Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

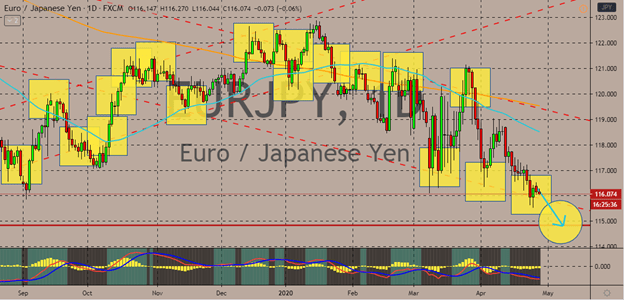

EURJPY

Last week the euro attempted to bounce back against the Japanese yen, however, as of writing, it appears that bears have quickly managed to regain control. The pair is expected to drop to its support level in the coming sessions, hitting its lowest levels since April 2017. Looking at the chart, it’s evident that bears are on the driver’s seat as the 200-day MA trades higher than the 50-day MA. The weak points of the euro have been exposed since the pandemic reached Europe. This caused investors to seek safe-haven protection from the Japanese yen, thus a downward trajectory for the pair. Also, investors are waiting for further guidance from the European Central Bank. The ECB is expected to step up its game and experts believe that its coming measures won’t be just a simple rate cut. Just recently, ECB governing council member Francois Villeroy de Galhau said that inflation has been falling, sending signals of upcoming stimulus from the bank.

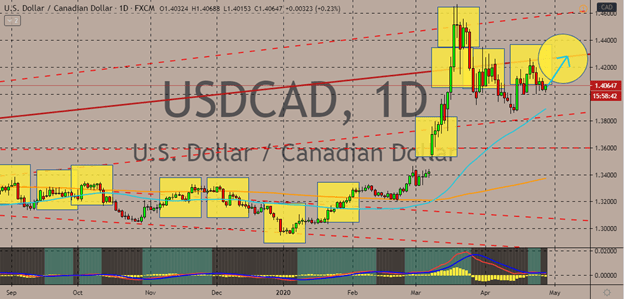

USDCAD

The Canadian dollar is on the defensive against the US dollar thanks to the uncertainty in the commodity market. Bearish investors should hold tight as the pair is expected to head back to its resistance. This time, the USDCAD pair is widely expected to break through the resistance level as bullish investors floor their gas pedals to further drive the 50-day moving average higher against the 200-day moving average. As for the Canadian dollar, as long as the commodity market remains highly unstable, it remains extremely volatile to the crashes faced by crude oil prices. However, the Canadian dollar is also getting support from the gains of both the Australian dollar and New Zealand dollar, rallying alongside the rest of G-10 currencies in the past sessions. Although that doesn’t mean that it’s strong enough to push the US dollar on the defensive as it’s actually under the mercy of the broader strength of the beloved greenback.

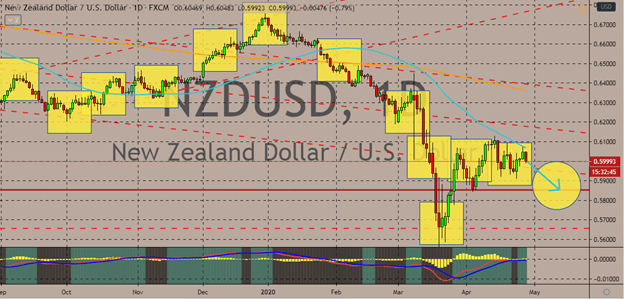

NZDUSD

The US dollar has managed to regain control this Tuesday’s trading. The odds have swiftly turned against the New Zealand dollar as it drops following news about possible negative rates from the Reserve Bank of New Zealand. Although the news stated that the negative rates may come later this 2020, it still took a toll on the short-term performance of the New Zealand dollar against the US dollar. Just last month, the RBNZ said that it will hold on to its official interest rates at 0.25% for at least 12 months. However, just this week, news about the possibility of negative rates have come into the surface. Reports suggest that the back is preparing for a 0.75 basis point cut which will lower the rates to -0.50%. Looking at the pair, it appears to be stuck in an extremely bearish tone despite the attempts of the kiwi to recover. The bearishness of the pair is evident as the 50-day moving average has plunged lower against the 200-day moving average.

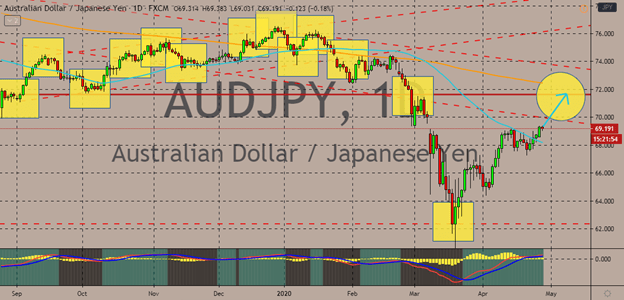

AUDJPY

The Japanese yen steadies against the Australian dollar this Tuesday as tries to defend its gain. However, the Australian dollar is projected to surge in the coming sessions as the government looks to ease some of its lockdown restrictions to reopen the economy. In that case, the Japanese yen would then lose some of its safe-haven appeal to AUDJPY traders. The Aussie appears to have a positive correlation to the risk sentiment in the market, rising when the global markets are rising and contracting when the markets are retreating. Aside from that, it’s also receiving support from the improvements and gradual reopening of the Chines economy. States in Australia have recently announced that they will partially lift some of the restrictions as the country curves the number of cases. Bullish investors are now hustling hard to shift the momentum and buoy the 50-day moving average and force it to overtake the 200-day moving average.

COMMENTS