Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDDKK

The pair bounced back from 50 MA, sending the pair higher towards its previous high. The US dollar is taking advantage of the recent rift between China and Denmark. A Danish newspaper published an image depicting China’s flag with its stars replaced with virus. The news came as fears around the world increases with the new deadly coronavirus. The Danish krone has been struggling in recent months following the election of the new European Commission president. Ursula Von der Leyen was Germany’s former Defence Minister. Her election on one of the EU’s top job cemented Germano-Franco alliance leadership in the EU. The continuous fall of the Danish currency has resulted in Denmark Central Bank’s intervention. Just last month, the central bank bought 12.1 billion Danish Krone to prevent the currency from falling against the single currency. Over the past four (4) months, the central bank purchased a total of 17.8 billion Danish Krone.

GBPNZD

The pair will continue its steep decline and break down from MAs 200 and 50. New Zealand will benefit the most from the withdrawal of the United Kingdom from the European Union. After Boris Johnson became UK’s Prime Minister, his government promised Wellington to be its top priority for post-Brexit trade agreements. Now that Britain is officially out of the EU, investors are beginning to accumulate investments in NZ stocks and currency. Ministers for Trade and Foreign Relations of the two (2) countries are starting to negotiate agreements on immigration and trades. New Zealand’s Minister for Trade expect the two (2) countries to come up with a deal before the year ends. The British Pound will fall in sessions as the country enters negotiations with the EU and non-EU countries. Analysts expect negotiations for the United Kingdom, who had its last negotiation in 47 years before its accession to the European Union, to be tough.

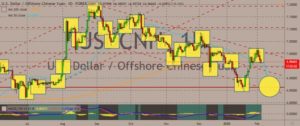

USDCNH

The pair failed to breakout from a resistance line and from 200 MA, sending the pair lower. The coronavirus will delay US exports to China. Under the phase one trade deal, China agreed to purchase additional $40 billion worth of US goods annually. However, as coronavirus continue to pose threats around the world, delay on shipments to China will be imminent. Economists have no projection as to when the coronavirus scare will end. Today, China made a statement saying it will halve tariffs on some US imports to keep up with its commitment. Meanwhile, US trade deficit between the United States and China fell by 1.7% amid trade curbs imposed by the Washington. Moreover, the figures will increase once China began to implement the agreements made on the phase one trade deal. However, it will be catastrophic for the US dollar is China do otherwise. Demand for the US dollar will continue to weaken until there will be updates on coronavirus.

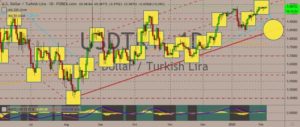

USDTRY

The pair will fail to breakout from an uptrend channel middle resistance line, sending the pair lower towards the support line. The United States ends is secretive drone program with Turkey. This is one (1) of the most visible proof of tension between Washington and Ankara. In 2019, the relationship between two (2) NATO (North Atlantic Treaty Organization) members began to fall after Turkey purchase Russia’s S-400 missile defence system. This was despite being a member of the NATO (North Atlantic Treaty Organization) alliance and F-35 program. Furthermore, Turkey continues to disappoint the Western world after it backs opposition in Cyprus. Turkey became the only country to acknowledge the existence of the Turkish Republic of Northern Cyprus. The backing angered the European Union as Cyprus is a member of the bloc. Economic sanctions to Turkey will further cripple its economy.

COMMENTS