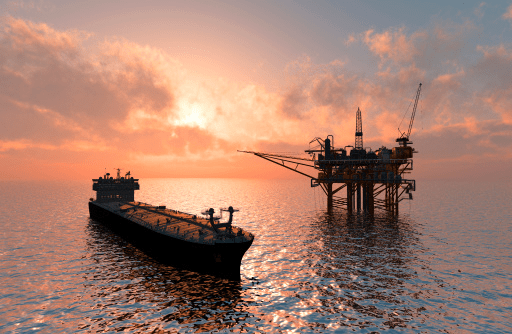

Hot Commodity: Western Canadian Oil Sands in 2024

In the dynamic energy market landscape, Western Canadian oil sands have become a hot commodity, adeptly navigating the price differentials’ highs and lows. The anticipated pipeline expansion in early 2024 should significantly alter market dynamics and open new export opportunities, attracting the attention of commodity brokers and those using commodity trading platforms. Pipeline Expansion Spurs …

Hot Commodity: Western Canadian Oil Sands in 2024 Read More »