Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

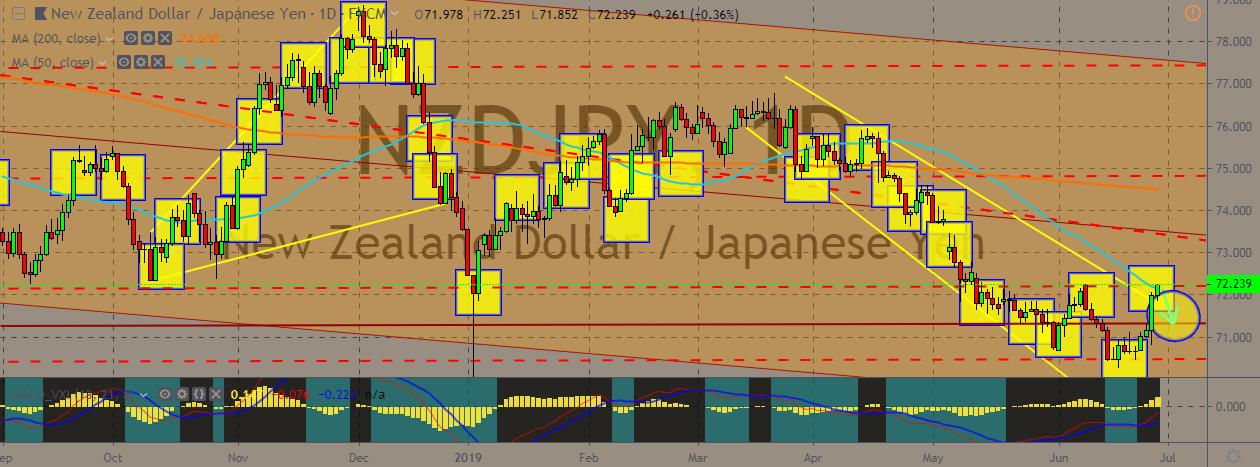

NZDJPY

The pair is continuing an upward move today, coming back from June 14’s low. The price has already converged with the 50-day moving average on the daily chart, which means the price might be poised for a pullback, as it has also hit an important resistance level. The New Zealand dollar appeared to be gathering its strength though, as the country’s central bank, the Reserve Bank of New Zealand, indicated an interest rate cut because of economic risks both domestic and abroad. This comes after the bank passed up on a chance to cut rates during its latest policy meeting, in which it decided not to touch the current rates. The markets are indicating around 63% chance of a cut in the rates, and traders are generally pricing in one rate cut this year. The Japanese yen, on the other hand, has been paring its gains back after other currencies managed to firm up ahead of the G20 meeting this weekend.

USDHKD

The pair is traversing the lower levels of the daily chart, although the price last close much higher in previous session after the US dollar strengthened against the Hong Kong dollar as well as against a basket of other currencies. Recently, an extradition bill in Hong Kong sparked protests and disruptions on the streets. This bill, according to some analysts, risks undermining the special status of the city for the international community. A flight of capital could be on the horizon, and this could in turn threaten the city’s currency. Some of them even said that its government’s unpopular extradition bill was laying out the foundation for the next currency crisis in the city. The Hong Kong dollar is pegged with the US dollar, and law requires the US to monitor the governance of Hong Kong. This status could be lost if the US deems the city not autonomous enough to justify different treatment from China.

USDSGD

The pair is trading in tight ranges right now in the lower parts of the daily charts. The price has of the pair has taken a downward hit even after the confirmation of the golden cross earlier in June. This was due to the Federal Reserve’s change in tone, inclining towards the dovish side, which weakened the US dollar broadly against a number of other major currencies. However, the pullback and reversal in price right now was due to another change in tone by the Federal Reserve’s Chairman, Jerome Powell, who indicated that the US central bank remains data dependent and avoids making decisions based on “short-term situations.” He also tried to rule out any belief in a guaranteed rate cut. This boosted the dollar a bit, with the pair stepping up a key resistance level that it has previously made its support level. Overall, the USDSGD pair will probably start another downward channel—at least until the results of the G20 meeting comes.

EURDKK

The pair’s price has converged with the 200-day moving average, dipping to their lowest in nearly two months. The euro is standing on shaky grounds ahead of critical data and in spite of reports regarding a US-China trade truce. Traders are keeping close tabs on German inflation economic data. Meanwhile, Denmark is having its new leader, Mette Frederiksen, who has just become the county’s youngest-ever prime minister after announcing she will form a left-leaning, one-party minority government. She is also the leader of Denmark’s center-left Socialist Democratic Party. The country’s Social Democrats beat the three-party center-right bloc headed by Lars Lokke Rasmussen earlier in June. Denmark is now going to be the third Nordic country this year to have a leftist government, after Social Democratic parties formed governments in Finland and Sweden earlier in the year.

COMMENTS