Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

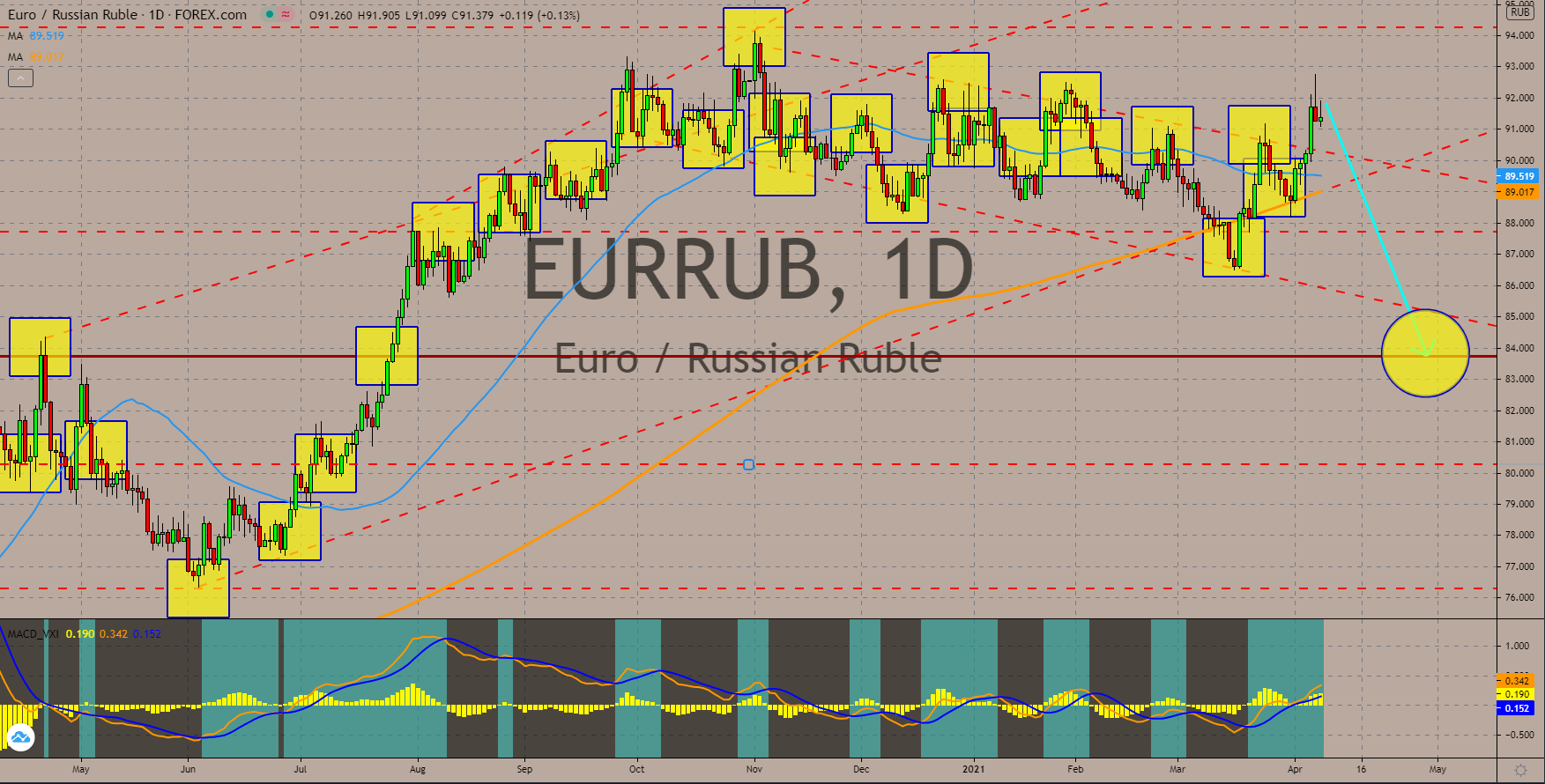

EURRUB

On March 19, the Russian central bank raised its benchmark interest rate by 0.25% to 4.50%. However, the recent data on inflation puts pressure for the Central Bank of the Russian Federation to continue interest hikes in the upcoming meetings. Prices of basic goods in March advanced by 0.7%, which sent the year-over-year figure to 5.8%. This was the highest reported data in the past four (4) years, surpassing the numbers from January and February at 5.2% and 5.7%, respectively. The March data is also way past the 4.0% target set by the central bank. BCS Global Markets is anticipating another 25-basis points hike on April 23’s meeting and further increase by another 25-basis points before the year ends. In other news, the Russian economy is expected to contract in Q1 due to the resurgence of COVID-19 in Europe. The 50 and 200 moving averages are near to form a “bearish crossover” while the MACD indicator is showing fatigue with the recent rally.

