Are you looking for a stock broker that accepts credit cards? There are several benefits of using a credit card for funding your stock trading account.

- Deposits made using a credit card to a trading account are processed immediately.

- Card verification processes make it safe to use your card for deposits.

- Ease and speed of withdrawals are guaranteed.

If you wish to trade stocks using a credit card, you will have to know the best brokers that accept this deposit method.

Stock brokers that accept credit card for deposits

eToro: Best forex trading broker for beginners

Founded in 2007 and based in Cyprus, eToro is a good Stock broker regulated by the CySEC, FCA, and ASIC, with more than 10 million international clients. eToro offers the most user-friendly platform for forex trading. Of all the best forex brokers, this is surely the most suitable for beginners.

Their copy-to-copy technology allows beginners to copy successful forex traders on the network, benefit from their knowledge, and share trading tips and strategies.

Besides a wide range of financial products, their platform offers 47 currency pairs for trading with low spreads and no deposit fees.

XTB: The best stock broker for an optimal experience

XTB online trading broker with more than 20 years of experience, XTB broker offers an optimal online trading experience because of the many services they provide. The modern interface allows you to enjoy fluid and intuitive navigation.

Offering more than 5,400 financial assets, XTB allows users to vary their investments in an attempt to optimize their returns. In addition, several trading software is available, thus responding to different investor profiles.

On the security side, it should be noted that the broker is recognized and regulated, which confirms the legitimacy of the XTB to operate.

Android, iOS, and Windows. In order to ensure that the navigation quality will not be reduced on mobile, please check that the platform’s website runs under HTML5 coding.

- Libertex: Forex trading without spreads

The Libertex broker is a Stock broker that has been around since 1997 and currently serves over 2.2 million clients in 11 different countries and offers 49 pairs of splits.

Libertex only charges commissions on transactions: no spread is charged on transactions, which is an industry first. Commissions vary from asset to asset and also vary during a transaction. For the EUR-USD split pair, for example, the commission is around 0.008%.

Leverage rates on Libertex is a maximum of 1:30. The broker also offers a user-friendly platform that works well on mobile along with a number of technical analysis tools, financial products, and quick withdrawals. However, note that MT4 and MT5 are not supported on this platform, and there are fees for some deposit and withdrawal methods.

Trade on Libertex

- UFX: Access award-winning “MassInsights” technology

UFX Stock Brokerage is a CySEC-regulated Stock Brokerage that offers a unique platform, ParagonEx, alongside MT4 to give traders the best possible experience.

This broker offers fixed spreads on all its account types, 68 split pairs, a range of financial products, and low transaction costs.

However, the spreads are quite high, especially on mini accounts. Also, there are no variable spread accounts.

