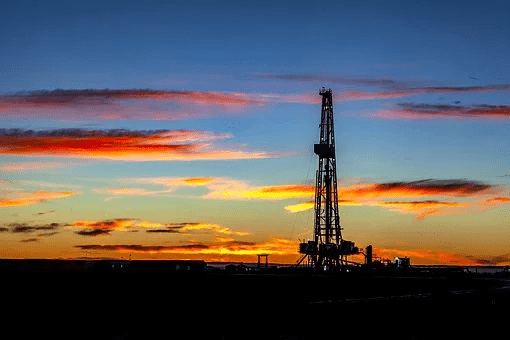

Ease of Geopolitical Tensions Drags Oil Prices Down

The price of oil continued to fall on Thursday as anxieties about global unrest subsided and concerns about demand in China, the world’s largest petroleum importer, increased because of an increase in COVID-19 cases. Fears of the conflict between Russia and Ukraine spilling over the border were eased when Poland and NATO indicated that the …

Ease of Geopolitical Tensions Drags Oil Prices Down Read More »