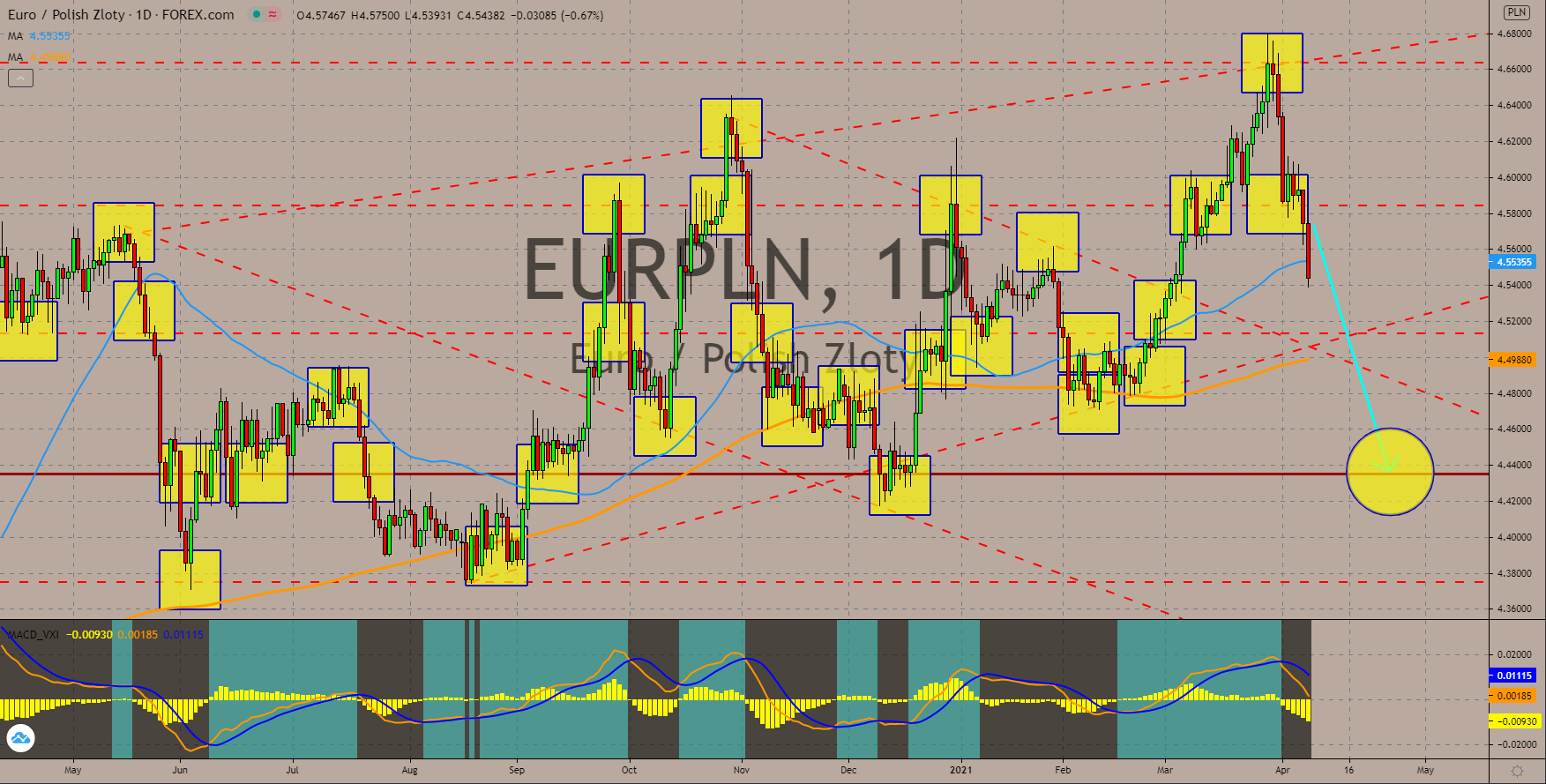

EURPLN

Despite the dovish stance of the Narodowy Bank Polski, analysts remain bullish with the zloty. The Polish central bank left its interest rate of 0.10% unchanged during the recent meeting citing the improving economic outlook. The country’s GDP shrank by -2.7% in fiscal 2020, but readings showed a robust recovery in one of the EU fastest growing economies of 4.1% this year. In addition to this, the S&P 500 and Fitch Ratings reaffirmed their bullish forecast with Poland. Long-term foreign currency issued debts was given a -A rating by both Fitch and Standard & Poor’s. However, the rising inflation could pressure the central bank to lift its record low rate. Core inflation is expected to jump to 3.5% according to the central bank while the Central Statistics Office is anticipating a 3.8% figure YoY. The EURPLN pair broke down of the 50 MA with further decline expected in coming sessions below the 200 MA. MACD is expected to follow the price trend.

