Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

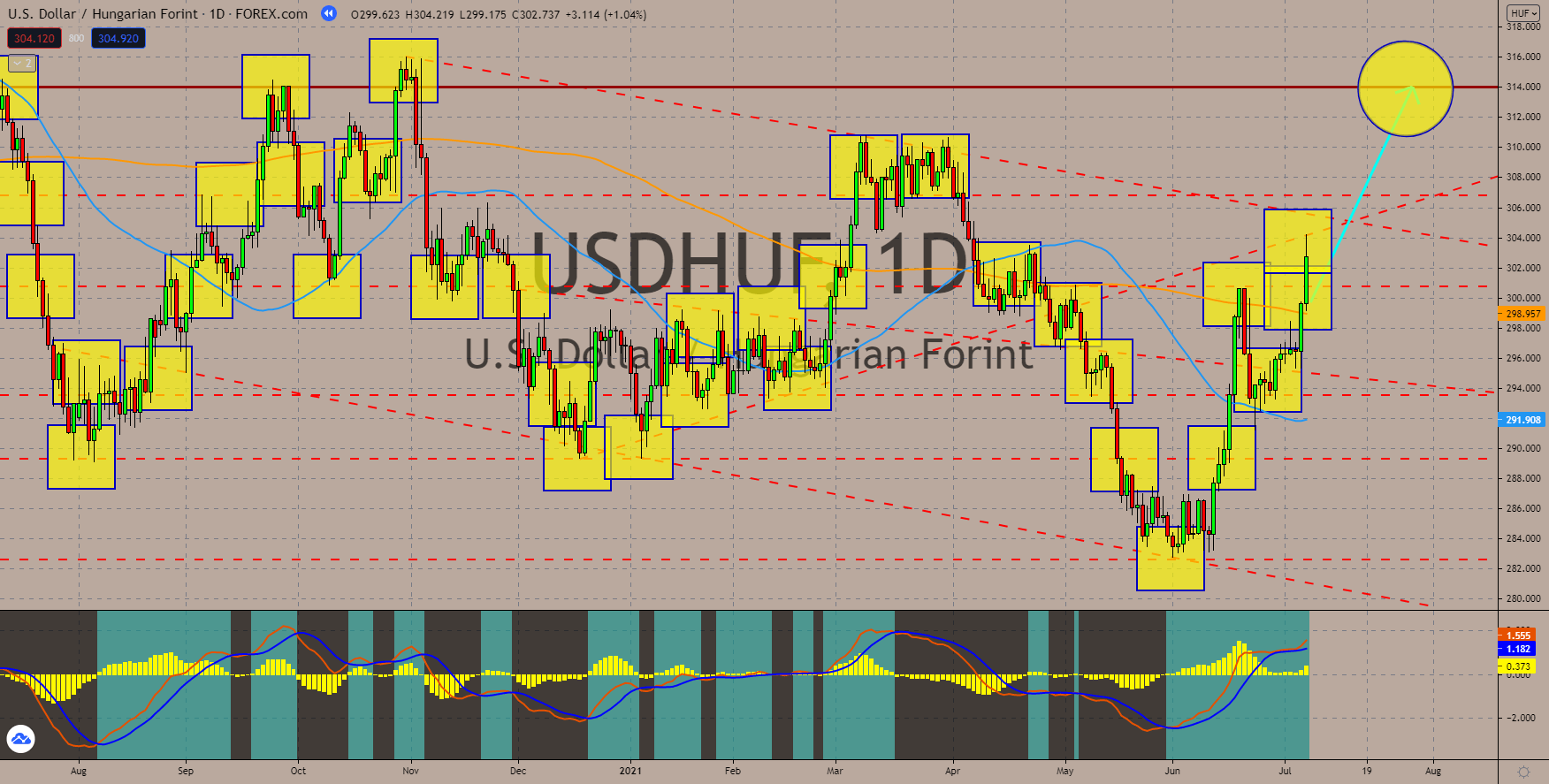

USDHUF

Hungary led the interest rate hike in the European Union with a 30-basis points increase to 0.90% on June 22. This was the same level seen before the coronavirus became pandemic. As a result, the market is divided on whether the Nemzeti Bank would further raise its benchmark to a 5-year high. Meanwhile, the forecast for retail sales and trade balance next month turned bleak with the disappointing economic reports this week. Retail sales slowed down in May to 5.8%. The hike would discourage business expansion as it will cost more to take business and personal loans than when interest is at a historical low of 0.30%. The same analysis is applicable for net exports of which mid-May result came in at 97.0 million. This represents a 12-month low for the report. On price action, the USDHUF pair successfully broke out of the 200-day moving average at 298.957 on its second attempt. The first try on June 18 failed but the 50-MA kept prices above 291.908.

