Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

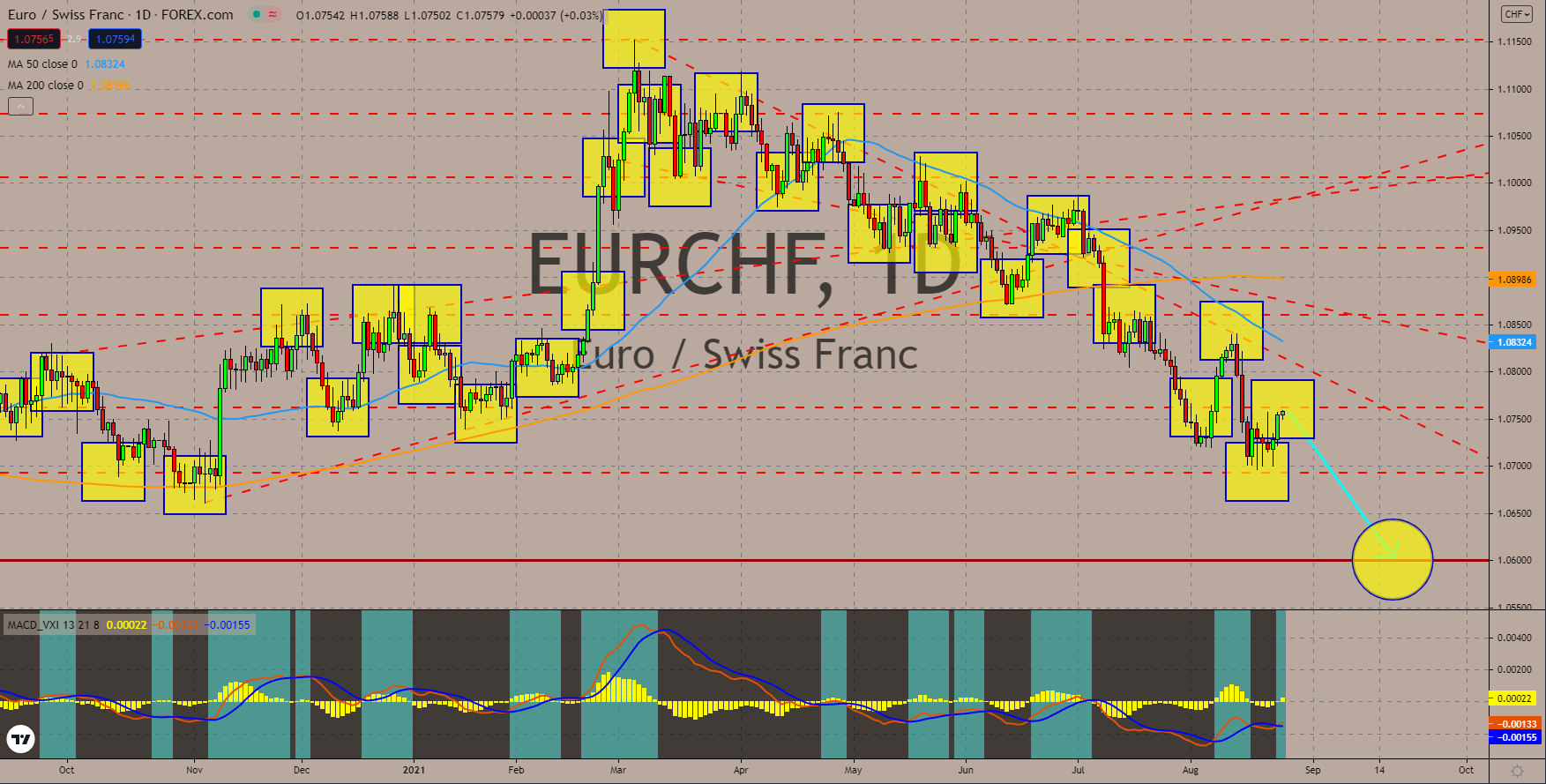

EURCHF

Germany will drag the Eurozone’s economy lower. The current economic expectation is positive, with an advance to 101.4 points. However, the projection for the next six (6) months is bleak. The Business Expectations report slipped below 100 points to 97.5 points. Overall, Germany’s business confidence is down for the second consecutive month to 99.4 points. Analysts expect the reports published on August 25 to shrug off the country’s Q2 performance. The April to June GDP is up 1.6% quarter-on-quarter, while the annual data came in at 9.8%. Both results are higher than the consensus estimates of 1.5% and 9.6%. However, with tighter border measures and increased local restrictions, the economy might experience a double-dip recession. The pessimistic forecast is supported by the 200 and 50 moving averages as the MAs entered August with a ‘bearish crossover.’ Meanwhile, the MACD indicator is below zero. This indicates a continued downtrend.

