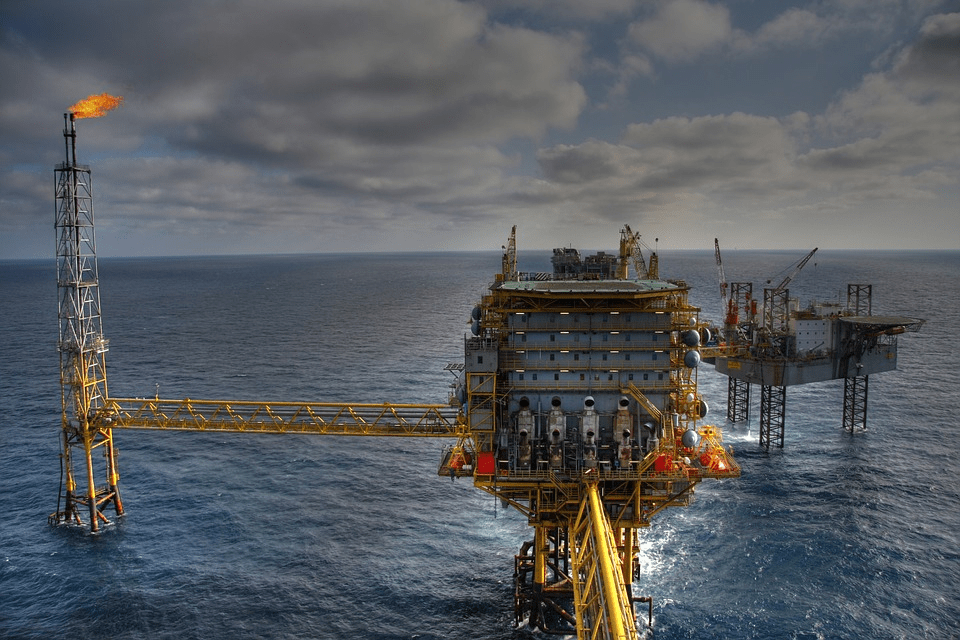

he International Energy Agency said the bans and price caps on Russian oil are having an “intended effect” despite surprising production and exports in recent months.

The EU embargo on Russian oil went into effect on February 5, based on the $60 oil price ceiling that the G-7 implemented on December 5.

In particular, India, China, and Turkey stepped up purchases to partially offset a 400,001 bpd drop in Russian crude exports in January.

The IEA said that Russia’s net oil output fell by just 160,001 barrels per day in January from pre-war levels, sending 8.23 million barrels of oil to world markets. The agency added that the G-7 price cap might also help boost Russian exports, as Moscow has to sell its Urals oil. The price ceiling was put in place to keep Russian oil from flowing into the market while reducing Russian revenues.

Russia’s 2023 budget is based on Urals price of $70.11/barrel, so reduced fiscal revenues from oil operations each year leave a significant hole in public finances.

Bosoni also noted indications that Moscow may not be able to redistribute its oil trade in the way it has crude exports.

Russia announced last week that it would cut output by 500,001 barrels a day in March.

Oil demand will increase in 2023

The IEA suggested that the output cuts may be less retaliation and more Moscow’s attempt to increase prices by curbing production rather than continuing to sell at deep discounts to countries that adhere to G-7 price caps.

Global oil demand should increase in 2023, after a sharp slowdown in 2022.

The IEA said that recent increases in air traffic show how jet fuel will affect the economy in 2023. Oil supplies should rise by 1.1 million bpd to 7.2 million bpd in 2023, with total demand at a record 101.9 million bpd.

The effects of the recent Western oil embargo and price cap will be a major factor in meeting this demand growth.

Beijing’s looks on refinery operations and product exports will change based on its reopening. New refineries in the Middle East, Africa, and China will drive demand for refined products.

COMMENTS