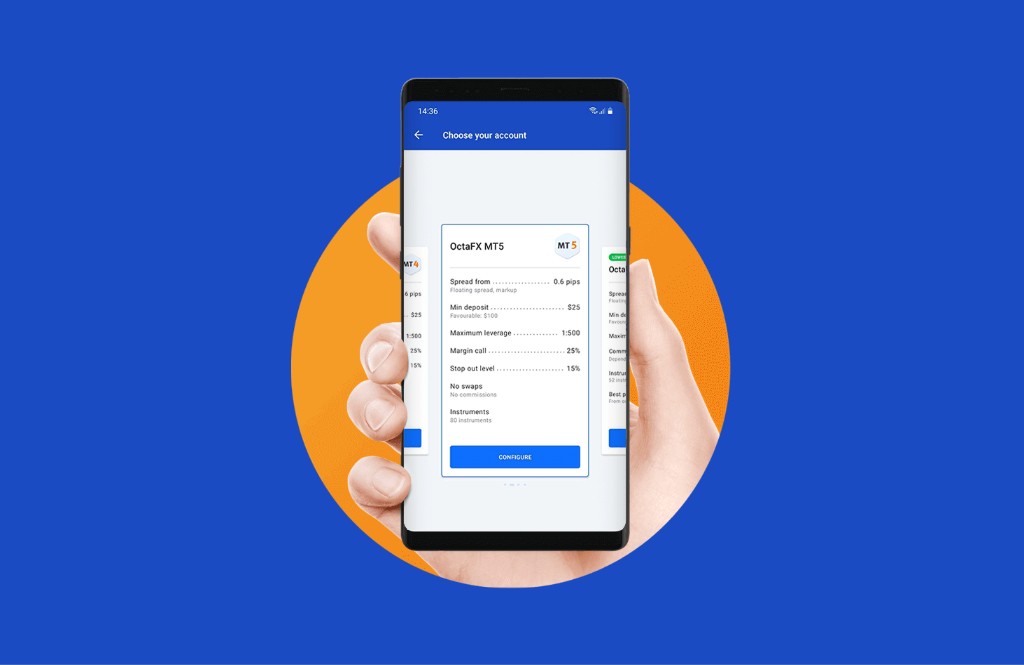

OctaFX

This is a very competitive trading platform with a global reach good reputation. It offers very low spreads, incorporating advanced trading technology in its trading interface. Their pricing is reasonable, which is the main reason they attract thousands of traders worldwide.

Easy to navigate trading platform allows for various trading account types for all types of traders and trading levels.

OctaFX lets its clients make deposits with credit card payment options without commissions. Also, this broker offers one of the lowest trading limits possible.

Alpari

Another broker that accepts credit card deposits is Alpari. Their service is impeccable in many ways. You won’t find any bad reviews regarding this brokerage platform. This platform offers very favorable spreads of 0.09 if you use a Standard account. And there is an amazing 0.01 for those using an ECN account. It’s a very competitive spread compared to many brokerage platforms nowadays.

FXChoice

This brokerage platform has operated since 2010. It has an impeccable business record and has emerged as one of the leading brokers operating online. For professionals and retailers, this broker specializes in CFD trading, the Forex market. FXChoice complies with the best online trading standards and is a transparent and trustworthy business with many awards won for its good business practices.

Tickmill

This broker provides clients trading on the MetaTrader4 platform. It offers trading services encompassing bonds, stocks, commodities, Forex, and indices. The maximum leverage offered is 1:500. Such high leverage may raise suspicion. Still, this broker excelled in every aspect of business, from the trading process and execution speed to trading education and customer support. It’s an award-winning platform.

InstaForex

InstaForex has become one of the most reliable and touted brokers in recent years. The number of its clients goes beyond seven million. The volume of trading operations rises every day. This broker accepts credit cards as a payment method. Besides, it incorporates in its system Moneybookers for sending and receiving money from and to more than 200 countries in 40 currencies.

ThinkMarkets

Among stock brokers that accept credit cards, this is also one of the most trusted by traders. It offers trading with a variety of assets. Besides stocks, you can invest in Forex, commodity, or crypto markets. They offer high-quality service and high-speed execution to an ever-growing number of investors and traders. It’s an Australian broker with many awards won in the brokerage sector: ThinkMarkets has won awards such as Best New Contributor, Best Broker in Asia, and Best Broker in Australia.

There are a variety of trading tools you can use on ThinkMarketsplatforms. It’s perfect for new traders without basic trading knowledge. The ergonomics of the platforms are also very suitable for rookies. This platform uses Trade Interceptor proprietary, which is the leading trading system in the trading community.

IC Markets

The company was founded in Australia in 2007. It offers great spreads, a user-friendly interface, and great overall service. Many regulatory authorities, such as CySec, FSA, and ASIC, regulate the company. The fees are low, and opening an account is easy. And you can also fund your account using a credit card.

Just Markets

JustMarkets is yet another great stock brokerage platform that accepts credit cards. The company is based in St Vincent’s jurisdiction and the Grenadines. This brokerage enables you to choose from many popular payment methods, such as various trading instruments. Besides stocks, you can trade commodities, Forex with thigh spreads, beneficial programs, and no limits on trading strategies.

What is a Stock Broker?

A broker is a website that connects customers with stock service providers.

A Stockbroker is a virtual platform that acts as an intermediary, selling one or more stocks for a fee. The arrival on the internet of this type of site has allowed a real democratization of stock trading.

Before opening an account with a stock broker that accepts credit cards, you must ensure that the site is authorized by the financial authorities in your jurisdiction.

How to Choose a Good Stock Broker?

Choosing a Stockbroker is not easy.

Today almost every stock broker accepts credit cards, but many don’t serve clients in some countries. And the problem for the future trader is to pick a credit card stock broker that operates in the trader’s country. Also, there is always a security risk. So picking up a reliable and regulated stock broker that accept credit card is essential for your trading success.

There are also other factors you should look for when choosing a stock broker that accepts credit cards. Below we highlight what makes a good stock broker.

