Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDCZK

The pair has recovered from recent record slump, although it is trading again in the red this session. It appears that neither currencies are taking control of the trend. The 50-day moving average also recently crossed below the 200-day MA, confirming the death cross and indicating largely bearish momentum for the pair. Over in Prague, the Czech unemployment rate rose to 2.9%, higher than the 2.6% recorded in November, during typical winter seasonality. Meanwhile, the labour market remained tight despite the global slowdown in 2019. Over the last year, the unemployment reached 2.8%, compared to the 3.2% a year earlier. It is expected this year to see further slowdown in the domestic economy, with the unemployment rate to stagnate. However, the latest forecasts from the Ministry of Finance and the CNB indicate further declines, assuming that higher earnings can motivate some workers to move from the shadow economy to official employment.

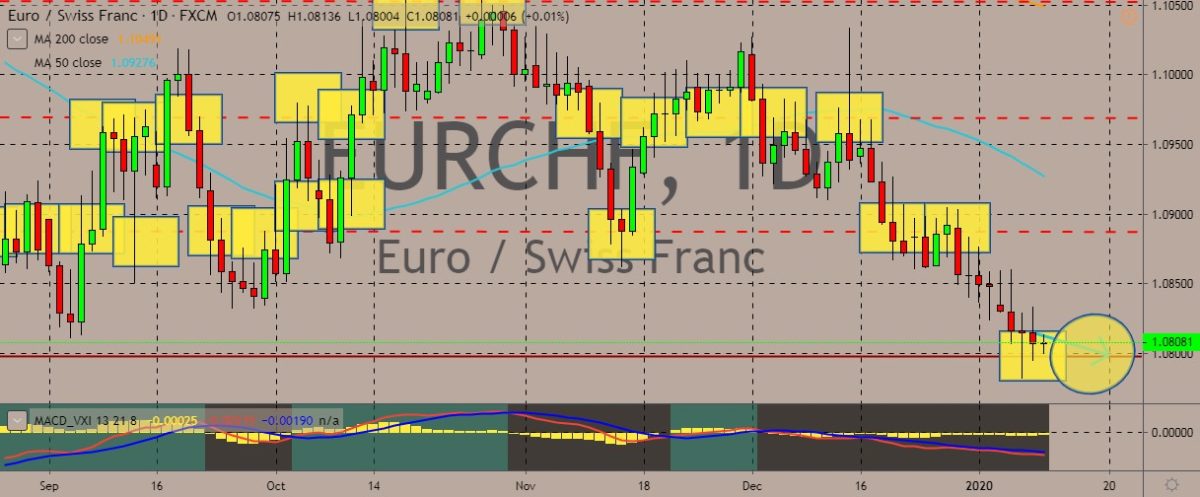

EURCHF

The pair remains trading within a down-trending channel, with some room for further downside before traders realize it’s becoming oversold. Meanwhile, the pair moves along the busy period in the European market. For economic data, German month-on-month exports posted a decline of 2.3%, worse than the expected decline of 0.5%. On the flipside, seasonally adjusted trade balance for the same period came short of expectations with EUR 18.3 billion against EUR 20 billion. Fortunately, the non-seasonally adjusted current account balance beat EUR 16.9 billion with EUR 24.9 billion. Industrial production also beat the expectation of 0.7% with 1.1%. Also, the non-seasonally adjusted industrial beat the year-on-year expectation of -3.8% with -2.6%. Over in Switzerland, retail sales for November missed the expected change of 0.4% and came in only with 0.0% change. The SNB’s December foreign reserves moved lower to 771 billion.

