Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

NZDCAD

Serving as a solid support line, the 200-day moving average has been used by the NZDCAD pair to rebound up after previously struggling and slipping down. After the signing of the phase one trade deal, the kiwi managed to perk up as the deal disappointed the markets. The agreement left the tariffs on $120 billion worth of Chinese goods untouched until the US and China reach a phase two deal. Meanwhile, the Canadian dollar is also moving in lockstep with the developments in the US-China trade deal. At first, markets were optimistic that the interim deal would be bullish for global trade outlook. However, with the tariffs staying in place until after phase two, markets were disappointed and concerned. Reports have it that the discussion of phase two won’t kick off until after the US presidential elections. Canada is a major trading partner for the US.

GBPUSD

The pair is trading in the green, but the British pound is largely under pressure, while the US dollar moves according to the results of the interim trade deal between Washington and Beijing signed on Wednesday. The pound is losing some stream after the dull release of the December UK inflation data, which gained at an annual pace of 1.3%, failing to meet market expectations. The core figure, which doesn’t include food and energy costs, came in at 0.0% when compared to the previous month and at 1.4% from a year earlier. The Bank of England as also turned dovish. Policymakers have issued indications that they would vote for a rate cut. For instance, BOE rate setter Michael Saunders said that signs of weakness in the UK economy should receive “relatively prompt and aggressive response.” These figures, overall, reinforce the case for monetary easing. The BOE will meet to discuss policy in several weeks.

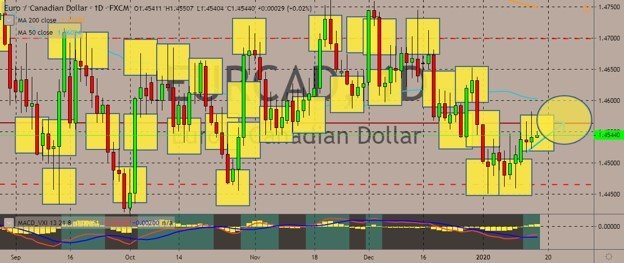

EURCAD

The pair is making moves to the upside, although traders appear to be reluctant to commit. Over in the eurozone, industrial production increased by 0.2% in November, coming after a large decline. German and Spanish production recovered nicely with 0.9% and 1.1% growth respectively. Although the eurozone average growth pace somehow disappointed, it was mainly because of the sharp declines in smaller countries. There were better energy and capital goods productions, which offset the declines in consumer goods and intermediate productions. Yet, the data, even if positive, confirms that it is quite too early to think that the eurozone industrial recession is over. December PMI still signalled that new orders and current production were falling steeply, meaning the November industrial data should not be considered a start of better days. Analysts agree that current conditions are still too weak to halt the trend.

The pair moved to the upside after the US-China interim trade deal has been sealed. Although the markets were disappointed because the tariffs on huge amounts of Chinese goods will still remain, the New Zealand dollar managed to perk up slightly, along with the Australian dollar. For some analysts, the phase one trade deal didn’t address the more crucial talking points of the two countries’ conflict. On a fundamental basis, the deal does little to change either the US or Chinese economy. Of course, the markets have taken the deal as a risk-on signal. However, the future will likely be sprinkled with headlines about the trade negotiations. According to Vice President Mike Pence said that discussions had already started for the phase two of the agreements. Analysts are expecting the phase two negotiations to be far more difficult that the first phase. Domestically for New Zealand, national house sales volumes in December hit a three-year high.

COMMENTS