| General Information | |

|---|---|

| Broker Name: | Trader House |

| Broker Type: | Forex and CFDs |

| Country: | UK |

| Operating since year: | 2022 |

| Regulation: | N/A |

| Address: | 2, Frederick Street, Kings Cross, London, WC1X 0ND |

| Broker status: | Active |

| Customer Service | |

| Phone: | +442037698283 |

| Email: / | N/A |

| Languages: | English |

| Availability: | 24/7 |

| Trading | |

| The Trading platforms: | Proprietary |

| Trading platform Time zone: | N/A |

| Demo account: | No |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | $10,000 |

| Maximal leverage: | 1:400 |

| Spread: | Floating |

| Scalping allowed: | Yes |

REVIEW CONTENT

- General Information & First Impressions

- Fund and Account Security

- Registration at Trader House

- The Trading Accounts

- Trader House’s Trading Platform

- Funding and Pricing

- Trading Products at Trader House

- Customer Service at Trader House

- Conclusion

Broker Review: Trader House – General Information & First Impressions

Trader House is a newly-founded brokerage that aims to provide trading services to serious traders and investors. It’s a forex broker that also offers other asset classes via CFDs, including global stocks and cryptocurrencies. Trader House works from the UK, and its exact address is 2, Frederick Street, Kings Cross, London. The broker hopes to attract new customers with a cutting-edge, customizable experience. If that sounds like an interesting prospect to you, read our Trader House review to learn more.

One of the primary things you notice when you go to the broker’s website is its non-standard design. If you’re a smart trader, you won’t use a broker just because it looks good. However, when a broker breaks norms, even in relatively unimportant areas, they inform us of themselves. It tells us that Trader House isn’t afraid to innovate, even with features that are somewhat set in stone.

So its different design is a clever way of conveying a message about the broker’s overarching philosophy. However, it also has the practical advantage of cutting some confusing navigational elements. That makes browsing traderhouse.com much more straightforward and less time-consuming. That benefits newer traders by eliminating the overwhelming feeling some brokers create. Furthermore, it also helps more experienced traders, as it leads to them wasting less time.

The broker’s website is clear and lacks filler content, which we enjoy seeing. It means Trader House isn’t afraid to let its service speak for itself, which is a good precedent. The broker does a fantastic job at introducing itself, leading to a positive start to our Trader House review.

Fund and Account Security

As Trader House is a luxury brokerage, we paid close attention to its safety protocols. Our practice is to judge brokers that require a higher deposit requirement more harshly. Losing $250 to a broker is unfortunate, but it’s not the end of the world for most who attempt trading. However, losing your initial deposit of $10,000 can present a significant financial blow, even if you’re well off.

However, we’re glad to say that we found no reason to worry about security. As we said earlier in our traderhouse.com review, the broker was careful to set up its website in a clear and intuitive manner. Although that by itself doesn’t automatically mean a broker is safe, it’s a good baseline.

Another thing we should talk about when discussing Trader House’s safety is the place where it operates. It works from the United Kingdom’s capital of London. As you can imagine, the capital of one of the world’s more prominent economies is a strictly-regulated place. Even that location lends the brokerage more credibility than licenses from some offshore regulators would.

Carrying on, we also checked the broker’s legal documentation. That’s where dishonest companies like to put malicious clauses that validate their shady behavior. Trader House’s documents were clear and simple to interpret. Since the documents are written using legal language, that means the broker put in the effort to make them more understandable.

Trader House shows none of the usual warning signs of an underhanded broker. Quite the opposite, as the firm actually does a lot to ensure its traders are safe. As such, we predict you won’t run into any problems safety-wise while using traderhouse.com.

Registration at Trader House

You can register for Trader House by pressing the Get Started button in the upper-righthand corner. The registration screen is simple to understand, and the broker isn’t invasive with the data it requests. Once you submit basic personal and location information, you’ll have a Trader House account. However, you will need to have some funds in your profile to actually start trading.

The Trading Accounts

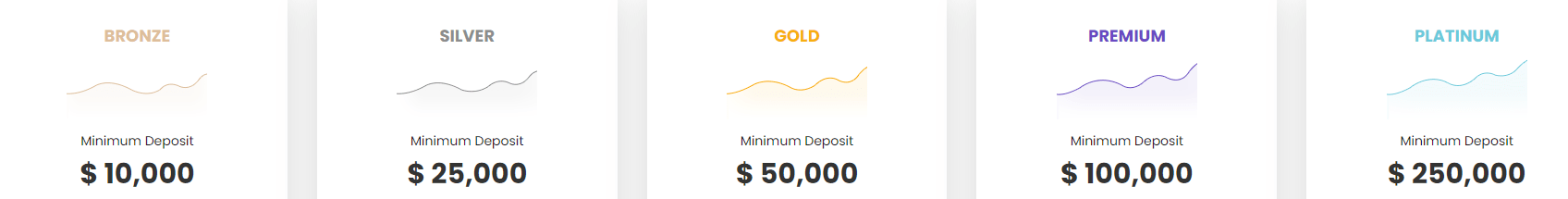

One of Trader House’s bigger advantages is the versatility of its various different account types. Before we go into specific types, though, we need to say that even the baseline one requires a $10,000 deposit. While some traders may view that as a substantial amount, it’s not massive in the trading world. And while that does establish Trader House as a brokerage for serious traders, it’s not out of reach for most people.

