Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURNZD

The euro is gaining ground against the New Zealand dollar, with the price recovering from a recent slump just above the 50-day moving average. The Reserve Bank of New Zealand is almost certain to hold rates at record lows of 1.0% during its first policy meeting next week, according to a survey. Key reasons include the dissipation of domestic risks. However, an interest rate cut could come soon, with the higher growth risk growing as the Chinese virus epidemic fears spread. Last year, the RBNZ delivered 75 basis points of easing, which helped lift inflation in the previous quarter, moving it closer to the 2% midpoint of the bank’s 1% to 3% target. The unemployment rate also dropped. Over in the eurozone, new orders at German industrial firms slipped in December, according to official data. The underperformance was likely due to the plummeting demand from the country’s eurozone neighbours.

AUDNZD

The NZD is gaining against the AUD in recent sessions, breaking the Aussie’s upside rally as it hit the 50-day moving average level. Over in Australia, the Reserve Bank of Australia Governor Philip Lowe said that coronavirus might hit the economy worse than SARS did. According to Lowe, the Chinese economy is now bigger and more integrated to the world’s economy. Therefore, the impact of the epidemic will probably be greater. The crisis was also affecting tourism, according to Lowe, who added the economy lacked the “dynamism” even though it was gradually improving. Such lack of dynamism was reflected in the lack of private sector investment. He said that it was needed to move wages again and lift inflation back up into the RBA’s target band of between 2% and 3%. On the flipside, Lowe told the committee that the implementation of negative rates was “extraordinarily unlikely.” They also have not reached the need for quantitative easing.

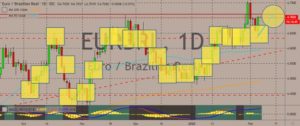

EURBRL

The pair is trading in the green in recent sessions, with the price staying above the 50-day moving average and pulling back from a recent slump. The Brazilian real slipped despite the country’s central bank’s signal that it would pause cutting interest rates. This meant that speculative flows were the reasons for the currency’s slide, especially with the fact that the rise in futures was widespread and on strong volume. Traders unwound bets on further monetary easing from the central bank. Also, the bank’s rate-setting committee reduced the benchmark Selic rate by 25 basis points to 4.25%. This was largely expected by the market. However, the committee issued a surprisingly clear future guidance that the easing cycle was now over. On-target inflation enabled the central bank to begin easing rates last year. However, over the past months, inflation has increased sharply. Last December, the year-over-year inflation was 4.3%.

GBPBRL

The pair is still trading in the green despite the recent slump in prices. Price is just above the 50-day moving average, and it appears that GBP bulls are still positive that the royal currency would continue to outperform non-major currencies. However, the British pound still faces a lot of pressure, particularly against other majors, as traders try to reduce their exposure to the pound as the United Kingdom and the European Union enters a tricky phase where the they negotiate the terms of the UK’s exit from the EU and the future of trade between the two parties. According to reports, the EU is going to target the financial services sector in the upcoming negotiations. Some news reports suggested that the EU was planning to impose stricter financial regulations on London the moment the UK has exited the bloc by the yearend. The UK is a net exporter to Europe of financial services to the EU.

COMMENTS