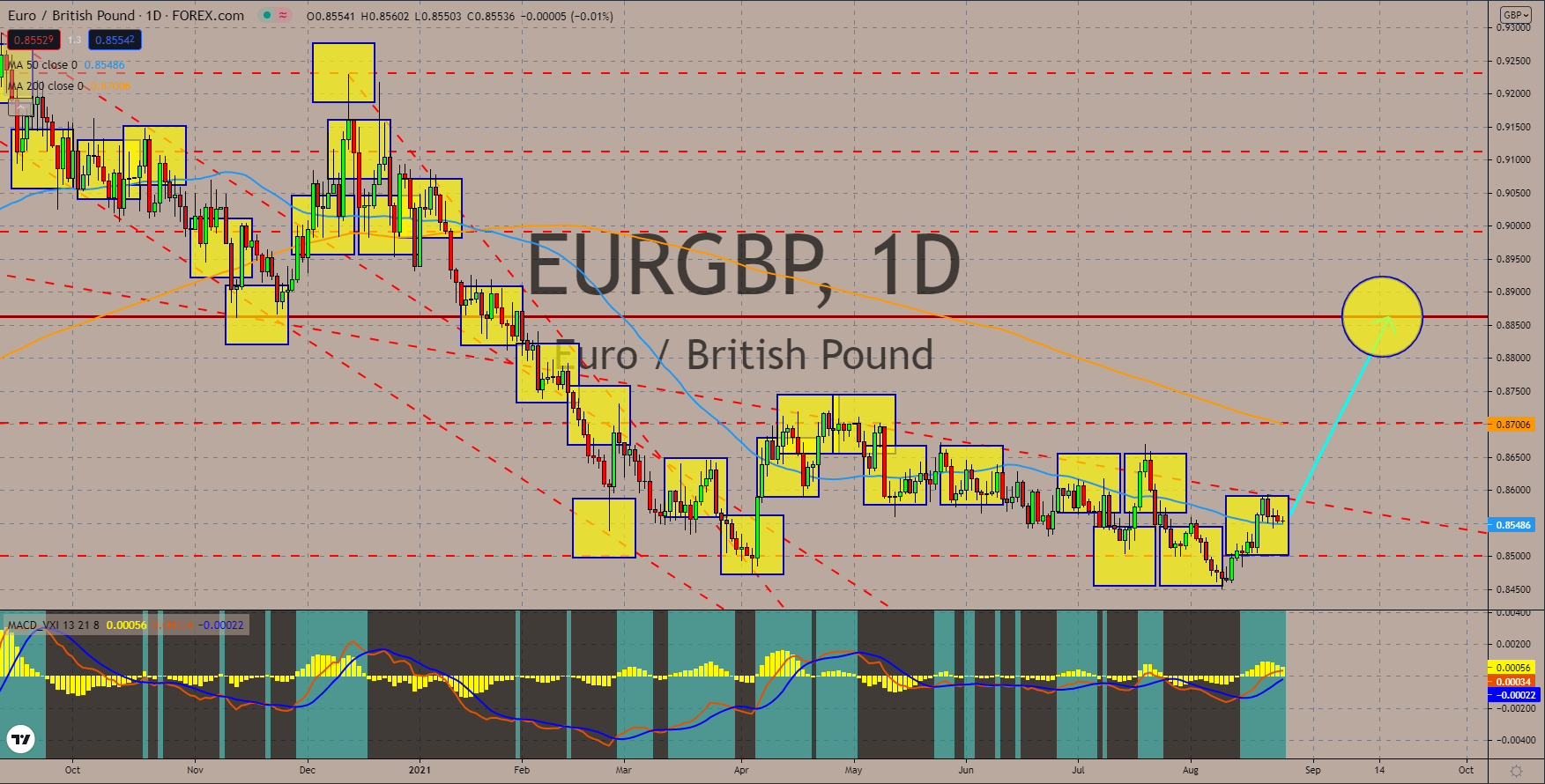

EURGBP

The United Kingdom continues to record disappointing economic reports. In the first half of fiscal 2020, foreign direct investment (FDI) shrinks 57% amidst the pandemic and Brexit. This is a sharp decline of 37.7 billion against 45.7 billion in 2019. Meanwhile, another double-digit decrease was recorded for home sales. The 73,740 July property transactions represent a 62.8% decline, while the annualized data in the prior month came at 219.1% to 198,240 home sales. Another drawdown in the British pound is employment. The United Kingdom saw an expansion of the gig economy. Short-term, project-based workers increased amidst the pandemic. This was following a massive layoff by companies to cut costs. However, this is also catastrophic for the long-term stability of most companies. In the UK, 90,000 truck drivers are needed. The EURGBP pair trailed above the 50-day moving average this week. Meanwhile, the MACD is inching towards positive territory.