Naturally, since the price point is a bit higher than most brokerages, the account is of a higher quality as well. You get a personal account manager, as well as other helpful features, such as custom training in various areas. You’ll be able to adapt to the broker’s trading platform, as well as learn about various markets and risk management methods. Furthermore, the $10,000 deposit also brings a bonus, but more on that later in our Trader House review.

There are seven active account types in total, culminating in the prestigious VIP option. Each version brings advantages over the last, some in the realm of convenience, others in the realm of assistance. Some features improve the technical qualities that the broker offers as well.

It’s also worth noting that there’s a side-grade to the VIP option in the managed account. If you have disposable funds but aren’t much of an investor, it’s a solid way to establish a passive income source.

Here are some of the account qualities you can expect at traderhouse.com:

Bronze

- Minimum Deposit: $ 10,000

- Dedicated Account Manager

- Trading Platform Training

- Risk Management Training

- Basic Market Training

Silver

- Minimum Deposit: $ 25,000

- Dedicated Account Manager

- Trading Platform Training

- Risk Management Training

- Basic Market Training

- Daily Trading Alerts

Gold

- Minimum Deposit: $ 50,000

- Dedicated Account Manager

- Trading Platform Training

- Risk Management Training

- Basic Market Training

- Daily Trading Alerts

- Risk Free Trades

- Advanced One-On-One Training Sessions

Platinum

- Minimum Deposit: $ 100,000

- Dedicated Account Manager

- Added to the VIP Trading Signals Telegram Channel

- Added to the Exclusive Jack Scienza WhatsApp Group

- Trading Platform Training

- Risk Management Training

- Basic Market Training

- Daily Trading Alerts

- Risk Free Trades

- Advanced One-On-One Training Sessions

- Access to the Trader House Managed Account Service

Platinum

- Minimum Deposit: $ 250,000

- Dedicated Account Manager

- Added to the VIP Trading Signals Telegram Channel

- Added to the Exclusive Jack Scienza WhatsApp Group

- Trading Platform Training

- Risk Management Training

- Basic Market Training

- Daily Trading Alerts

- Risk Free Trades

- Advanced One-On-One Training Sessions

- Access to the Trader House Managed Account Service

- Higher Leverage

VIP

- Minimum Deposit: $ 500,000

- Exclusive Benefits – Ask Your Account Manager

Trader House’s Trading Platform

Trader House’s platform emphasizes ease of use and technological potency. It provides you with access to the most important global markets and ensures a comfortable trading experience. You can access it via all major methods, such as a downloadable terminal, web platform, or mobile app.

Funding and Pricing

Earlier in our Trader House review, we said that your deposits were worth more than they seemed. Here, we’ll explain that statement by clarifying that the increased value comes from Trader House’s bonus offering. They match your deposit to essentially double your money on your initial investment. That’s worth quite a bit and nearly guarantees a positive trading experience once you start.

Furthermore, the broker funds itself via spreads, reducing the costs on users’ sides. The spreads are tight over all account types, so there’s no reason to worry about the broker taking an unreasonable cut.

As for the funding, there are options for both cards and direct wire transfers, covering most users’ preferences. The card deposits and withdrawals are instant but incur fees when getting money out of your brokerage account. Bank wire transfers are slower, ranging from 1-3 business days to process, but are free of any additional charges. That tells us that perhaps the optimal strategy is to deposit via card and withdraw via wire.

Trading Products at Trader House

Trader House offers a variety of assets you can trade on. It focuses on forex, but its selection is far from lacking in any major category. Here are some of the asset classes you can expect to see on traderhouse.com:

- Forex

- Crypto

- Indices

- Commodities

- Metals

- Energies

- Stocks

Customer Service at Trader House

Trader House offers 24/7 support to its customers, so resolving any issue shouldn’t be a problem. You can reach the company via phone or fill out a form to request them to email you.

Phone: +442037698283

Conclusion

Trader House is a versatile brokerage that brings numerous advantages over competitors. The most apparent one comes from pricing, with its fee-free experience with tight spreads topped with a bonus. That guarantees that any competent trader will manage to earn some money with the initial deposit. However, even beyond pricing, the broker is customizable, versatile, and comfortable.

One of the things most high-end brokerages don’t understand is that it’s not just about being technically competent. If the trading experience is miserable, you’re unlikely to attract the customer group you’re aiming for. Trader House recognizes that fact and organizes its service in a way that makes trading enjoyable, as well as lucrative. That’s what sets it apart from other brokerages of a similar caliber.

It should come as no surprise that we think the broker is one you should keep an eye on. We’ll wrap up our Trader House review by suggesting you try it out if it fits your price range.

Enthusiastic brokers

Enthusiastic brokers and customer service. They always work with fun. Easy to deal with and best of all, they never ail to deliver good result.

Did you find this review helpful? Yes No

Profitable deals

Skilled and competitive brokers to deal with. Profitable deals also. I have no withdrawal isuues and I am keeping the services.

Did you find this review helpful? Yes No

Good trading experience

Good trading experience. I had a very positive trading experience with this broker. I get good trading results all the time.

Did you find this review helpful? Yes No

Good

There are so many affordabe trading instrumentsto chose from. Signals are effective and services are reliable.

Did you find this review helpful? Yes No