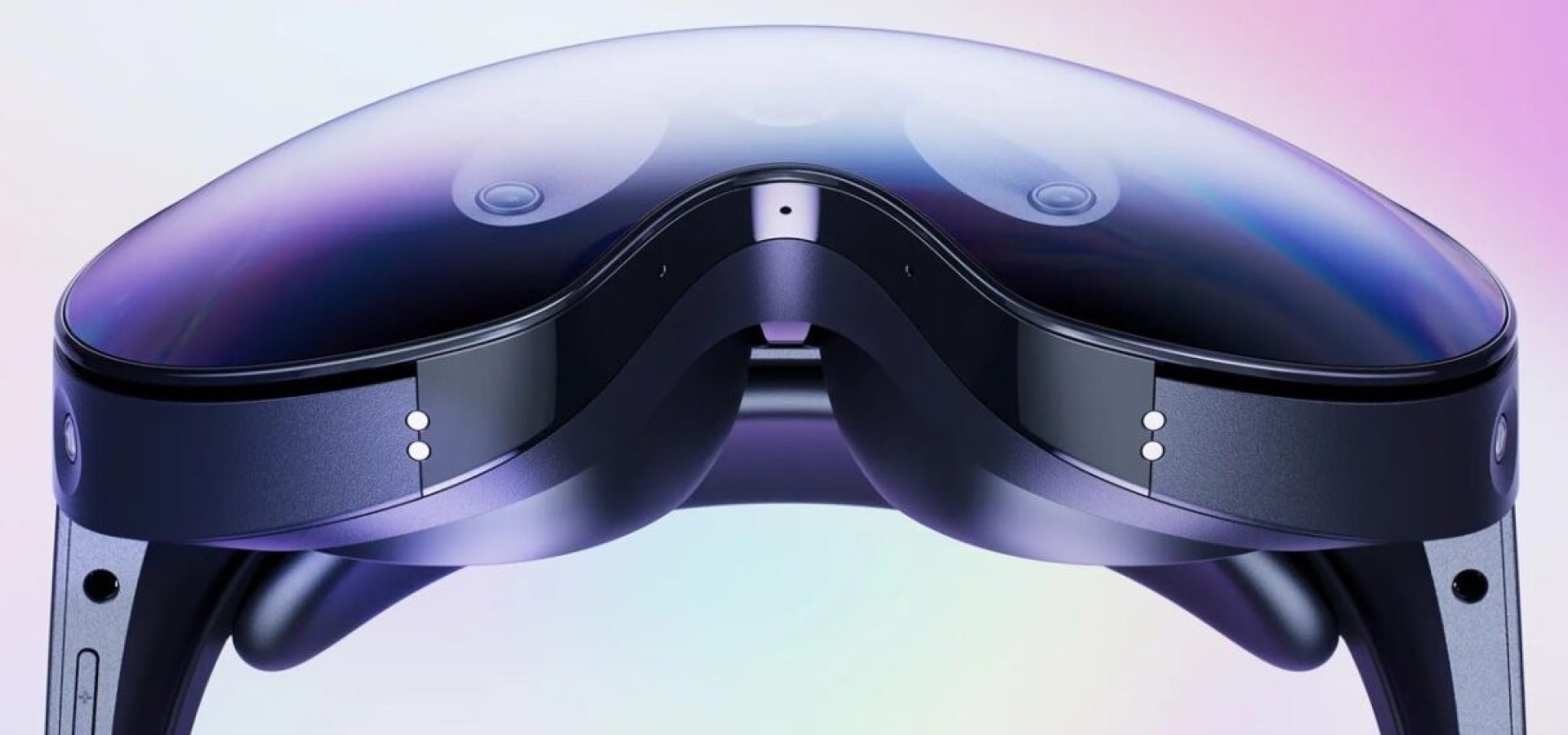

Meta Platforms Inc, a Facebook parent company, reduced the price of certain Quest virtual reality headsets. Due to weaker demand than expected, the list includes its top-end mixed reality device.

The company’s headset, the Meta Quest Pro, made an entrance last fall with corporate users in mind. Beginning March 5, the price will drop to $1,000 from $1,500, according to the firm. The 256-gigabyte Meta Quest 2 will soon cost $430, as previously announced.

Chief Executive Officer Mark Zuckerberg said on his Instagram account that the price was going down so that “more people can get into VR.” However, according to a person familiar with the situation, the decision is also motivated by slow demand from both corporate and consumer customers. Since they were not authorized to make public comments about the firm, the informer requested that their name be kept secret. A Meta representative did not respond for comment.

The Quest Pro was supposed to be sold to business clients who wanted to utilize it in corporate environments. However, that idea has not panned out. Third-party apps that were not compatible with the platform also affected sales.

What are the causes of a price dump?

For the Quest to sell hardware and software in bigger batches, Meta has been looking at ways to package it. The firm has been speaking with firms like Autodesk Inc about which workplace contexts the technology might be beneficial for.

Gabriel Paez leads Autodesk’s Mixed Reality division. He said that they are collaborating closely with Meta to ensure that their consumers have resilient software and hardware solutions. These solutions must meet their stringent level of security, privacy, usability, and performance. Moreover, Meta’s recent problems with the FTC could also play a part.

However, in New York trading on Friday, shares of Menlo Park, California-based Meta, which owns Facebook, Instagram, and WhatsApp, increased by 6.1%. Zuckerberg’s emphasis on reducing costs and becoming more efficient has helped the stock grow by 54% this year.

COMMENTS