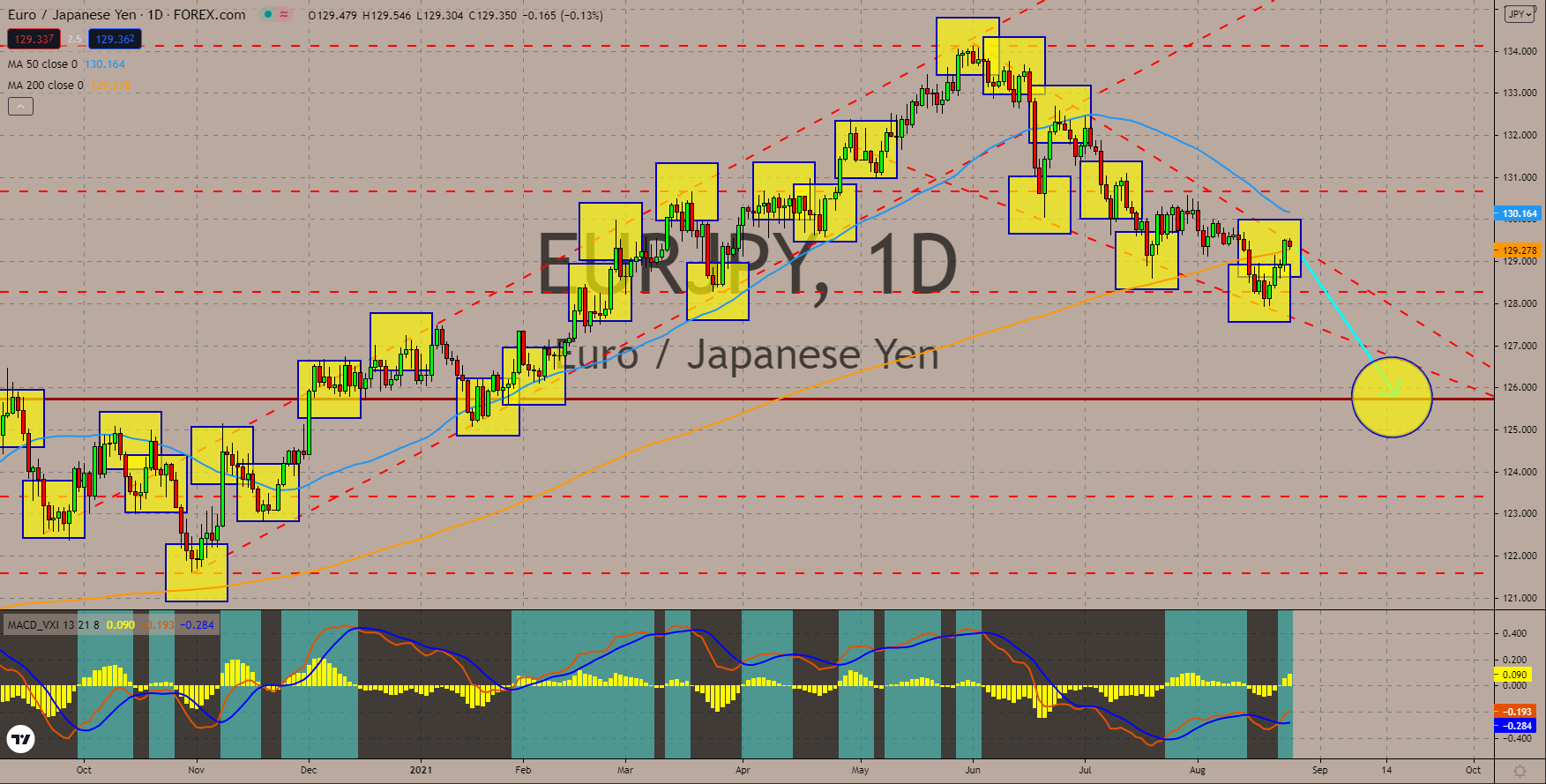

EURJPY

The Tokyo Core CPI is due for release on August 26. Analysts are expecting the report to post a -0.2% contraction. The market, however, sees inflation picking up following the CPI increase of 0.2% based on the Bank of Japan’s inhouse record. The Leading Index and Coincident Indicator in July also showed a positive result. The current condition is better with a 2.4% increase, while the forward-looking index jumped 1.5% YoY. This is despite the economic uncertainty amidst the resurgence of the pandemic. Meanwhile, around 90% of Japanese businesses are optimistic for next year. Currently, 79% of Japan’s economy is under a national emergency. In other news, the proposed government budget for fiscal 2022 is at 1.2 quadrillion yen. The pair is expected to fail to break out from the ‘Falling Wedge’ pattern resistance line. The 50-day and 200-day MAs also loom to form a ‘bearish crossover.’ Meanwhile, the MACD indicator is expected to reverse.