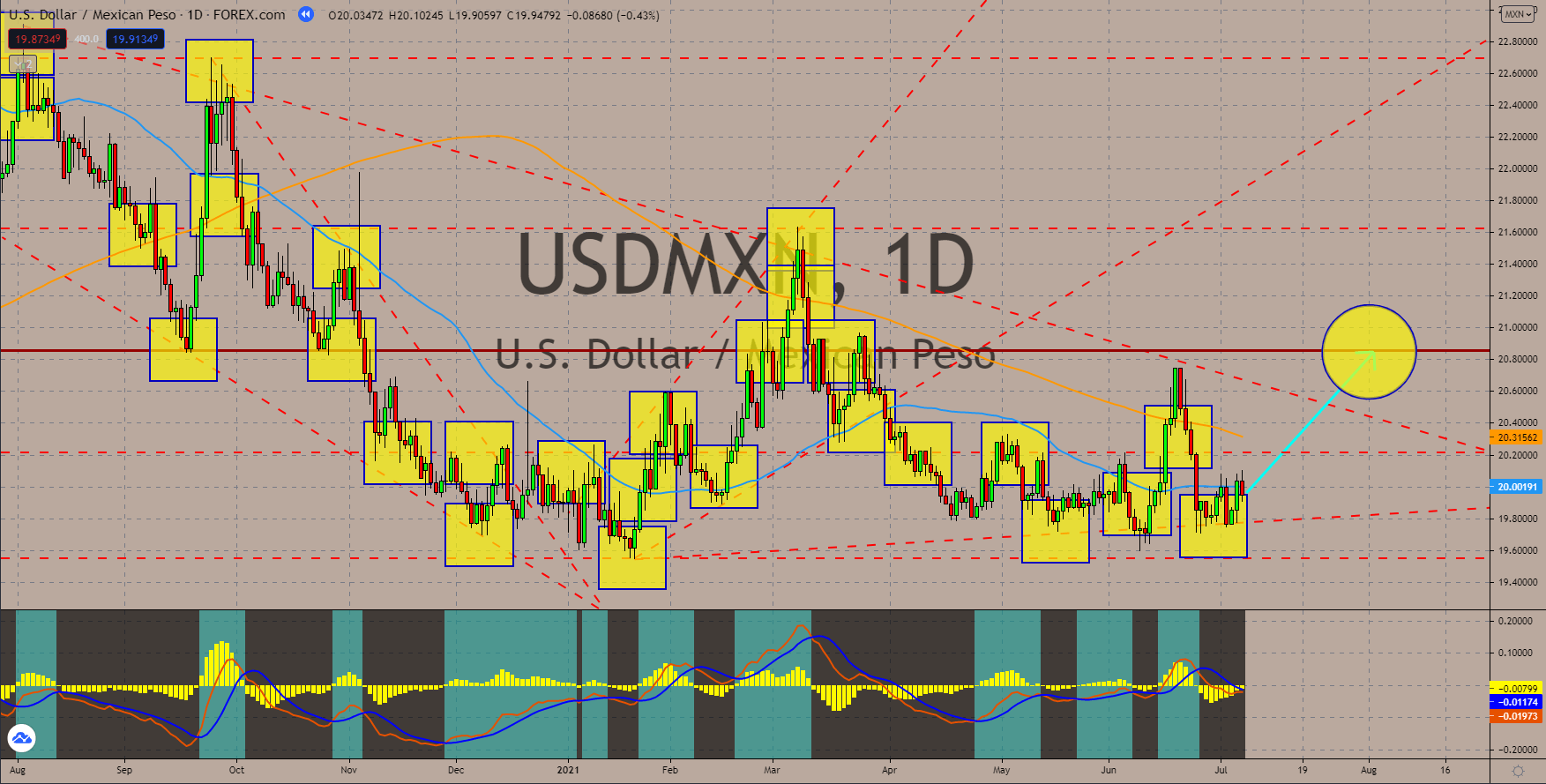

USDMXN

Mexico’s consumer confidence is back to the pre-pandemic level. The report was up by 1.8 points to 44.5 points. A year ago, the result was at the historical low of 34.4 points. As a result, the Gross Fixed Investment data jumped by 43.10% in May. This figure follows an increase of 1.40% in March which was the first time that the report turned positive since April 2019. On a month-on-month basis, the report contracted by -0.90%. Adding to the optimism was the recent upgrade by Fitch Ratings in Latin America. The credit rating agency sees the region expanding by 5.1% in fiscal 2020 from the earlier forecast of just 3.5%. However, the growth is slower compared to other regions especially in North America led by the United States. The 50-day moving average at 20.00191 offers immediate resistance for the USDMXN pair. Meanwhile, the 200-day MA at 20.31562 is a key resistance to break before prices could retest 20.87000 in the short to near term.

