Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

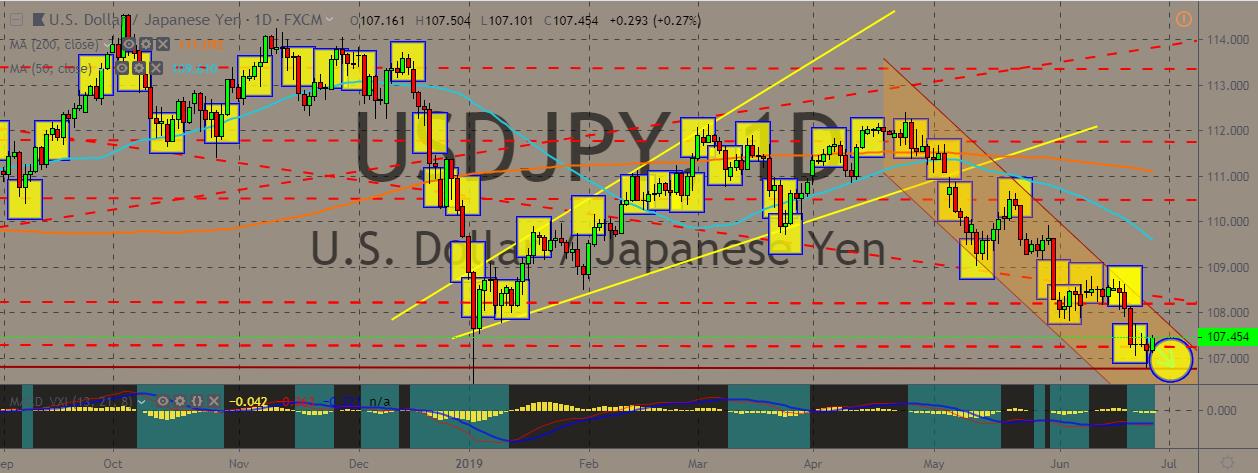

USDJPY

The pair managed to shoot out a bullish candlestick on the daily chart as the dollar goes back to action, pushing the price up during the early trade, although the buck can also be considered as moving back and forth against the safe-haven appeal of the Japanese yen. Still, the greenback still lies on the lower levels of the price channel. Considering this a short-term rally, traders could be expected to take the chance to sell the pair. In spite of the said bullish movement, the pair is believed to have much lower to go. The still-unresolved US-China trade tensions as well as the geopolitical tensions simmering between the United States and Iran aren’t helping the buck but they are boosting appeals of safe-haven assets, including the Japanese yen. Traders will probably continue to side with the Japanese currency while no signs of easing in tensions are seen.

NZDCAD

The NZDCAD is going up the charts, with the pair going nearer the 50-day moving average line on the daily chart. The New Zealand dollar is holding on to its gains while other currencies, particularly the US dollar, are pressured by the global trade and geopolitical tensions. As expected, the Reserve Bank of New Zealand held on to the established rates, not changing anything, and issued forward guidance that sounded even more dovish than before. The kiwi initially weakened after the release of some statements from the central bank but perked up after probably absorbing the whole report. Meanwhile, the Canadian dollar manages to cap some of the kiwi’s gains, with lofty oil and gold prices supporting the currency’s relative strength. As a commodity currency, the Canadian dollar’s movement at present is largely driven by the simmering tensions between the US and Iran in the oil-rich Middle East.

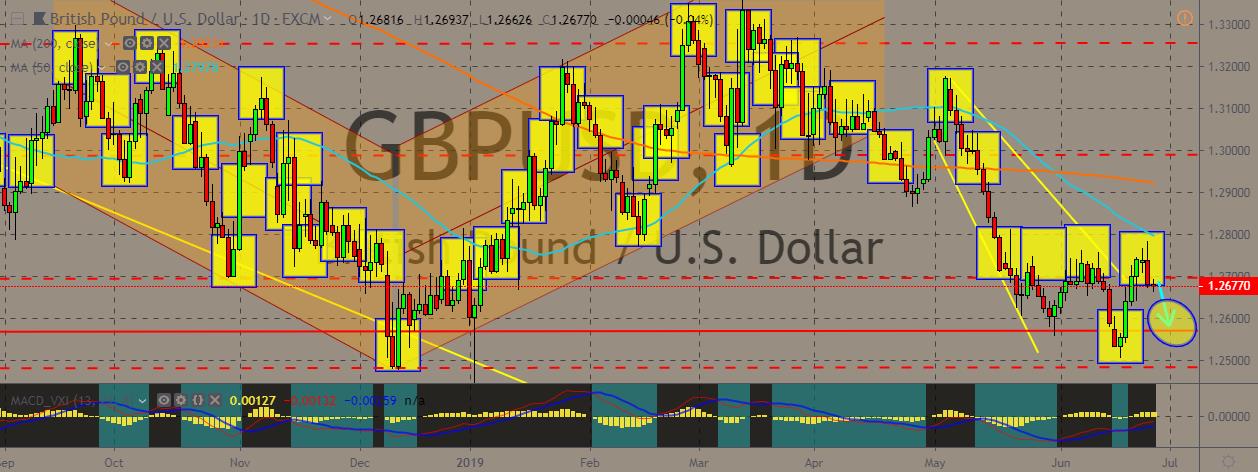

GBPUSD

The GBPUSD pair remains under pressure as the pair hits a key resistance level, as the British pound continues to struggle against major currencies like the greenback and the New Zealand dollar, as well as the euro. Boris Johnson’s rhetoric over-delivering Brexit on October 31st continues to gather traction. It’s possible to push this through the Parliament, but it could worsen the rift existing among the Conservative Party members, ultimately triggering a general election as a result. That could lead to further uncertainty, and it could push the GBPUSD pair to fresh new lows on the week. Mark Carney and other Bank of England policymakers are going to attend the House of Commons Treasury Select Committee to be quizzed regarding the latest inflation report. The BoE slashed growth forecasts in for the UK last week. However, inflationary pressures remain a risk. Rate increases would be likely if a no-deal Brexit is avoided.

EURCAD

The pair remains trading within tight ranges and inside the trading channel established in March. Going back and forth, both the currencies in this pair are experiencing various pressure factors. The euro remained broadly weak against currencies. It also reacted negatively when St. Louis Federal Reserve President James Bullard said that he doesn’t see the need for a half-point interest rate cut during next month’s Fed policy meeting. At present, the pair is sitting on top of the key support level at 1.49503 on the daily chart. It’s possible for it to continue going down that level and hit the bottom of the channel, but it’s very likely the euro would remain inside its current change, going back and forth until the Canadian dollar shows a drastic reaction against or for the current tensions between Washington and Tehran. Overall, traders ought to keep tabs on euro-side developments while also watching over the developments in the commodities market.

COMMENTS