Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

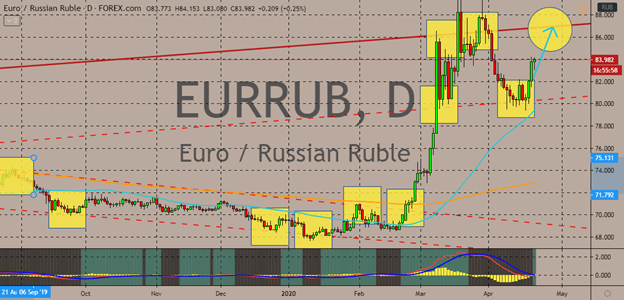

EURRUB

After the pair touched its support levels in the earlier half of the month, bulls were able to turn things around and force the pair to pivot. After bouncing off, the bullish rally of the EURRUB pair came in stronger. The pair is now widely believed to reach its key resistance level in the coming sessions as the euro takes advantage of the high volatility faced by the Russian ruble from the commodity market. It’s undeniable that the pair’s trajectory in the market is bullish considering that the 50-day moving average has just successfully pulled itself further away from the 200-day moving average. The Russian ruble weakened following the historic plunge of crude oil to the negative area, aggravating an economic slump for the Russian Federation’s economy that has been heavily pressured by the ongoing coronavirus pandemic. The virus and the lockdowns have pushed the Russian economy onto the brink of recession, worrying EURRUB bears in the market.

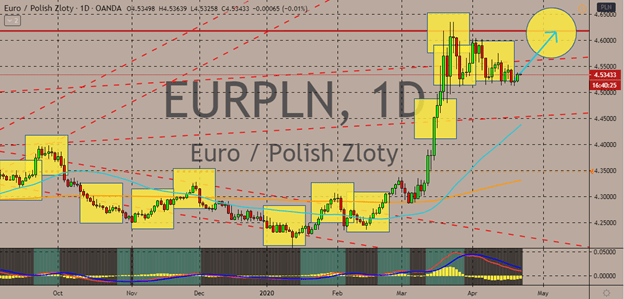

EURPLN

EURPLN bulls are struggling to regain their momentum back in the sessions resulting in the pair to trade sideways in recent days. After the pair touched its resistance level in the past sessions, bears were able to tone down the momentum of bulls. Still, looking at the chart, it’s evident that bullish investors continue to hold on to their gains as the pair remains widely bullish. Since the second half of March, bulls have propelled the 50-day moving average farther above the 200-day moving average, signaling a promising bullish run for the pair in the near-term trading. Moreover, according to recent reports, for the first time in record, the National Bank of Poland has started to purchase government bonds. The quantitative easing worried the investors of the Polish zloty, leaving the currency volatile in the forex market. Reports say that a bond-buying operation worth PLN 30.6 billion has trigger questions and concerns for the Polish economy’s status.

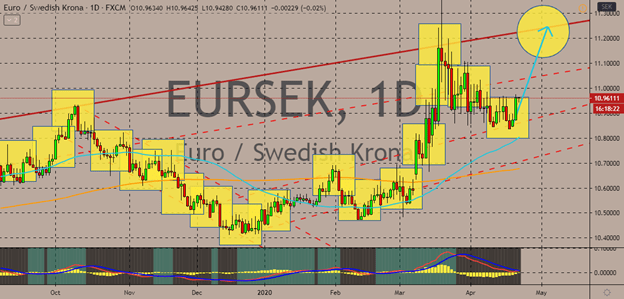

EURSEK

The Swedish krona’s exchange rate has depreciated thanks to the unprecedented fall of the US crude oil market. The euro is expected to snatch the momentum and propel the pair to its resistance after the pair bounced off its support and received support from the falling crude market. Looking at the chart, unlike most currency pairs of the euro, the EURSEK’s rally isn’t as big as the 50-day moving average has not totally taken flight against the 200-day moving average. Still, the upcoming rally will work in favor of bulls, allowing the 50-day MA to advance higher in the coming sessions. Also, the Swedish unemployment rate which just sharply fell helped drain the confidence of bearish investors in the sessions. As for the euro, it’s not spared yet as more headwinds are coming to its way. At first glance, the PMIs from the region may look grave, but don’t be fooled because the worst has yet to come for the single currency.

EURSEK

The Swedish krona’s exchange rate has depreciated thanks to the unprecedented fall of the US crude oil market. The euro is expected to snatch the momentum and propel the pair to its resistance after the pair bounced off its support and received support from the falling crude market. Looking at the chart, unlike most currency pairs of the euro, the EURSEK’s rally isn’t as big as the 50-day moving average has not totally taken flight against the 200-day moving average. Still, the upcoming rally will work in favor of bulls, allowing the 50-day MA to advance higher in the coming sessions. Also, the Swedish unemployment rate which just sharply fell helped drain the confidence of bearish investors in the sessions. As for the euro, it’s not spared yet as more headwinds are coming to its way. At first glance, the PMIs from the region may look grave, but don’t be fooled because the worst has yet to come for the single currency.

COMMENTS