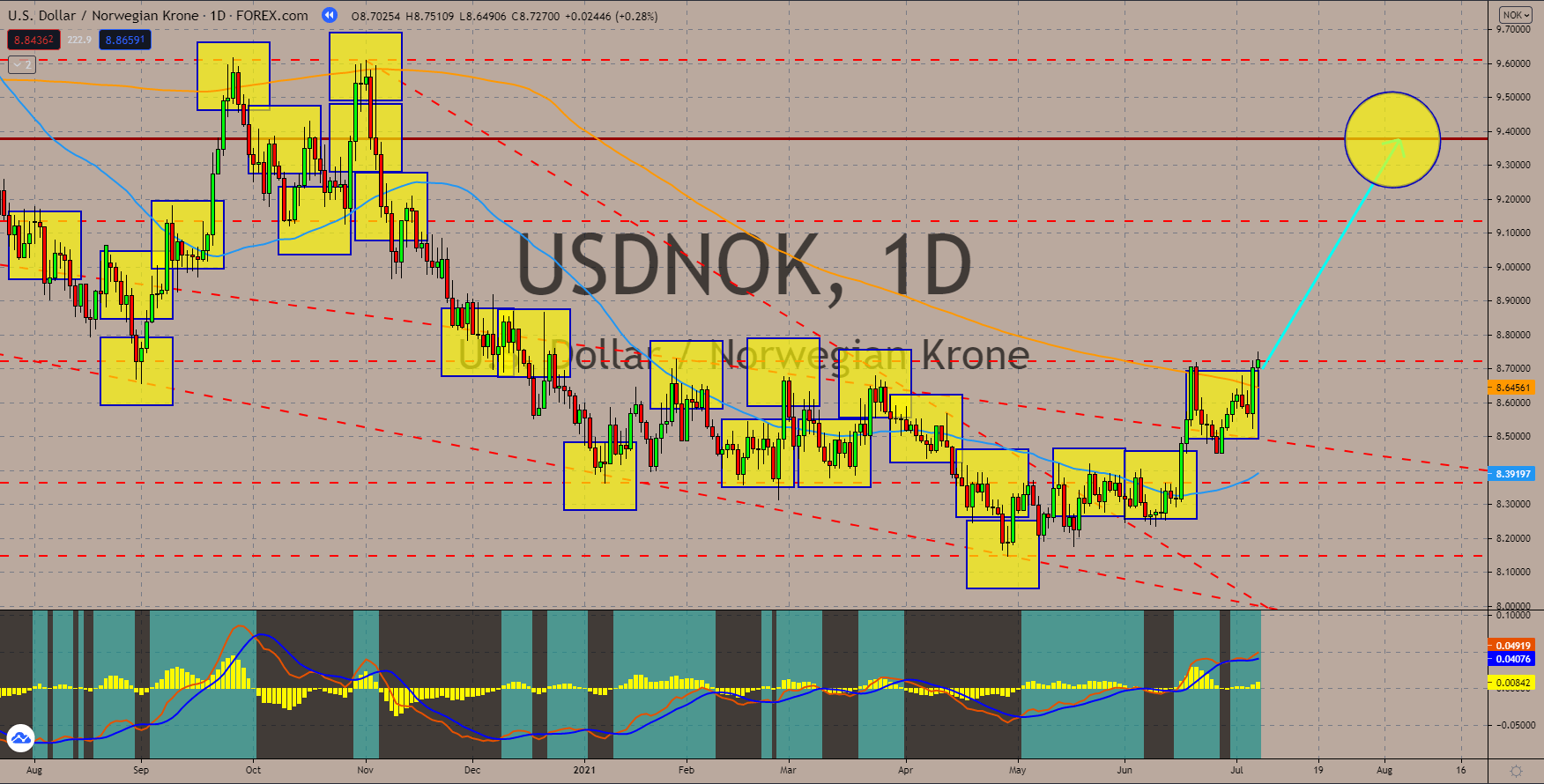

USDNOK

The decline in Norway’s House Price Index (HPI) report could ease the pressure for Norges Bank to tighten its monetary policy. The figure for June came in at 10.10% representing the third month of decline from a pandemic high of 12.50%. A clear downtrend is also visible which is bearish for the Norwegian kroner. In addition, the consumer price index (CPI) report showed a slowdown in the monthly figure at 0.4% resulting in a 2.9% annualized figure. The cooling of monthly inflation would see lower YoY data in the next reports. Meanwhile, the unemployment rate beat the 3.00% consensus estimate from a prior result of 3.30% with an actual 2.90% for June. This was the lowest recorded figure since March last year. The improvement in the unemployment report was despite the lower job additions in June of 103,200. The pair is currently retesting a key resistance area from August at 8.72223 after inching higher from the 200-day moving average around 8.64561.