1. Stock broker Regulation

One of the most important steps before investing your money is to make sure that a Stock broker is legal.

As the financial markets have greatly expanded in recent years, trading platforms have appeared in droves.

2. Security of the stock broker

When selecting a trustworthy stockbroker, be sure to look for encryption of data that passes through their domain. This should meet the Secure Socket Layer (SSL) protocol, indicated by the URL starting with https:// and a padlock icon. Data encryption begins when you enter your personal password upon logging into the customer area. The encryption level is determined by the number of bits, with 56 bits as the minimum and 128 bits offering the highest level of security.

3. The broker’s trading platform

Choosing a Stock broker with an intuitive platform that gives you access to all the trading tools you will need to place your trades is crucial.

4. Easy payment methods and transactions

When picking a stock trading platform, you should consider the payment options. Some key factors to be aware of are our access to secure and legitimate payment methods for withdrawals and deposits and that the transactions are done quickly and smoothly. Here are some of the most common payment methods usually available on trading sites:

- Debit card /credit cards: Visa, MasterCard, or Maestro, for example.

- E-wallets such as PayPal, Skrill, and Neteller.

- Bank transfers.

A handful of brokers only offer Bank transfers. The fastest solution is electronic wallets, with immediate deposits and withdrawals in 24 hours.

6. Customer service

Any support offered to members of a platform is extremely important. This is proof of the legitimacy of the broker. How do you judge customer service from a stock broker? First of all, the platform must have a professional team that speaks your native language, available through different means of contact (email, telephone, live chat, even WhatsApp or Skype)

7. The software and the interface of the trading broker

The interface’s intuitiveness is an essential criterion, especially for novice traders. You must be able to carry out your actions quickly and without hassle while having access to all information in real-time. Make sure the site offers market analysis curves and the ability to see odds and live prices.

8. Mobile trading

Being able to trade anywhere, anytime is the best. There are two solutions for trading in a mobile version: from a web browser via a portable device or through a mobile app.

9. The reputation of the trading platform

This element may be obvious to some or even overlooked when looking for the best broker, yet it is a key criterion. Indeed, the reputation of the Stock broker does not lie in these services. Find out about these assets. Read broker reviews.

10. The diversity of assets offered by the broker

How to profit if the broker only offers a handful of assets? Your trading site must offer various assets, such as currencies and commodities. Trading commodities and stocks are great risk management. Diversification of assets helps you to hedge the risk in trading.

11. Leverage

If you are looking to trade Forex besides stocks, leverage is a welcome feature too. Find a broker that provides the leverage you are looking for. Generally, the maximum leverage on European forex brokers is 1:30, but some platforms may offer more if you have a professional account.

All brokerages have their pros and cons. It all depends on your trading profile, whether or not you aim to diversify, and the capital you want to invest. Also, it depends if the broker is registered in the country or jurisdiction you are trading from.

Credit Card Chargeback

This is a very important option when you use a credit card to fund a trading account. In case you notice some unauthorized transaction, this option should be available so you can get your money back in your account.

Stock brokers that accept credit cards FAQs

What Are the main perks of using a credit card for trading stocks online?

Using your credit card implies you can count on convenient payments and a smooth trading process. Credit cards are generally allowing immediate transactions allowing you to start trading whenever you want from wherever you want.

Does using a credit card cost more than other payment methods?

Most trading platforms don’t charge any extra fee for credit card usage. However, credit card companies or banks may apply for shares beyond the broker’s control.

How much time is needed to process a credit card withdrawal?

Depending on your jurisdiction and the brokerage company, it usually takes one to three days, but it can be instant also.

Why Use a Credit Card as Your Deposit Method?

Before credit cards as transaction and payment methods on trading platforms, traders depended on bank wire transfers. It required paperwork and was really slow. Traders dealt with all kinds of restrictions imposed by the bank. For example, there are countries with limits on the amount of money that can be transferred out of or into the country. With the advent of credit cards, trading became less cumbersome. Traders could make instant transactions and start trading immediately upon funding their trading account.

What are the best stock brokers that accept credit cards?

Some of the most prominent and trusted stock brokers that accept credit cards are Admiral Markets, Etoro, and Libertex. There are also some less-known brokerage companies with great reputations. Make sure you thoroughly research their services, fees, and commissions before opening a trading account.

COMMENTS