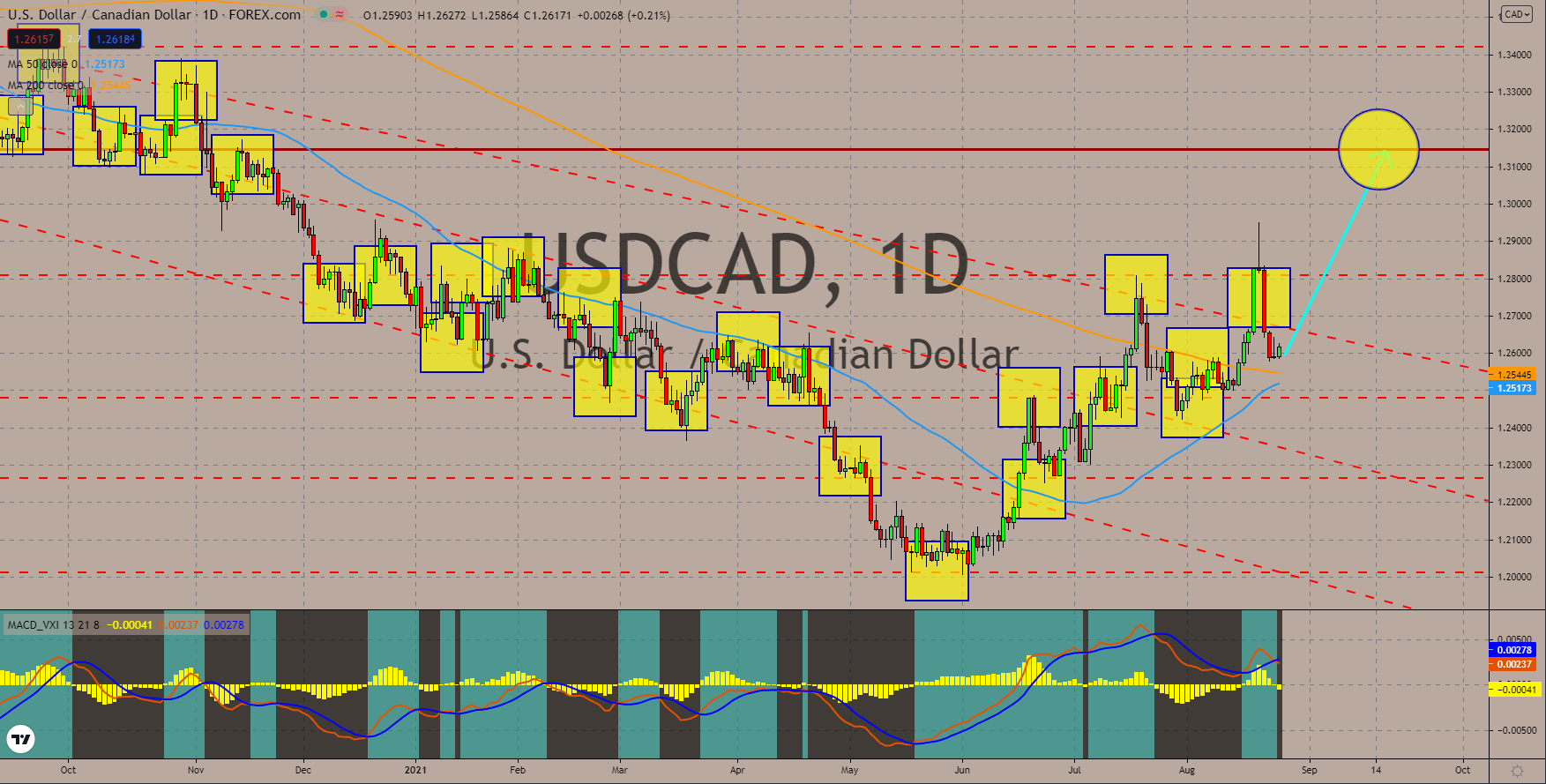

USDCAD

The US economy is anticipated to expand by 6.7% on the second reading for Q2 2021. On July 29, reports showed an increase of 6.5% in the preliminary data. The final Q1 result came at 6.4%. Expectations of flat jobless claims back the bullish forecast. The number of individuals who filed for unemployment insurance is projected at 350,000. But with an upbeat result of 348,000 in the previous week, analysts hope for lower data. Aside from economic results, market participants are looking forward to the Jackson Hole Economic Symposium. The annual August event will start on August 26 until Saturday. The meeting is joined by central bankers and influential people in the finance and economics field. Analysts expect the Federal Reserve will discuss topics such as inflation and employment. The central bank might also give hints on its planned 120 billion bond purchases tapering. On the chart, the MAs would form a ‘bearish crossover’ in the sessions.

COMMENTS