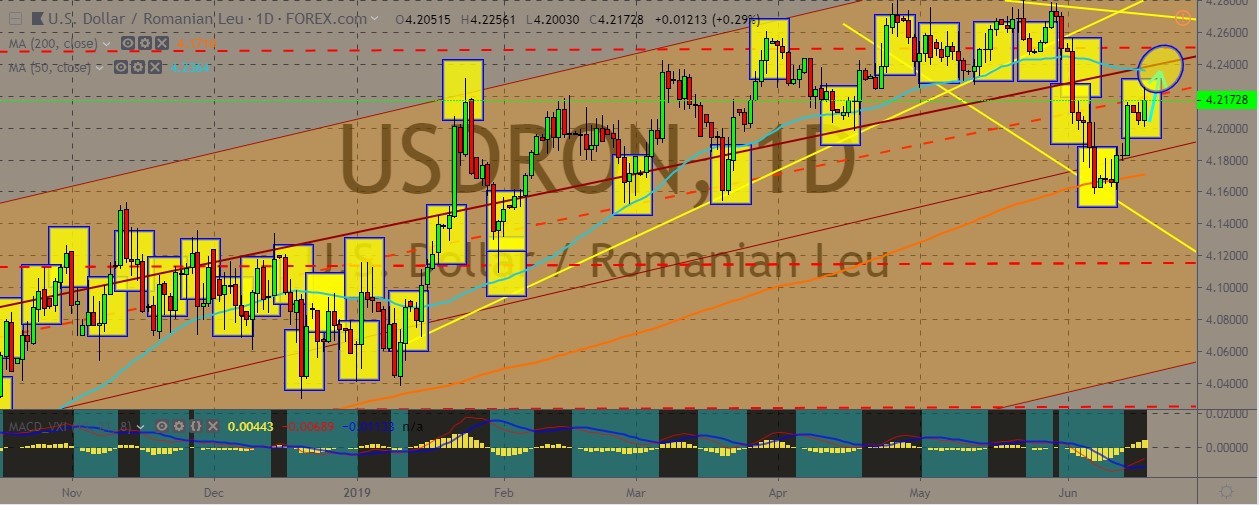

USDRON

The pair is still treading towards an upward trajectory within a trading channel. It has tested that middle band of the channels and broke it, but eventually reversed back and is now testing a key resistance level. The Romanian economy has been affected by various factors. The Business People of Romania has recently said that the country has been drifting away from reaching sustainable growth on the long term because of the deepening of the current account deficit as well as the acceleration of imports. On top of that, Romania has ranked 27th out of 28 countries in the European Commission’s 2019 Digital Economy and Society Index (DESI), which reports the digital performance and monitors the progress of EU countries on digital competitiveness. Romanian money markets also is suffering, with cash rates dropping below the key rate as we approach the end of the minimum reserve period.

EURNOK

The pair is trading at the endpoint of a triangle on the daily chart, with some bearish bias for the euro. The 50-day moving average still points to a bullish near term, while the 200-day moving average apparently refuses to give any hint. Meanwhile, the trading channel still remains intact. The euro slipped low while German bond yield reached a new record low following European Central Bank Chief Mario Draghi’s statement that the bank was providing more stimulus if inflation doesn’t start to pick up. The eurozone will probably see the need to ease policy again through either rate cuts or asset purchases if inflation doesn’t head toward the target. Meanwhile, Norway’s central bank is apparently ready to raise interest raise as the rise in oil wealth spending and investments put the country at odds with global economic cooling. Policymakers are expected to raise rates to 1.25%.

COMMENTS