On Tuesday, aluminum prices declined as tightening COVID-19 restrictions in top metals consumer China stoked worries about demand.

On the London Metal Exchange, futures tied to the commodity skidded 1.78% or 49.00 points to $2,709.00 per tonne. It trailed Monday’s slump of 3.13% to $2,758.00 per tonne, representing the lowest level since January 5.

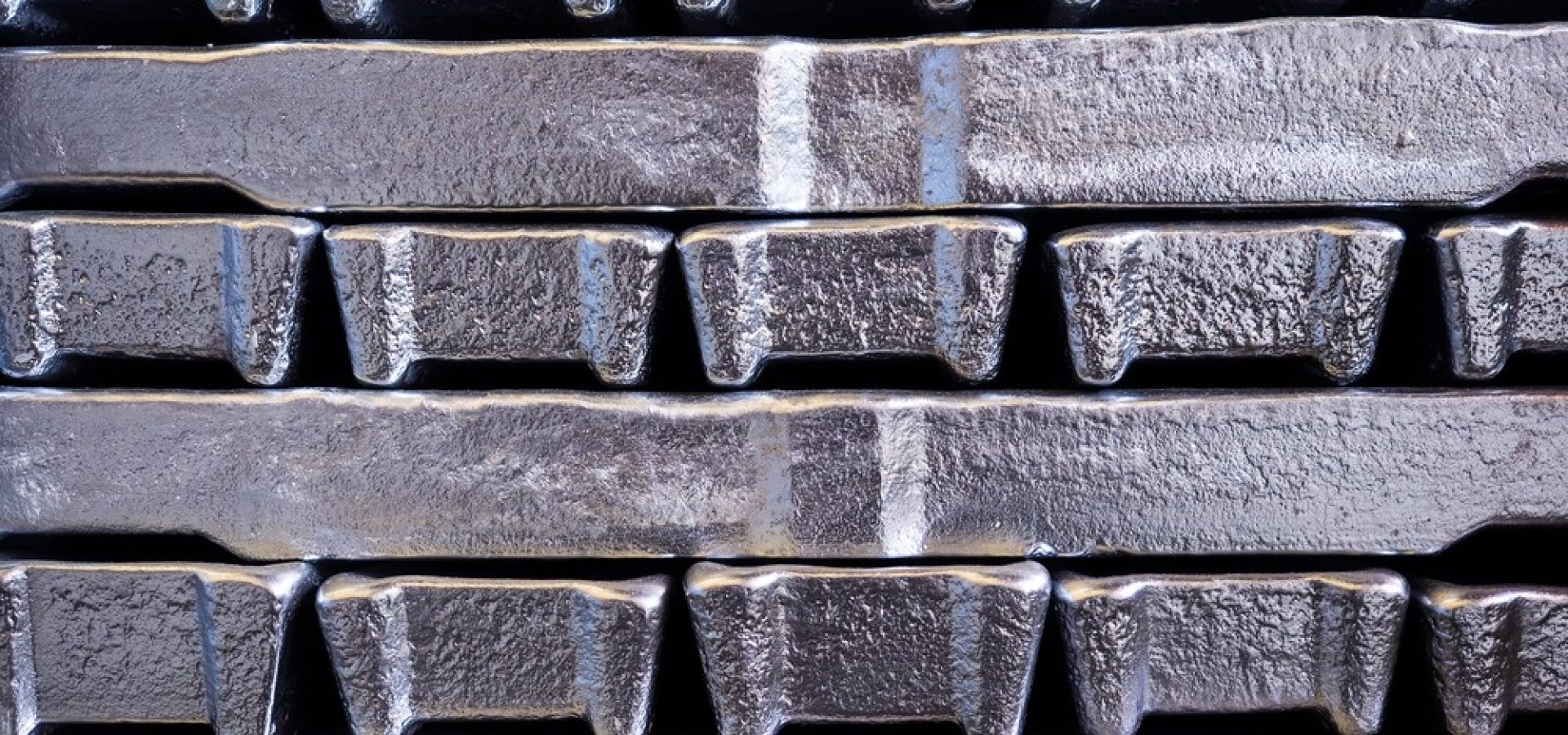

China is also the world’s largest producer of aluminum. This metal is significantly essential in the power, construction, and packaging industries.

However, Shanghai and Beijing still wrestled with their worst COVID-19 outbreaks since the epidemic began.

The Chinese cities further tightened curbs on their residents this week, blocking them from leaving their homes and compounds. This measure triggered public angst and even questions about the legality of the brutal battle with the virus.

Accordingly, worries over tightening lockdowns in the world’s second-largest economy hurt global economic growth prospects. At the same time, it dented the appetite for risky assets among investors.

Traders now look forward to the release of the country’s loan data and total social financing this week. It is a key gauge of industrial metals consumption that will provide clues to the demand projections.

In addition, the prospects of higher interest rates by the US Federal Reserve also weighed on industrial metals. The aggressive sentiment of the Fed has boosted the greenback.

A higher American currency makes dollar-denominated metals more expensive for holders, undermining the demand.

Nevertheless, the aluminum supply risks remained elevated. About 1.50 to 2.00 million tonnes of output are at risk of closure across Europe and Russia. This projection is about 2.00% of global supplies, estimated at 70.00 million tonnes this year.

Ukraine war turned China into aluminum exporter

The ongoing conflict between Russia and Ukraine has upended the global aluminum market. This geopolitical crisis has transformed China into a net exporter.

In February, Beijing exported 26,378 tons of aluminum ingots in February. This record posted an increase of more than 500.00% from the start of the year.

Consequently, imports dwindled by 53.00% to 18,343 tons, surpassed by exports for the first time since 2019.

The Chinese imports in the January-February period declined by 77.00% on the year. Meanwhile, exports soared from light levels in 2021. The country notably improved from the previous two years when it imported massive amounts of aluminum.

Due to Russia’s invasion, natural gas and other energy prices skyrocketed. Eventually, European aluminum makers reduced metal production as electric power prices rose, creating a shortage.

COMMENTS