Quick Look

- Nvidia’s stock price surged, reaching over $788 post-earnings, peaking at $800 before a slight retreat.

- Earnings shattered expectations with $5.16 per share on $22.1 billion in sales, marking significant year-over-year growth.

- Data-centre sales skyrocketed by 279% from the previous year, underpinning Nvidia’s revenue surge.

- The future outlook brightens with the anticipation of the B100 chip and strategic investments in AI, aiming to bolster its market position.

- Analysts adjust price targets amid Nvidia’s rally, signalling confidence in its continued market dominance.

Nvidia’s financial landscape experienced a significant uplift following its latest earnings report. The company’s stock price, after an impressive rally, soared above $788, momentarily breaching the $800 threshold in early trading sessions. This momentum, albeit with a minor pullback on Friday, resumed its ascent on Monday, underscoring investor optimism. The catalyst behind this surge? A stellar earnings report revealed earnings of $5.16 per share on sales of $22.1 billion, comfortably surpassing the anticipated figures. This performance not only eclipsed previous quarters but also set a new benchmark for the company’s financial health.

593% Earnings Boom & Sales Double to $22.1B

Year-over-year, Nvidia’s earnings and sales have witnessed astronomical growth, with earnings soaring by 593% and sales by 206%. Such growth trajectories are seldom seen in the tech industry, indicating Nvidia’s robust market positioning and operational efficiency. The previous quarter’s performance, with profits at $4.02 a share on $18.12 billion in sales, already hinted at the global manufacturer’s upward trajectory. However, the recent figures have surpassed expectations, highlighting the company’s unparalleled market appeal and innovative edge.

Data Center Sales Leap 279% & B100 Chip Future

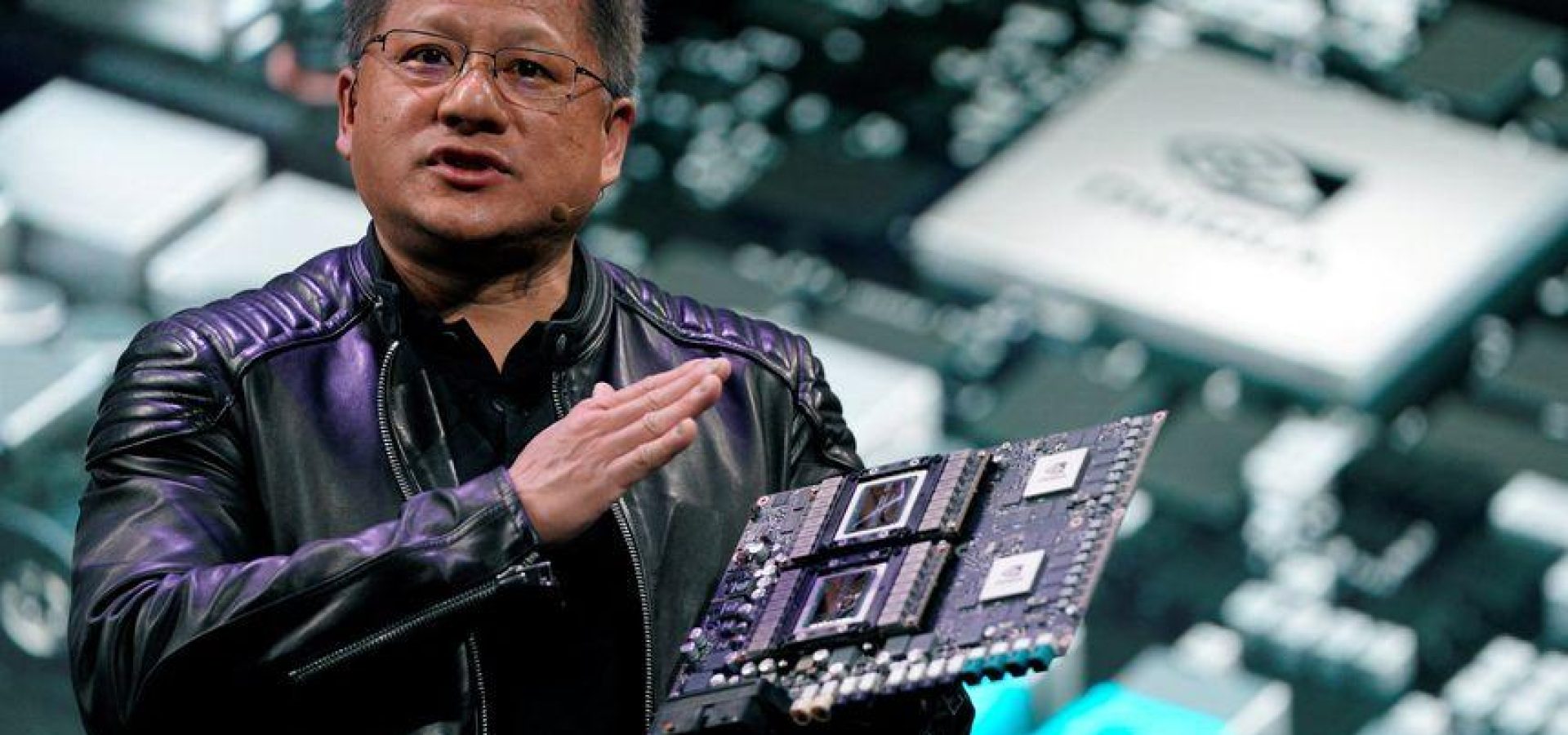

Nvidia’s financial success is its data-centre sales, which notched a staggering 279% increase year-over-year. This surge is a testament to Nvidia’s dominance in the data centre sector, further bolstered by a 41% increase from the second quarter. On the innovation front, Nvidia’s anticipation of the next-generation B100 chip signals its commitment to staying ahead in the AI chip race despite facing supply challenges. Moreover, strategic investments in AI and projections for data centre spending, as envisioned by CEO Jensen Huang, underscore a forward-looking approach to harnessing growth opportunities.

Strategic Partnerships & 239% Stock Surge

Nvidia’s collaboration with industry giants like Dell Technologies and Lenovo for advanced chips in portable workstations exemplifies its strategic innovation. This move, aimed at accelerating video streaming and content-related tasks, reinforces Nvidia’s competitive edge. On the stock front, Nvidia’s impressive rally, culminating in a 239% increase in 2023, reflects its strong market position, underscored by top-notch ratings in Composite, EPS, and Relative Strength.

$30B AI Bet & Analysts’ Strong Nvidia Outlook

While Nvidia’s stock currently stands beyond the buy zone, the upward revision of price targets by analysts like KeyBanc signals strong confidence in its market trajectory. With the AI chip revenue projected to grow significantly, Nvidia’s strategic positioning and investments, including a $30 billion infusion into a new business unit for customized chips, position it well for sustainable growth. As Nvidia trades at a valuation slightly above the S&P 500 average, its financial performance and strategic foresight paint a bullish long-term outlook for the tech titan.

COMMENTS