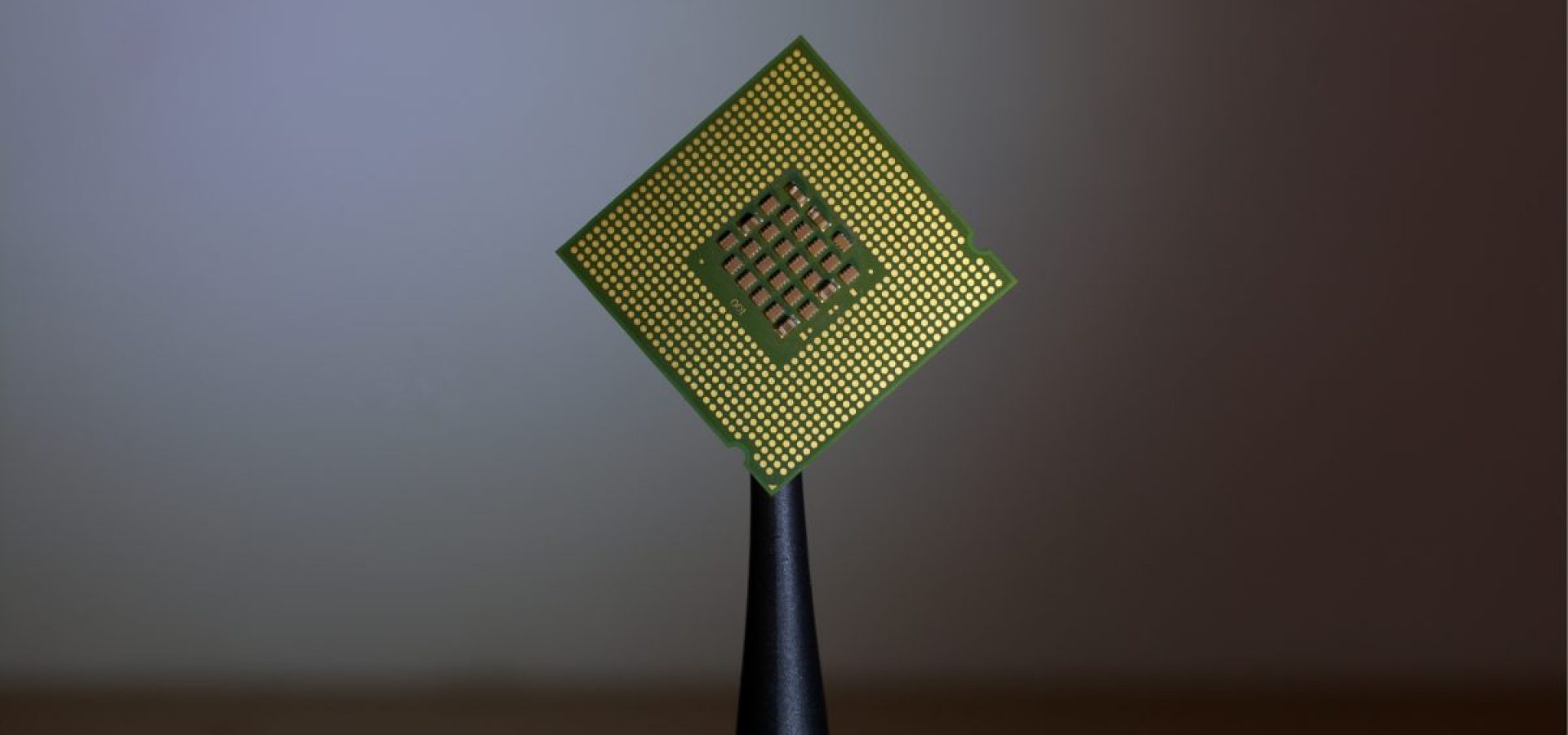

In technology and geopolitics, the term “chip wars” has gained prominence, highlighting the intense global competition over semiconductor dominance. One of the most significant players in this arena is Huawei Technologies Co, a Chinese tech giant at the centre of controversies involving chip production and international sanctions.

The Rise of Huawei’s Secret Semiconductor Facilities

Amid escalating tensions with the United States and growing restrictions on its technological endeavours, Huawei is making strategic moves in the chip wars. Covertly establishing concealed semiconductor plants throughout China, the company seeks to evade U.S. sanctions hindering its tech access. These moves come in the wake of Huawei’s foray into chip production. Therefore propelled by an estimated $30 billion in state funding from the Chinese government.

Huawei’s efforts in establishing these secret facilities need to be more subtle. The Semiconductor Industry Association, based in Washington, has sounded the alarm about the construction of these facilities. The company’s actions include acquiring at least two existing plants and constructing three additional ones. Huawei’s bold strategy highlights its resolve to ensure microchip supply and maintain prominence in the worldwide tech arena.

Escalating Tensions and Security Concerns

The U.S. Commerce Department placed Huawei on its export control list in 2019, citing security concerns. This move led to restrictions severely limiting the company’s ability to obtain the necessary semiconductor chips for its products. The subsequent trade blocklist, however, further exacerbated the situation, compelling most suppliers to seek licenses before shipping goods and technology to Huawei. The global tech industry watches these developments with rapt attention, as they have far-reaching implications.

In conclusion, amid the ongoing chip wars, Huawei’s covert efforts to establish secret semiconductor facilities represent a bold gambit to counteract the challenges posed by U.S. sanctions. As the company strives to ensure its chip supply, tensions between economic giants are palpable. The saga surrounding Huawei’s actions underscores the critical importance of microchips in contemporary technology. Also, the intricate interplay between trade, security, and innovation in the ever-evolving landscape of chip production and global politics. China chip news continues to follow these developments closely as the world navigates the complex dynamics of the chip wars.

COMMENTS