Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

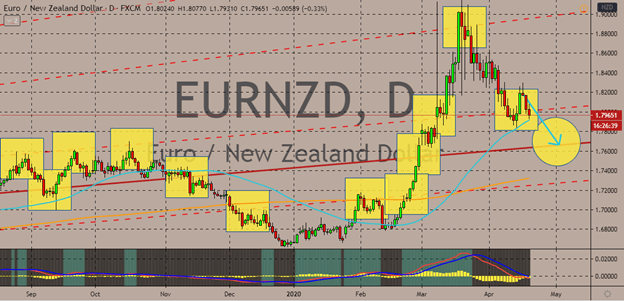

EURNZD

The EURNZD pair is heading downwards to its support level in the coming sessions as the euro buckles. The eurozone’s common currency is a current victim of the growing concerns about the absence of unity and cooperation with the many leaders of the bloc. The ongoing skew about economic relief measures has inflicted financial and political costs on the single currency. The sing currency is now once again on the defensive against the New Zealand dollar.

Looking at the chart, it appears that the euro still has the upper hand in the sessions. The 50-day moving average appears to be moving farther away from the 200-day moving average. However, bearish traders are looking to turn things around and for the 50-day moving average to slow down and pivot. The kiwi is outperforming in recent sessions against many currencies. This including the euro as investors rejoice about recent news about easing restrictions and lockdowns in the country.

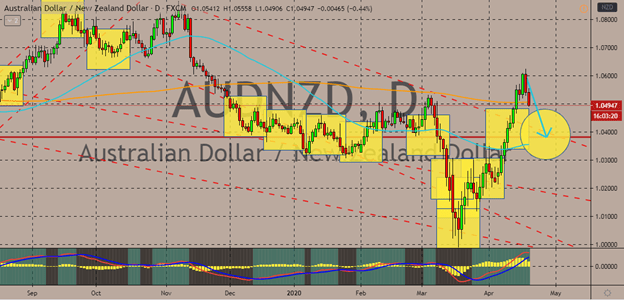

AUDNZD

The Australian dollar is on its back foot against the New Zealand dollar. Bearish investors are basking in the optimism about news from the country. Reports have stated that New Zealand is looking to lift or ease the Covid-19 restriction in the country which will ease the pressure from the economy. Looking at it, among the major currencies, both the New Zealand dollar and the Australian dollar has been seen strengthening. However, in their matchup, the kiwi reigns supreme over the Aussie.

Bears hold on the to momentum as the 200-day moving average remains significantly higher than the 50-day moving average. Analysts believe that the pair will touchdown to its support level soon despite the cautious tone in the market. The Australian dollar has struggled against the New Zealand dollar by the end of last week following the National Bank of Australia’s business confidence survey for March showing concerning figures, straining the AUDNZD bulls.

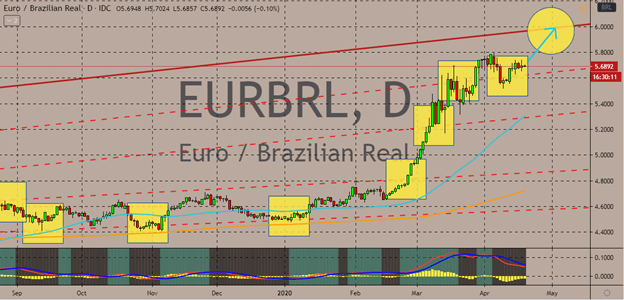

EURBRL

EURBRL bulls remain in control as investors of the Brazilian real worry about the country’s economy and its far-right leader. Projections show the euro will peak against the Brazilian real and force it to its resistance level by the end of April. That would propel the 50-day MA significantly away from the 200-day MA which has already been left in the dust.

The Brazilian economy is in danger as the pressure brought by the coronavirus pandemic piles up on Brazilian corporations. The ultimate impact remains uncertain as it will depend on how fast the virus will spread and be contained. Just recently, the Brazilian central bank’s president, Roberto Campos Neto, said that the country’s economy will most likely be able to recover by the final quarter of the year. Brazil has the greatest number of coronavirus cases than any other country in Latin America, but this doesn’t stop its president from encouraging his people to continue working.

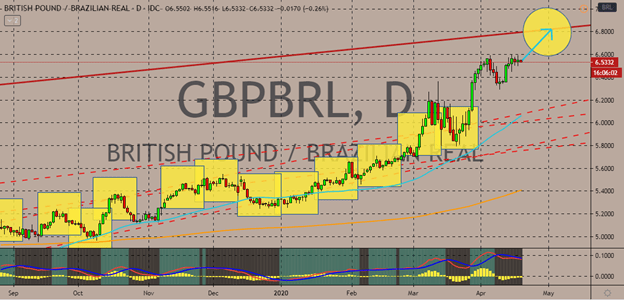

GBPBRL

The Brazilian real is in deep waters against the British pound. This follows the concerning statement from the head of the Brazilian central bank. Just recently, Roberto Campos Neto, President of the Brazilian central bank, said that the largest Latin American economy will only recover by the fourth quarter of 2020 because of the virus. Experts say that the damage will still depend on how fast the virus can be contained. Unfortunately, the country has the biggest number of confirmed cases in Latin America and critics are blaming its president.

In the past, President Jair Bolsonaro was criticized for campaigning and mixing with citizens, urging them to keep the economy going. And till this day, the Brazilian president continues to do so. Meanwhile, the British pound is also moving cautiously. Investors are still waiting for further guidance once the UK Prime Minister Boris Johnson returns to his post and start working again.

COMMENTS