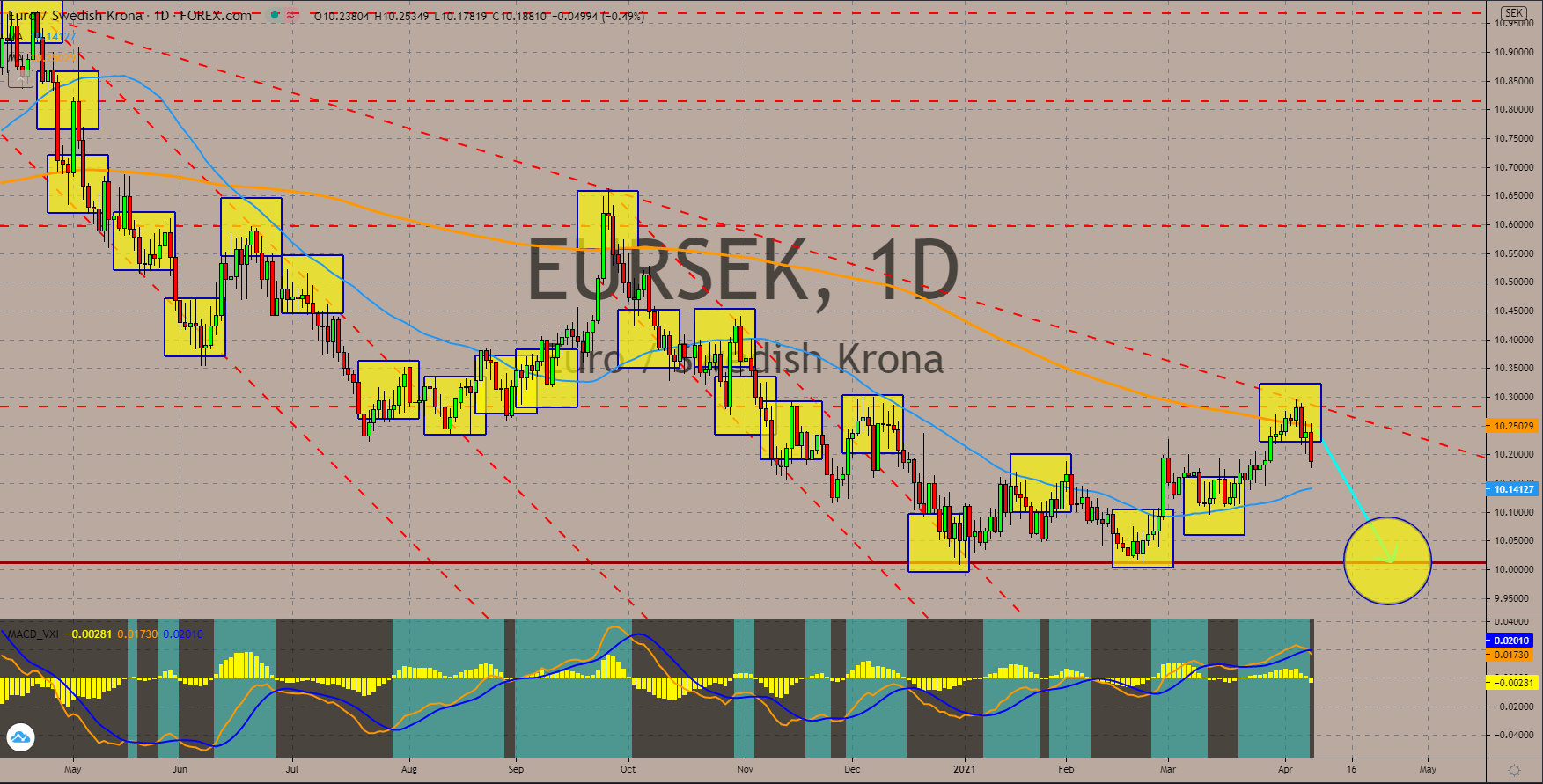

EURSEK

The booming housing market in Sweden is fueling the economy. In 2021, returns have soared past the 275% level as more individuals participate in the rising prices. However, the home buyers are spiraling down to debt with the majority of the 81 billion quantitative easing (QE) injected by the Riksbanken in the economy going to mortgage payments. Household debts in the country have also picked up during the pandemic, which narrowed the quarterly growth with the United Kingdom and Germany. Analysts believe that the government and central bank might intervene in the market to prevent a bubble. In addition to this, the central bank deputy governor, Martin Floden, dismissed rate cuts, which means that Riksbanken might continue to enter the positive territory in the near-term. Sweden has recently raised its rates to zero percent following the experimental 5-year negative rate. The 200 and 50 MAs are expected to fail to form a bullish crossover in sessions.