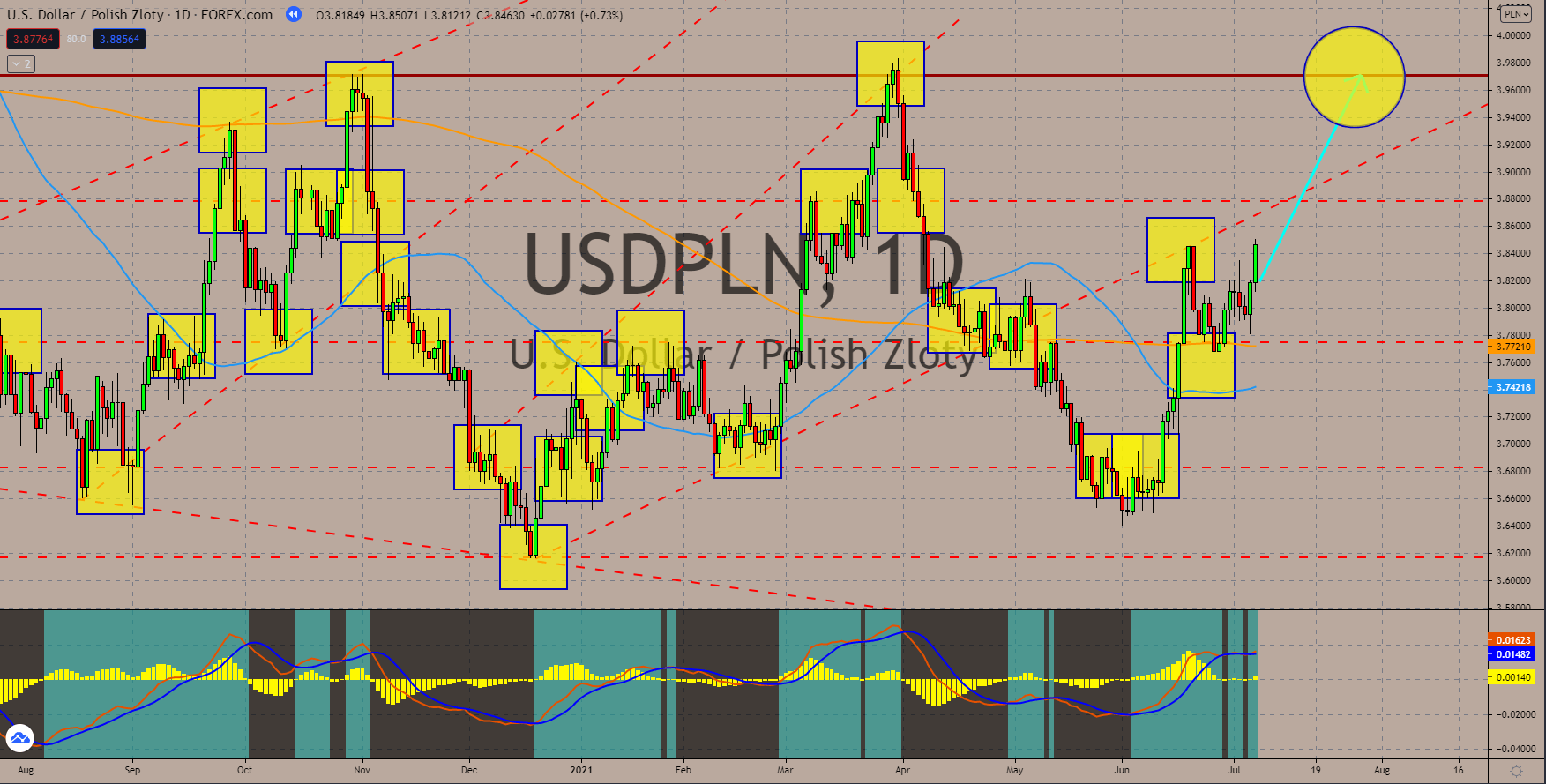

USDPLN

Crude oil inventories reports from the American Petroleum Institute and the Energy Information Administration were down in the week. The figures came in at -7.983 million barrels and -6.866 million barrels, respectively. This was the seventh consecutive deficit in the stockpile. Analysts see the numbers as a possible contributor to a rise in inflation. Importers of crude oil would pass the added amount to businesses, which, in turn, would result in higher prices of goods and services. Meanwhile, analysts are anticipating for the initial jobless claims report on Thursday, July 08, to drop to a pandemic record of 250,000. The 364,000 result in the previous week is currently the lowest weekly figure since March 2020. Also, the 9.388 million projected job openings encourage higher employment. With high inflation and improving employment data, the Fed might soon raise its rates. The MACD shows signs of a continued rally with the 200-moving average as the support.

COMMENTS