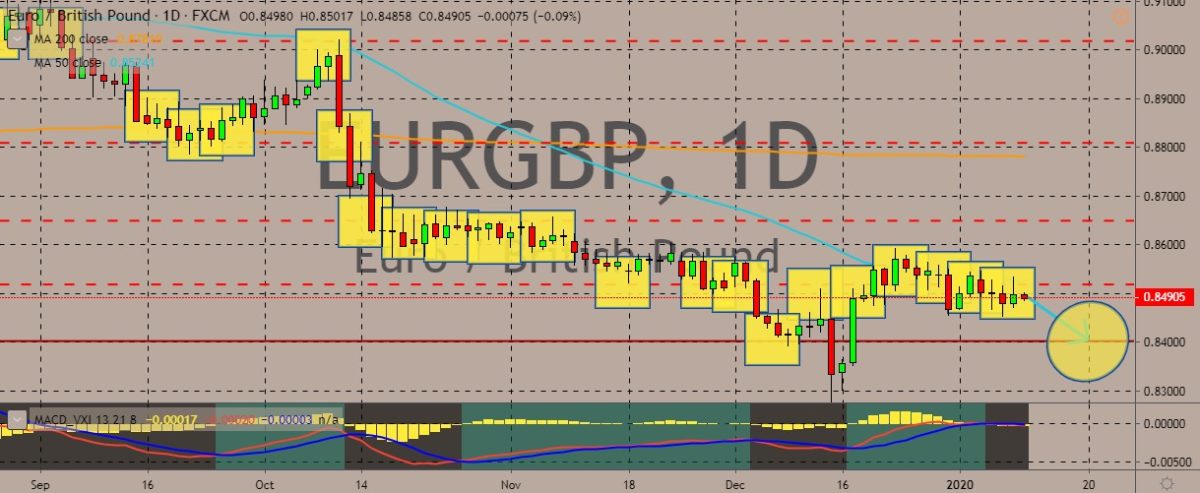

EURGBP

The pair still appears to be trading within tight ranges near the 50-day moving average. However, the British pound still seems to have the upper hand, with the euro bulls failing to take the price far above the 50-day MA. For fundamentals, the UK Parliament voted 330 to 231in favour of the Withdrawal Agreement Bill. The legislation will now head to the House of Lords, and if it is approved, the UK will officially leave the European Union on January 31. It will also trigger the start of the 11-month transition period. In that period, the MPs will talk about future trade relations. And by that time, the EURGBP will face some volatility that could push it higher. The British pound has proved to be prone to volatility every time new developments in the Brexit saga hits the headlines. After trading bullishly before and after the market-friendly December 2019 UK General Elections, the pound floundered after BPM Boris Johnson indicated a hard line in negotiations.

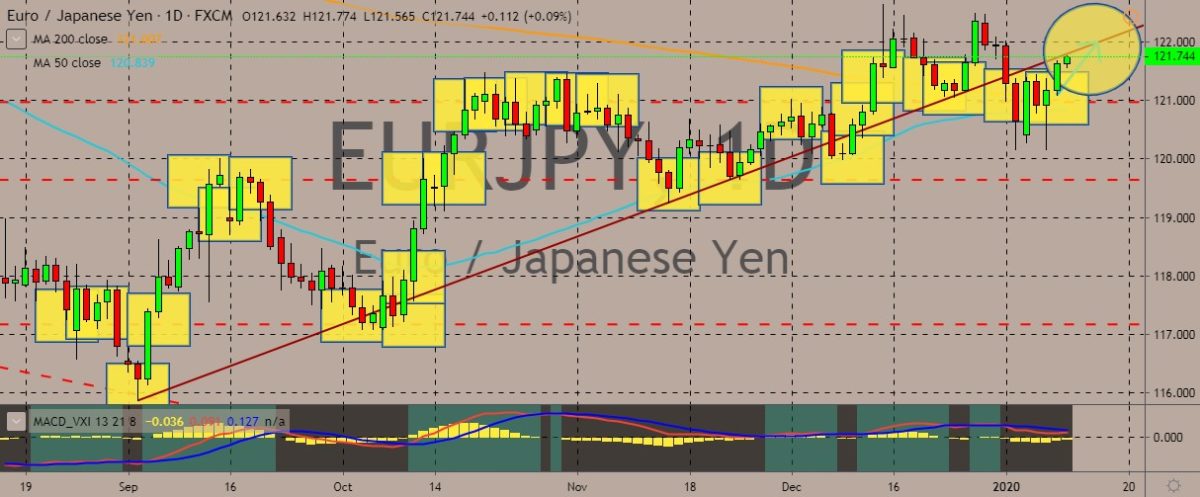

EURJPY

The pair is on a rally and the euro is gaining a lot against the Japanese yen as safe-haven demand fades amid the de-escalating geopolitical and world tensions. US President Donald Trump said that the US would not give any military reply to Iran for the recent airstrikes because of the minimal casualty. However, it would still impose economic and financial sanctions on Iran. Such sanctions will stay in place until Iran changed its behaviour and stopped supporting terrorism. The Japanese yen typically soars high as conflicts, wars, and economic uncertainties hit the market. It’s the reason it’s considered a safe-haven currency. With the apparently calming down conflict, the yen loses its grip on traders as they seek riskier but higher-yielding currencies. At the same time, the euro is being driven by the string of economic data as well as the activities happening right now in the eurozone.

COMMENTS