Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

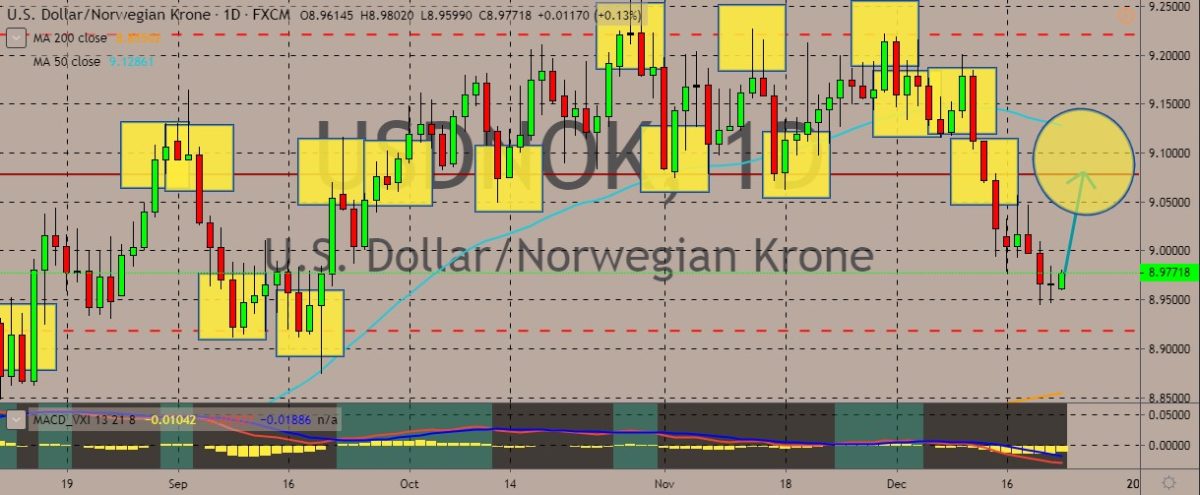

USDNOK

The pair is trading in the green in the latest trading session perking up after sliding sharply in the previous session and slipping far below the 50-day moving average. Over in Norway, the central bank said it would tighten the monetary policy if the wages were to increase faster than expected, according to Governor Oeystein Olsen. He said that the wage growth will be quite moderate in spite of the weaker currency and in spite of inflation being a little higher than what they have seen before. Olsen said that if the wage growth would be very different than what they see now, “we would react.” In its most recent monetary policy decision, Norges Bank opted to keep rates on hold and said that policy was not likely to change in the near future. As for fundamentals, the country’s consumer prices eased in November, meeting the forecasts of most economists. Core inflation stood at 2.0% year-on-year, slipping from 2.2% in October.

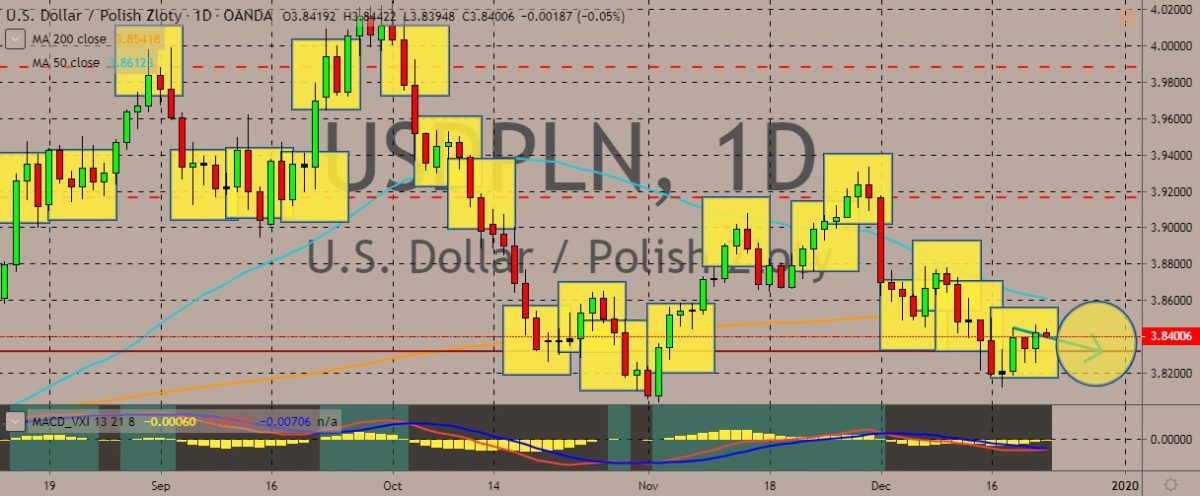

USDPLN

The pair has slipped to October lows, falling below both the 50- and 200-day moving averages, signalling strong bearish sentiment among the pair’s traders. Over in Poland, the Harmonized Index of Consumer Prices (HICP) gained 2.4% year-on-year in November this year, rising from 2,3% growth during the previous month, according to the European Union’s statistics office Eurostat. On a month-over-month basis, prices rose up by 0.1%, according to data. Meanwhile, according to Poland’s Central Statistical Office (GUS), the Consumer Price Index (CPI) indicator was at 2.6% year-over-year and 0.1% month-over-month in November. On the political front, Poland is currently locked in a war of words with Russia over who is to blame for World War II, with each of the sides accusing the other of revising history. According to Russia, it was Warsaw that “undermined” relations, while Warsaw said Moscow was “renewing Stalinist propaganda.”

USDILS

The pair has slipped sharply in the recent sessions although it has been paring back some of its losses. It was previously trading at the 50-day moving average before slipping towards its late-November lows. Israel is currently hoping to conclude a free trade agreement with China as early as next year, likely serving as a test for the amount of leeway the US president can give to its close allies. This latest development comes amid the heightened scrutiny around the relationship of Israel and China, with the US pressuring Israel to be cautious with the role of the Asian country in its economy. Although Israeli and Chinese officials met about a month ago for the seventh round of talks, an unnamed source that it was still unclear if Israel will be able to seal the deal next year. Since coming to power, Trump has slapped huge tariffs on Chinese products in a move to renegotiate a new trade agreement.

USDSEK

The pair is apparently trying to rise higher than the current support line, coming after a sharp decline from the 200-day moving average. Over in Sweden, the central bank concluded half a decade of sub-zero in a move that will offer relief to the finance sector. It would also serve as a test case for global peers that have been experimenting with negative borrowing costs. The Riksbank now is risking controversy after it increased its key rate by a quarter point in spite of the hints of the slowing economy. Governor Stefan Ingves downplayed the outlook in the run-up to the decision, emphasizing the effects of the negative policy. He specifically pointed out the chances that ultralow interest rates might trigger risky investing. At the same time, he highlighted the fact that such a measure was meant to be temporary. The rise in Swedish interest rate signals a turning point in the history of a policy started in recent years by other European economies and the BOJ.

COMMENTS