Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

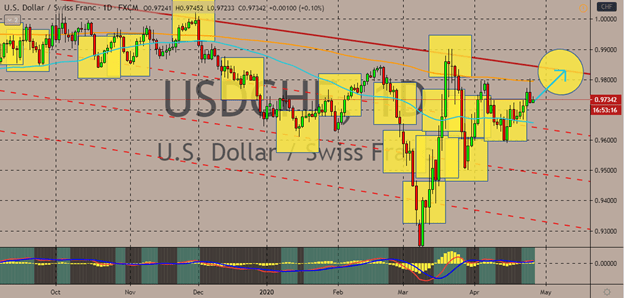

USDCHF

Bears have forced the pair to slow down in the previous sessions, but despite that, the USDCHF remains on track to reach its resistance by early May. The pair is still relatively bearish considering that the 200-day moving average continues to hover above the 50-day moving average. Last Friday, the precious Swiss franc managed to erase some of the gains of the US dollar amidst the deteriorating risk sentiment in the whole financial market. However, looking at it, both safe-haven assets are in demand as the hopes for a coronavirus vaccine were crushed. Recent reports say that Gilead’s antiviral drug called Remdesivir failed the initial round of clinical trials as stated in the papers accidentally published by the World Health Organization. The news drew more investors to safe-haven assets have rallied thanks to the news because investors, scientists, the authorities, and the whole globe had high hopes for the aforementioned drug.

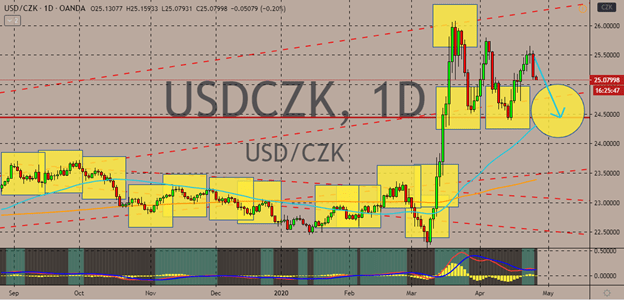

USDCZK

The Czech krona forces the USDCZK to pivot and head downwards late last week. Bearish investors are looking to hold on to the momentum and push the pair lower to its support level in the coming trading sessions. Experts are betting for a bearish direction for the US dollar in the short-term trading after it showed resilience in the previous sessions, suggesting that the beloved buck may have already run out of gas. Looking at the chart, the pair appears to be widely bullish as the 50-day moving average continues to trade significantly higher than the 200-day moving average. Meanwhile, the Czech krona receives support from the improving situation in the Czech Republic. Reports say that the authorities have opened the country’s borders to citizens as the number of coronavirus infections in the country starts to decline. The sudden U-tern in coronavirus cases in the country prompted the government to open its borders for outbound foreign travel.

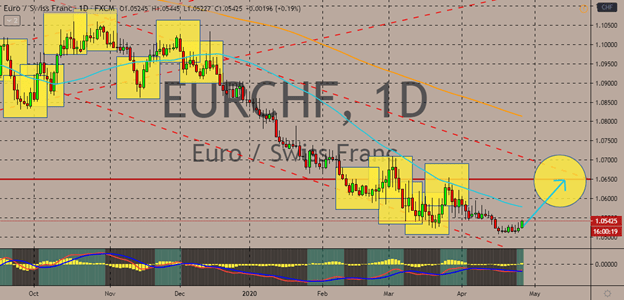

EURCHF

Bullish investors of the EURCHF pair are hoping to buoy the pair upwards to its resistance in the coming sessions. Since the latter part of 2019, the pair has taken a rather bearish direction as it continuously declines in the forex market. It appears that the strength of the broader strength of the euro is no match to the glowing safe-haven appeal of the Swiss franc. Bearish traders have held a firm grip on the direction of the pair as evident on the 200-day moving average which has dominated the 50-day moving average. However, the euro will have a tough time climbing to its resistance as turbulence within the members of the bloc fails yet again to secure a common mechanism to tackle the virus’ impact. French President Emmanuel Macron warned the European Union after it failed, suggesting the group could collapse. Fortunately for the euro, the Netherlands and Spain are both showing gradual signs of improvements in terms of new cases and recoveries.

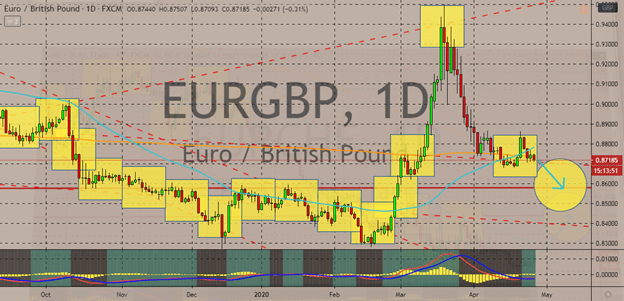

EURGBP

The single currency to pound sterling exchange rate has fluctuated in the recent sessions between the green and red territories. It appears that bearish investors are looking to turn things around and for the 50-day moving average to dive against the 200-day moving average. Looking at the chart, it appears that the 50-day moving average has just recently surfaced, but that doesn’t stop bearish investors from forcing it back downwards again. The pair is expected to reach its support levels in the coming sessions. The pound sterling has been slowed down by the warning that if the UK lifted its lockdown restrictions earlier, it might face another wave of coronavirus case according to a spokesperson from Downing Street. Despite that, the pair remains on a bearish track as the euro is also pressured by the concerning rift between leaders. Although the improvements in the number of cases and recoveries from both Spain and the Netherlands have eased some of the pressure.

COMMENTS