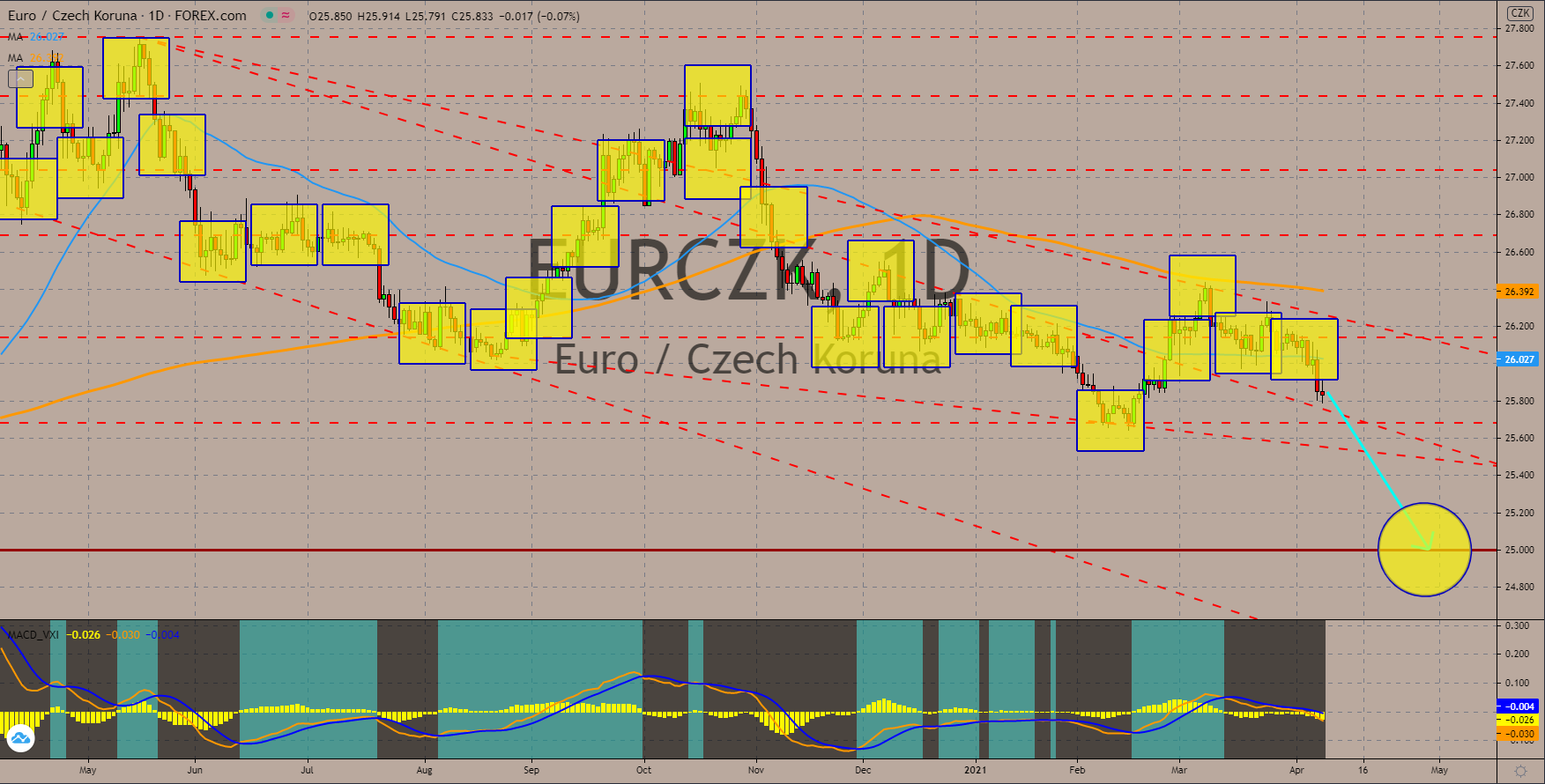

EURCZK

The improving economic environment in the European Union will send the single currency lower in the coming session while lifting the equities market. Composite and Services PMIs from Germany, France, and the Eurozone were all better-than-expected. The average results from the currency bloc were 53.2 points and 49.6 points, respectively. Germany’s data were above the average at 57.3 points and 51.3 points. The bloc’s second-largest economy, France, underperforms at 50.00 points and 48.2 points. Adding optimism in Germany was the second consecutive increase in factory orders after recording 1.2% growth for the month of February. On the other hand, industrial production in Czech Republic plunged by -2.6% in the same month. The rising COVID-19 cases in the country is expected to send upcoming industrial reports lower. The EURCZK pair failed to break out from the 200 MA in March and has slipped below the 50 MA on April 05, 2021.

COMMENTS